Elliott Wave Analysis: Is US Dollar About to Turn?

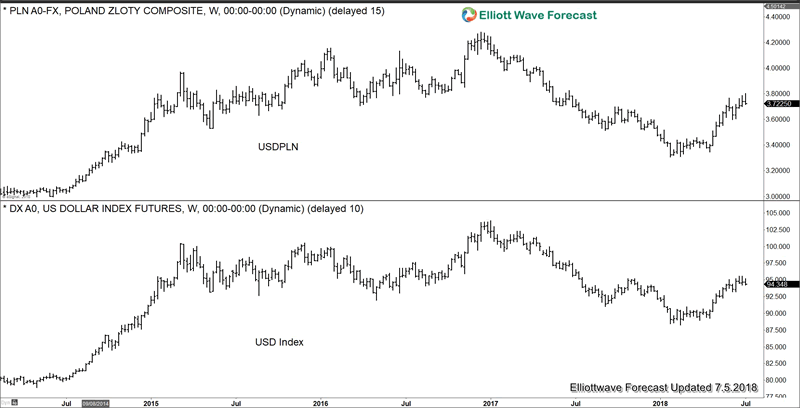

Currencies / US Dollar Jul 05, 2018 - 06:04 PM GMTAt Elliottwave-Forecast.com, we use correlation as one tool to complement our forecast. We often use USDPLN as we believe it is good proxy for Dollar Index (DXY). In below’s chart, we overlay the two instrument, and we can clearly see they are nearly identical

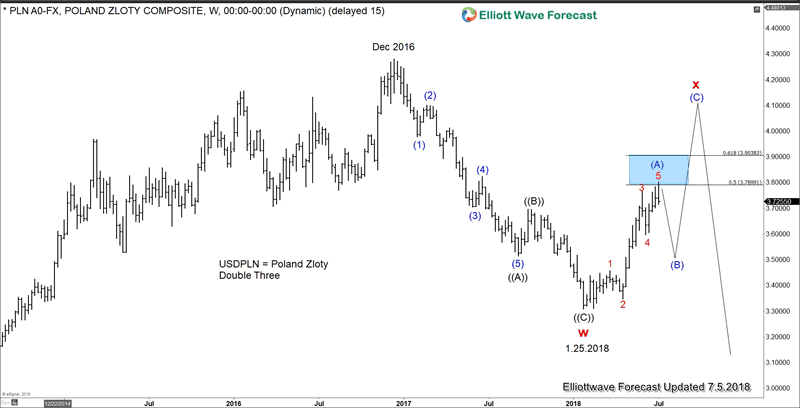

Short Term Elliott Wave Analysis on USDPLN

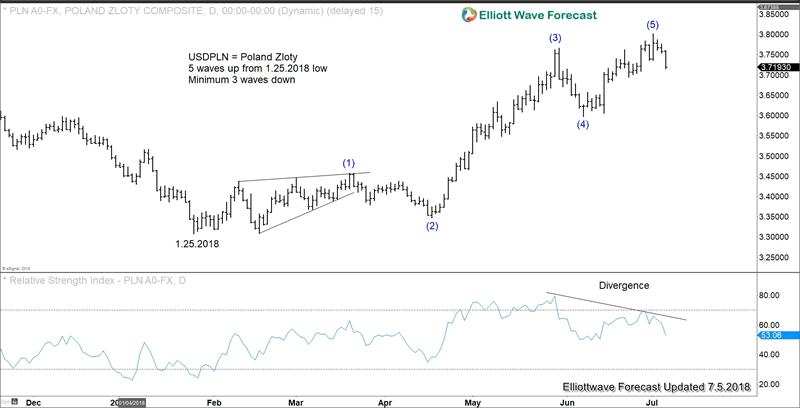

USDPLN shows a clear 5 waves impulse Elliott Wave structure from 1.25.2018 low, and there’s also a momentum divergence at the end of wave 5. The current reaction lower in the pair suggests it has likely ended wave (5). Therefore, at minimum, pair should see a 3 waves reaction lower to correct the rally from 1.25.2018 low (3.3075). Due to the positive correlation with Dollar Index, we could say that in the short term, we can see USD weakness in 3 waves at least.

