4 Reasons the Trump Stock Market Rally Has No Legs

Stock-Markets / Stock Markets 2016 Jan 07, 2017 - 12:33 PM GMTBy: David_Galland

US equity markets are already factoring in Trump’s promised reforms, while bond markets are pricing in higher inflation.

US equity markets are already factoring in Trump’s promised reforms, while bond markets are pricing in higher inflation.

There’s just one thing: Trump hasn’t done anything yet. We’re still weeks away from his inauguration, and details of his economic plans remain scarce.

Investors seem to take potential positives for economic growth (lower taxes, deregulation, and fiscal stimulus) at face value, but ignore the potential negatives (soaring deficits, tariffs, and trade wars).

After eight years and 100,000 pages of new regulations during the Obama administration, it’s not surprising why the markets are cheering for change.

There are reasons to be optimistic. But as an investor, I’m not ready to give Trump the Nobel Prize for Economics just yet.

Political Headwinds

There’s little doubt Trump will shake up the status quo of DC politics.

For example, earlier this year, the Republican-majority House passed a budget blueprint calling for deficit reductions of $7 trillion over the next 10 years—primarily through spending cuts.

Against that blueprint, we have Trump’s proposed policy changes. The Committee for a Responsible Federal Budget, a nonpartisan think tank, estimates those changes, in particular tax cuts, could increase the deficit by $5.3 trillion over the next decade.

Speaker of the House Paul Ryan and Senate Majority Leader Mitch McConnell have both indicated that tax reform should be “deficit neutral.” Moving forward with the tax cuts will therefore require the assumption that they will trigger enough economic growth to offset the projected budgetary hit.

Trump’s team will have to successfully argue that point.

Deregulation is perhaps the most encouraging, pro-growth policy priority Trump and most Republicans can agree on. But it’s far harder to repeal a law than it is to write a new one. The process of repealing Obamacare could take years and, according to the Congressional Budget Office (CBO), could add $353 billion to the deficit over the next decade.

It’s also going to be hard to get deficit hawks on board with a trillion-dollar infrastructure plan, even if it is for the most part privately financed and includes significant tax incentives.

However, it looks like the markets assume that Trump will be able to force his policies through Congress and do so without consequences.

A Mountain of Debt

The consensus view is that the era of boosting growth with loose monetary policy is giving way to a new era of expansive fiscal policy. Most of the proposed changes should boost inflation and maybe growth too, which should send interest rates higher.

But higher interest rates pose a major problem to the mountain of debt overhanging the US economy.

Federal debt is already $20 trillion—excluding the massive unfunded entitlement obligations that will balloon over the next decade as more Baby Boomers reach retirement age.

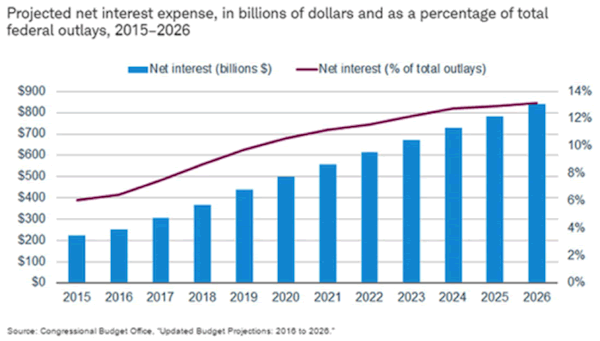

Six percent of the 2015 federal budget was used to pay interest on federal debt. That’s with historically low interest rates and the Federal Reserve owning 20% of the outstanding debt (interest paid to the Fed is remitted back to the Treasury).

If the interest rate on the 3-month Treasury bill rose from 0.5% today to 3.2% over the next 10 years, and the 10-Year Treasury bond from 2.6% to 4.1% over the same period, the CBO projects the interest expense could more than double—to 13.1% of federal spending.

And that projection was made before taking into consideration any of Trump’s plans to boost federal spending while cutting taxes.

An early-2016 report by Standard & Poor’s estimated that US companies have $4.1 trillion of debt coming due in the four short years between 2016 and the end of 2020.

If the recent trend for higher interest rates continues, rolling over that corporate debt will be a challenge.

