Bank of England's Worthless 2% 2Year CPI Inflation Forecasts

Economics / UK Economy Aug 14, 2008 - 04:08 AM GMTBy: Nadeem_Walayat

The Bank of England's in depth 48 page quarterly inflation report published yesterday concludes with the forecast for UK CPI inflation to be at 2% in 2 years time. Since the Bank of England first adopted the 2% CPI inflation target back in 2003, the Bank has perpetually made the same forecast for 2% CPI in two years time, and nearly always missed the target by a wide margin. Clearly there is something wrong in the banks procedures which appears to deliver the motions of generating paper work such as the 48 page report, followed by pats on the back rather than an effective response to the failure to meet the Banks primary objective.

The Bank of England's in depth 48 page quarterly inflation report published yesterday concludes with the forecast for UK CPI inflation to be at 2% in 2 years time. Since the Bank of England first adopted the 2% CPI inflation target back in 2003, the Bank has perpetually made the same forecast for 2% CPI in two years time, and nearly always missed the target by a wide margin. Clearly there is something wrong in the banks procedures which appears to deliver the motions of generating paper work such as the 48 page report, followed by pats on the back rather than an effective response to the failure to meet the Banks primary objective.

The August 2006 inflation report also forecast UK CPI inflation of 2% in 2 years time i.e. by August 2008.

The perpetual 2% Inflation forecast / target has repeatedly shown itself to be a worthless political exercise, as it does not take into account real world events such as the recent surge in global food and energy price inflation and therefore is liable to prove a hindrance towards the proper application of monetary policy which usually during a severe economic downturn as we are now experiencing requires deep UK interest rate cuts. The US central bank does not suffer from this paralysis and thus has been able to take drastic action by making deep cuts in US interest rates from 5.25% to 2% as the central bank puts the fight against inflation on the back burner in lieu of trying to stop the US economy from entering into recession, it is still early days on whether the US Fed has achieved its goal but the deep cuts in US interest rates do ensure that the situation is far better for the US economy than if the Fed had been concerned with fighting a losing battle by trying to keep US CPI below 3%.

Meanwhile in the UK, the Bank of England started cutting UK interest rates in December from 5.75% to 5% by April 08, however since that time the Bank of England has been in a state of paralysis on making further needed cuts in UK interest rates as UK CPI inflation busted through the artificial 3% ceiling and the bank remains paralysed by fear of not knowing what to do and proving totally inept in the application of monetary policy that is fast witnessing the UK heading for an unnecessary and avoidable recession during 2009.

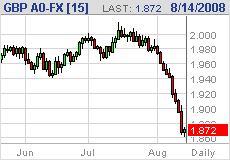

The Governor of the Bank of England, Mervyn King admitted in his statement that the BOE expects no economic growth during 2009, which in BOE speak mean's recession as the Governor cannot openly state that the UK is heading for recession because his objective is to talk up the economy rather than to tell the truth and make the BOE's job harder. The money markets understood the situation crystal clearly and led to a plunge in the British Pound through significant support levels all the way from the £/$2.00 to busting through £/$ 1.94, then 1.90 to stand currently stand at £/$1.87,. that's a drop of 6.50% in just 2 weeks which will have an inflationary effect on the UK economy as the costs of imports soars.

The Governor of the Bank of England, Mervyn King admitted in his statement that the BOE expects no economic growth during 2009, which in BOE speak mean's recession as the Governor cannot openly state that the UK is heading for recession because his objective is to talk up the economy rather than to tell the truth and make the BOE's job harder. The money markets understood the situation crystal clearly and led to a plunge in the British Pound through significant support levels all the way from the £/$2.00 to busting through £/$ 1.94, then 1.90 to stand currently stand at £/$1.87,. that's a drop of 6.50% in just 2 weeks which will have an inflationary effect on the UK economy as the costs of imports soars.

On the other side of the equation we have the Labour government fearful of losing the next election by going on a spending binge by busting through their golden never to be broken rule of government debt not exceeding 40% of GDP. My recent analysis Brown Breaks Another Golden Rule, Real UK Debt Above 40% of GDP , concluded that UK debt by end of 2009 may be as high as 60% of GDP, which would be extremely bearish for the British Pound and inflationary for the economy and thus defeating the Bank of England's feeble efforts to control Inflation.

The conclusion is that it may be better for the UK economy for the Labour government to take control of monetary policy from the Bank of England so as a unified effective strategy can be formulated with the primary goal of avoiding a recession and a secondary goal of fighting inflation, as the current situation of trying to do both at the same time is going to result in the failure of both goals.

The UK interest rate forecast for 2009 is due to be published later this week, existing and past forecasts are listed below.

2008 - UK interest rates to fall to 5% by September 2008 - Aug 07, Sept 07 (revised to 4.75% - Jan 08)

2007 - UK Interest rates to peak at 5.75% by September 2007 - Dec 07

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-08 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 150 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.