Feds Interest Rate Hikes Stance Equates to Nonsense and Masses are Turning Bullish on Stocks

Stock-Markets / Stock Markets 2016 Dec 24, 2016 - 09:56 AM GMTBy: Sol_Palha

"Beware of all enterprises that require a new set of clothes." ~ Henry David Thoreau

Remember over a year ago when they first raised hikes-they huffed and puffed warning everyone that they would raise rates several times in 2016 and viola nothing happened until now. Now they are repeating the same thing all over again. To illustrate how bad this economy take into consideration that the Fed has raised rates only twice in the last decade; the economy was a lot stronger in 2006 and 2007 than it is today. Yellen's statement below illustrates how the Fed is positioning itself so that it can pull another "oops we were wrong once again" moment.

"All the (Federal Open Market Committee) participants recognize that there is considerable uncertainty about how economic policies may change and what effect they may have on the economy," Yellen said

Has anything changed since the last hike; is the economy stronger? The only thing that is getting stronger is the illusion that this economy is on the mend. If the economy was improving, then a rising rate environment could be seen through a bullish lens. In this instance, this economic recovery is a joke; it is all an illusion that is funded by debt. If the supply of hot money is cut, the markets will tank. The real estate sector is not stable yet, and most people already can't afford a house, so raising rates is a recipe for disaster. Our take is that the Fed has raised rates to give them more room to manoeuvre while making it appear that they are loath to embrace negative rates. The Fed has to play a delicate balancing game; the US dollar has to look attractive to the world, as that is what gives the Fed the power to create unlimited money. The US dollar is the World's reserve currency. If it were not, then the US would have followed Greece's path long ago. It is our ability to rob the world by creating money out of thin air at other nation's expense that gives the US capacity to hold onto the top dog position precariously. It is precarious because it is just a matter of time before China displaces the US. On a purchasing power parity basis, China has already replaced the US as the World's largest economy. One day the world will realise that the emperor is naked, fat, old and ugly as sin. However, as there is still some time before this comes into play, we are not going to address this issue.

We believe that the Fed will have no option but to eventually embrace negative rates unless they are looking to trigger a crash. The Fed is famous for artificially creating every boom and bust cycle since the US went off the Gold standard. While it might appear that we are in a bubble like phase as far as the stock market is concerned, one needs to remember that the masses have not benefitted much from the current rally. History illustrates that the Fed usually pops the bubble after the masses have fully embraced the market. Additionally, the masses are not euphoric; however, they are turning more bullish, which suggests as we alluded in this article Stock Market Bulls-Stock Market fools-Market Crash next or is this just an Illusion, that it would not surprise us if the markets experienced a decent correction next year. In the interim, we think the Fed's current move is just a trick to make it appear to the world that our economy is healthy. Now the Fed can lower rates twice before they move to zero, but it will force the rest of the world to lower their rates even more; effectively still making the US dollar the most attractive currency.

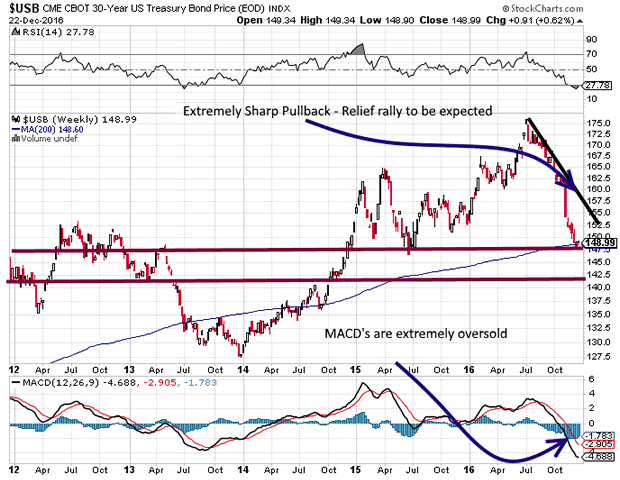

The bond market which many have given up for dead are looking for an excuse to rally sharply. We will look at this in more detail in a follow-up article. However, if you look at the long-term chart below, it is easy to spot that bonds have not crashed. They were pushed to extreme levels as individuals continued to embrace bonds for years despite the miserable returns they offered due to the safety factor. The masses, in general, were sceptical of this bull market and bought the hype that it was going to fall apart tomorrow for the past nine years. After Trump won money started moving out of bonds and into the market. What we have is a simple rotation; money is moving from one market into another. Now bonds are extremely oversold, and the markets are trading close to the extremely overbought ranges. When the markets start to pullback money will flow into bonds pushing rates lower. At that point, one will be able to tell if the rally in bonds is just a dead cats bounce or if the bull is ready to run again.

This is a weekly chart containing five years worth of data (each bar represents one week's worth of data); it is easy to spot that Bond market is extremely oversold. Trump's win has created a lot of enthusiasm, and a large number of individuals who were sitting on the sidelines moved out of bonds and into the market. As the move has been incredibly powerful, it is likely that bonds could experience a counter move that is equally strong.

For the first in time in roughly 24 months, bullish sentiment has soared to the 50% mark twice over a period of 6 weeks. Up until now, the masses were constantly negative, even though the markets continued to trend higher. Things are different right now; while the sentiment is not in the Euphoric, the percentage change is quite significant and signifies that some bloodletting is in order. Bond are attempting to find support in the 148.00 ranges; a weekly close below this level should result in a test of the 142.00-144.00 ranges, with a possible overshoot to the 140 ranges. The downside risk for bonds now is limited.

The markets have been resilient to sharp corrections for quite some time; a correction would be healthy for this market. It would scare the masses and sentiment would turn negative again, setting the bedrock for the markets to rally higher.

Conclusion

The illusion that the economy is doing well is supported because of the vibrant stock market. The stock market appears healthy because hot money is driving it. If the supply of hot money is cut, the markets tank and the illusion that all is well will come to screeching halt. If this economy were healthy, the Fed would have raised interest rates several times over the past ten years and not just twice. Moreover, Yellen's statement that we posted at the onset of this article clearly indicates she is hedging her bets.

In the interim bullish sentiment has surged significantly on a percentage basis, and Bonds are trading in the extremely oversold ranges. The ingredients are in place for a decent correction. Don't confuse the subsequent correction for a crash; the naysayers will do their best to have you believe that the world is going to end. We base our analysis on our Mass Sentiment indicators and the Trend indicator. When the trend turns negative, we will stop viewing substantial pullbacks as buying opportunities.

"He that's secure is not safe." ~ Benjamin Franklin

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.