Too Far, Too Fast

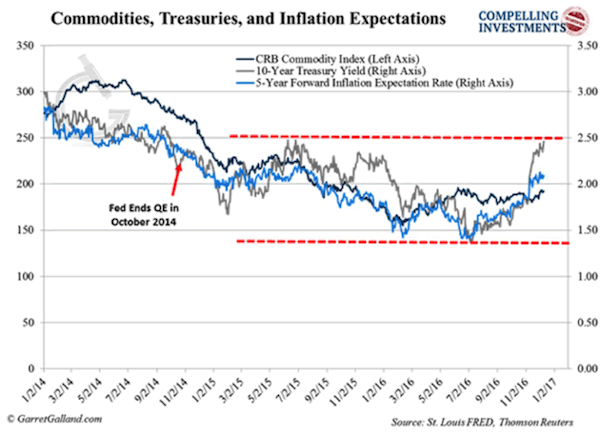

Inflation expectations have been the main driver behind the spike in rates—not actual inflation.

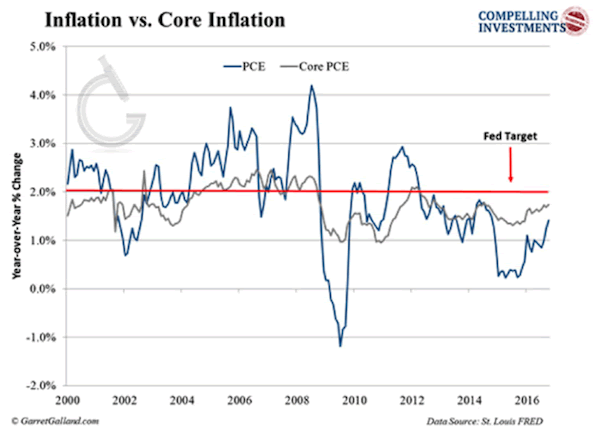

The Fed’s preferred inflation gauge is the annual change in the price index for personal consumption expenditures (PCE), which is still running below the 2% inflation target.

However, inflation expectations (the light-blue line in the chart below) have spiked above 2%. Following suit, the 10-Year Treasury bond yield has jumped as well.

Inflation expectations may be justified as Trump appears intent on jumpstarting inflation. However, interest rates may have gone too far, too fast.

If rates stay elevated before the tax cuts and stimulus spending kicks in, the US could slip back into a recession. In which case, the 35-year secular bull market in bonds may not be over.

Catch-22 Monetary Policy

The Federal Reserve recently hiked rates by a quarter point, and the projected path was raised from two rate hikes to three by the end of 2017.

That projection needs to be taken with a grain of salt. At the beginning of both 2015 and 2016, the Fed projected four hikes, but ultimately only hiked once during each year, in December.

Significantly, by projecting three rather than four hikes in its latest meeting, the Fed is actually entering 2017 more dovish than it has been at the start of the last two years.

Interestingly, the Fed only modestly adjusted real GDP growth up by 0.1% in 2017 and 2019. And its projections for inflation and core inflation were unchanged from 2017 onward.

For years, the Fed has begged for fiscal stimulus to complement its loose monetary policy. With the economy finally poised to receive a dose of Keynesian government spending, the Fed is itching to normalize rates.

The Fed wants higher rates so that when the next recession threatens, it’ll have enough ammo in its war chest to fend it off. However, even a modest rise in interest rates could be the thing that triggers a recession. It’s a catch-22.

A Few Concluding Portfolio Thoughts

If Trump can quickly push through his economic agenda and cooler heads prevail on the trade front, then the path of least resistance will be higher for interest rates.

In this optimistic view, strong economic growth could overcome the headwinds from the debt overhang. The Fed would still probably err on the side of caution.

Allowing inflation to run ahead of 2% would help relinquish some of the national debt burden.

However, it’s more likely that Trump’s agenda faces pushback from both sides of the aisle. If the last eight years have taught us anything, it’s that there are many creative ways to hold up action in DC. In that case, the stock market rally and the bond market rout have both probably overshot.

Of course, no one can predict how this will play out. No investment strategy is bulletproof, but you can tilt the odds in your favor by focusing your attention on buying great companies when they fall to a level of deep undervaluation.

Free report reveals: How to Eliminate Stock Market Risk with 3 Proven Investment Strategies

If you’re tired of being lied to by all those so-called “investment gurus” promising a sure-fire way to get 1,000% returns... but still need a system to safely get stock market returns…you need a copy of Garret/Galland Research's latest free special report.

Click here to learn more about this proven investing system that will change how you invest forever.

David Galland

Managing Editor, The Passing Parade

Garret/Galland Research provides private investors and financial service professionals with original research on compelling investments uncovered by our team. Sign up for one or both of our free weekly e-letters. The Passing Parade offers fast-paced, entertaining, and always interesting observations on the global economy, markets, and more. Sign up now… it’s free!

© 2016 David Galland - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.