The Big Unwinding

Currencies / US Dollar Sep 11, 2017 - 06:36 AM GMTBy: Submissions

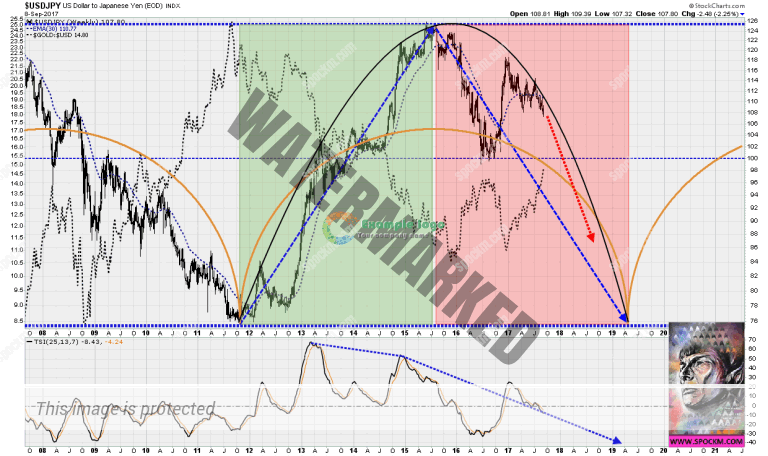

Below is $USDJPY weekly, with $GOLD:$USD in the background. I am using $USD as the denominator for consistency.

Comments:

1. $USDJPY and $GOLD:$USD are inversely correlated

2. The long super cycle for $USDJPY is 180 months (or 15 years) low to low, and the half cycle harmonic is 90 months, low to low.

3. The long super cycle low bottomed in 2011, and its next low will be in 2026/27, which also coincides with the 5th K wave peak in commodities.

4. The 90 month half cycle also bottomed in 2011, with the 15 year super cycle. The next half cycle low will be in first half of 2019, followed by 2026/27, with the 5th K wave peak in commodities.

Probable scenario: $USDJPY drops to the mid line at 100 over coming months, followed by a dead cat bounce and consolidation, before another larger drop to 75, into April time frame, 2019. $GOLD:$USD will move inversely, that is up, consolidate, then make another move up into April 2019.

Percentage moves: Approx. 30% from current prices, into April 2019. That is $USDJPY to 75 and $GOLD:USD to $1750.

The Big Unwinding: Since 2011, our “friendly” banksters, who were bailed out by us taxpayers post GFC, have been using our tax dollars, and our deposit funds, to play the derivatives markets. Its more profitable and less risk for them, than lending into the economy to help main street business. One of their favorite derivative trades since 2011 has been borrowing $JPY at zero interest rates, buying $USD and then, amongst other bankster acts, shorting the commodities sectors, including precious metals, in the derivatives markets. So the banksters have large legacy positions now, that they will be forced to unwind. That is, they are being forced by the markets, to close $Gold legacy shorts, sell $USD and buy $JPY to close out the carry trade loans. Why…because they are on the WRONG side of the market. We are talking very very large amounts of legacy carry trades on their books, accumulated over the last 6 years. The Big Unwinding.

At some stage there will be a big move in price, as these banks reach a point of recognition that they must close out their legacy positions, or suffer big losses.

Investment Strategy: Medium and long term, into 2026/27 5th K wave peak, long precious metals sector, long metals and mining, long hard commodities, long commodity currencies …. and short $USD.

If holding $USD cash, get out of it. It will lose up to 30% of its purchasing power over the next 2 years.

Be good. Spock

© 2017 Copyright Spock - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.