Long Term Elliott Wave Analysis on USDPLN: Bearish View (Scenario #1)

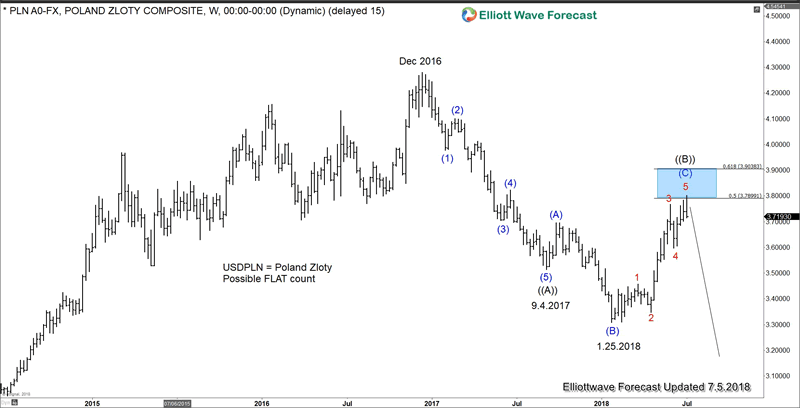

In Scenario #1 (Bearish view) above, the 5 waves rally from 1.25.2018 low is part of wave (C) of FLAT which starts from 9.4.2017 low. Thus, the decline from Dec 2016 peak to 9.4.2017 low ended wave ((A)) as 5 waves impulse Elliott Wave structure. Then wave ((B)) correction is unfolding as an expanded FLAT Elliott Wave structure. In this count, USDPLN is ready to extend lower and will eventually break below 1.25.2018 low. As it has a positive correlation with Dollar Index, then we can see Dollar Index resuming the weakness to new low.

Long Term Elliott Wave Analysis on USDPLN (Scenario #2)

In Scenario #2, USDPLN ended cycle which starts from Dec 2016 high at 1.25.2018 low in wave “w” as a zigzag Elliott Wave structure ((A))-((B))-((C)). Wave “x” correction is taking place as a zigzag structure in which wave (A) ended at 3.8011. In this scenario, pair should pullback in wave (B) then extend higher 1 more leg in wave (C) of “x” to retest the Dec 2016 high. Even in this scenario however, US Dollar should still weaken at least in 3 waves in the short term due to the wave (B) pullback.

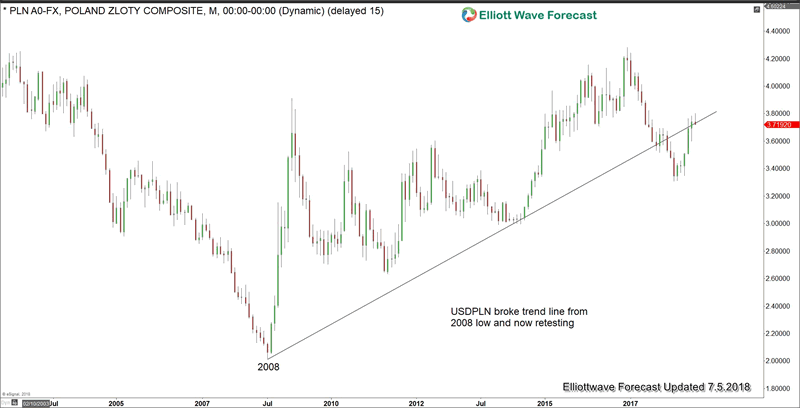

USDPLN broke 10 year trend line

It’s worth to mention that USDPLN broke trend line from 2008 low last year. The pair has since recovered and currently sitting at the same broken trend line retesting it. If the break is valid, then ideally the pair doesn’t close above the broken trend line and should continue to extend lower at least 1 more leg.

In this video today, we will analyze US Dollar through USDPLN (Poland Zloty). Below you can find the short term and long term outlook in US Dollar

Video on US Dollar Elliottwave Analysis through USDPLN

We do this type of analysis everyday in Live Session and Live Trading Room. If you’d like to know more, you can take our 14 days FREE trial. We currently also run 4th of July promotionand you could get 2 months subscription for the price of 1, effectively getting a 50% discount.

By Ayoub Ben Rejeb

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 78 instruments including Forex, Commodities, Indices and a number of Stocks & ETFs from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup and Weekend videos .

Copyright © 2018 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.