If You Hold VT Or Any Other Global ETF, You’ve Put All Your Eggs In One Basket

Companies / Emerging Markets Jan 08, 2018 - 03:38 PM GMTBy: John_Mauldin

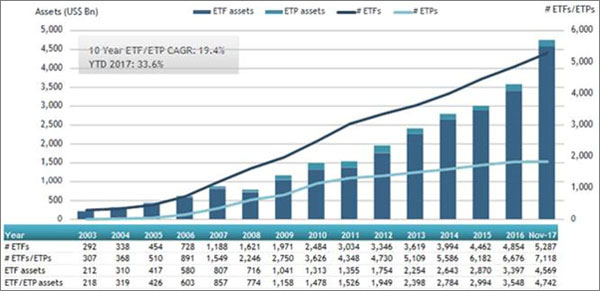

BY OLIVIER GARRET : The growth of ETFs since the Global Financial Crisis has been staggering.

BY OLIVIER GARRET : The growth of ETFs since the Global Financial Crisis has been staggering.

Total ETF assets under management is now approaching US $5 trillion, a 400% increase from the $1 trillion held in 2009.

Investors now have access to over 7,000 ETF/ETP products. To put that number in perspective, there are only 2,400 stocks listed on the New York Stock Exchange.

Source: Moneyweb

This year, there has been no stopping the ETF train. Along with S&P 500 index trackers, global stock market ETFs have received extraordinary capital inflows.

The Vanguard Total World Stock ETF (VT) is one such fund.

Perhaps investors are under the impression that VT and other global stock market ETFs will “diversify” their portfolios away from expensive US equities.

This would make sense in theory, as an allocation to global equities should reduce portfolio risk.

However, the truth is, ETFs such as VT offer very few diversification benefits (learn more in an exclusive ETF special report from former ETF head at Lehman Brothers Jared Dillian, which you can download here).

The chances are, if you hold VT or other similar investment vehicles, you’ve most likely increased your portfolio risk, instead of decreasing it.

Here’s what you need to understand about VT.

Unhealthy US Exposure

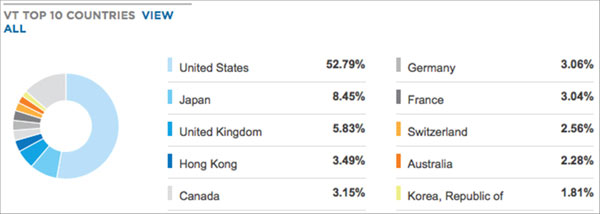

For starters, while VT is meant to be a “global” index, in reality it’s heavily skewed to US equities.

Currently, over 50% of the index is allocated to US equities. In contrast, Europe and the UK have weightings of just 10% and 6% respectively.

The top 10 holdings are all US-listed stocks. In fact, there are only two non-US stocks in the top 20 holdings - Tencent Holdings and Nestle.

Source: ETF

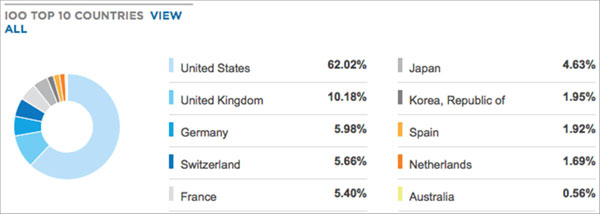

It’s a similar story with the iShares Global 100 ETF (IOO). This “global” ETF has a 61% weighting to the US.

Source: ETF

While these overweight allocations to the US look dangerous at portfolio level, the problem is made worse by the US market’s unsustainable valuation right now.

The S&P 500 trades at a forward-looking P/E ratio of 18.3, according to Factset. In contrast, the UK’s FTSE 100 index and Europe’s Stoxx 600 index currently trade on ratios of 15 and 15.6 respectively.

The result is that investors are heavily overexposed to one of the most overvalued stock markets in the world.

This goes completely against conventional investment wisdom. Buy low and sell high? These global trackers are doing exactly the opposite.

Lack of Emerging Markets

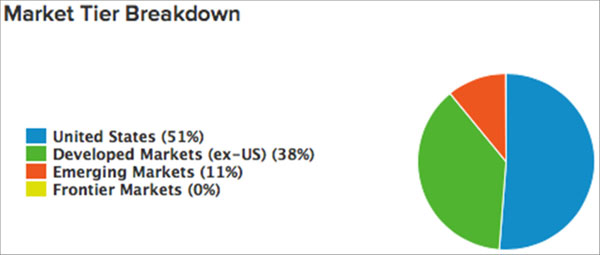

VT and IOO are also seriously underweight the emerging markets. To give you a quick example, here’s a chart of the VT ETF breakdown by market.

Source: ETFdb

As a global investor, wouldn’t you want a significant allocation to these growth regions? After all, emerging markets as a whole are growing at twice the pace of developed economies.

VT and IOO are over exposed to slow-growing developed countries, and under exposed to the world’s fastest-growing economies.

For example, countries such as China and India make up just 2.6% and 1.2% of VT’s portfolio respectively.

Overexposure to FAANGs

But it’s not just country weightings that look unbalanced.

VT also has unhealthy sector weightings. Like the S&P 500, it’s way too overexposed to the tech sector.

It’s the same old familiar names at the top of the index - the FAANGs.

In the same way that Apple, Amazon, Facebook and Google dominate S&P 500 ETFs, these companies also dominate the world index. Between them, they make up almost 5% of the index.

It’s even worse with IOO. As the more concentrated ETF, holding only 100 stocks, Apple, Amazon and Google make up over 15% of the portfolio.

I don’t need to remind you how overpriced some of these stocks are.

Overall, it’s quite clear to see that there’s a serious diversification breakdown here.

Which brings us back to the same problem.

Everyone Owns the Same Stocks

ETFs have distorted the market. Investors have forgotten how to look for value, and have instead just bought the whole market. The result is that every portfolio now contains the same overpriced stocks.

The issue is that as a product of the last decade, ETFs are largely unproven in major market volatility. While capital has flowed into ETFs in a relatively orderly fashion, we have no idea how these products or indeed, the market will fare if investors all want their capital back at once.

Investors Became Lazy

Investors need to go back to basics, and refocus on fundamentals and value. That’s ultimately what generates alpha.

Determine your ideal geographic asset allocation, and select ETFs that are properly diversified.

Look at the emerging markets for long-term growth, or consider undervalued areas of the market such as Europe. Gold is another asset class that could offer diversification benefits.

Rebalance your portfolio regularly.

In times of record-high valuations, risk management is now more important than ever.

Free Report: 5 Key ETF Trading Strategies Every Investor Should Know About

From Jared Dillian, former head of ETF trading at Lehman Brothers and renowned contrarian analyst, comes this exclusive special report. If you’re invested in ETFs, or thinking about taking the plunge into the investment vehicle everyone’s talking about, then this report is a clever—and necessary—first step. Get it now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.