Lehman and Normalcy Bias

Stock-Markets / Financial Crisis 2018 Sep 10, 2018 - 08:26 AM GMTBy: Andy_Sutton

It is now September. The time of year that the fright forecasters live for. Their dispatches grow more and more desperate. Tragedy lies just on the horizon. ‘Buy our products now’ they say or ‘reap the whirlwind’. We are now just a few days from the 10th anniversary of the Lehman Weekend Extravaganza which was the official start date of what stuffed shirts in media and politics call the ‘Great Recession’.

It is now September. The time of year that the fright forecasters live for. Their dispatches grow more and more desperate. Tragedy lies just on the horizon. ‘Buy our products now’ they say or ‘reap the whirlwind’. We are now just a few days from the 10th anniversary of the Lehman Weekend Extravaganza which was the official start date of what stuffed shirts in media and politics call the ‘Great Recession’.

On the US side of the Atlantic, the goings on since have edged people into what is called normalcy bias. How can that be you might ask; the Dow has quadrupled since 3/6/2009. That’s an average annual return over double the market’s average annual return over the prior 100 years. The sad thing is there is not a single average investor we know of who has seen their paper stocks quadruple in the last ten years. Those types of gains are reserved for hedge funds, and JP Morgan’s trading desk, not the average person. The idea that the playing field is level is so ludicrous it is actually funny.

However, Americans – and many across the world - look at those meaningless stock index values as a measure of the economy when they’re really just numbers. Yes. Just numbers. They mean nothing to the average person. We might break down at some point how the Dow Jones Industrials average is calculated sometime, just for informational purposes, but it’s not high on the priority list.

What of the rest of the USEconomy? If you listen to the Bureau of Labor Statistics, there is no unemployment. If you look at the debt numbers, the trajectories are the same as when U-6 was almost 18%. Cognitive dissonance. Which one is right. Put together, they make no sense. We might seem to beat credit activity like a dead horse, but when it’s the one thing separating your entire economy and way of life from oblivion, then you’d be smart to pay attention to it. The Europeans didn’t pay a shred of attention and they’ve paid dearly. We wonder when the word ‘austerity’ will be mentioned in our nation’s capital. The Congress is completely off the rails, hanging trillion-dollar deficits on the back of America for the foreseeable future.

These same quislings gave the ‘middle class’ a tax break recently. Now we know people love to love or hate politicians. We don’t really give a rip about politicians. They all lie, that’s all we really need to know. By virtue of many surveys over many decades 9 out of 10 of you agree with that assessment. But let’s look at the tax break. The government collects taxes to pay for its programs, lavish salary and benefits for what used to be public servants, and so forth. If they collect less tax revenue vis a vis a ‘tax break’ then that is less collected for programs, etc. But they don’t spend less. They spend even more. And it isn’t like the USGovt had any kind of surplus with which to ‘pay’ for the alleged ‘tax cut’. No, they took out a loan and sold more USTreasury bonds and went further into debt to give us that great ‘tax cut’. But it’s not their debt. It’s OURS. Tax cut how???? Inquiring minds really want to know.

The whole ruse of the tax cut was about a mile wide and maybe a millimeter deep. If that. It was so thinly veiled in fact that you’d think nobody would fall for it. Cognitive dissonance. But they did. En masse. Hind end over tin cups in fact. Normalcy bias.

How much has changed since Lehman? We got the Dodd-Frank Act of 2010 which while touted as a consumer protection mechanism gave rise to the bail-in resolution mechanism for failed banks moving forward. That’s great for consumer protection. Was there anything put in place to prevent another Lehman episode? Nope. Glass-Steagall? Nope. Both political ‘parties’ have had a chance to do something since Lehman and neither have been inclined. So much for the idea of having someone looking out for the average American. Time to wake up, folks. You’re a target. Your government has joined hands with corporations to kill tens of thousands of people so those corporations can build pipelines through distant lands. Yes, it is really that simple. So, let’s dispense with the baloney. What has government ANYWHERE done for its citizens? Nada. Squat. Zero. Nothing. Oh wait, we got a tax break, I’m sorry. Cognitive dissonance.

In all seriousness; and it is serious, not a whole lot on the good side has changed since Lehman or 9/11. We had a brief period from December 2009 through January 2011 where Americans actually attacked their bills and paid some down. But then the previous trend resume with extreme prejudice and at an even steeper trajectory. When Ron Paul was running for President in 2012, the national debt was $14 trillion. It has increased 50% in the last 6 years.

We’ve been at war for nearly two decades. Persistent war and economic hurt have become the norm. Both have lost their serious nature and because of normalcy bias, the next hit – whichever direction it happens to come from will catch people, businesses, perhaps even nations completely unaware and unprepared.

But we’re not hurting! Life is good! Vacations, new vehicles, new toys, lots and lots of toys do we have. Being in hock has been normalized as well. There were times in our past when it brought shame to owe someone. Nobody wanted to be in that position. People were self-sufficient for the most part. Through clever marketing campaigns and the actions of government, we have become normalized to debt. In fact, on a subconscious level, we actually equate the money we borrow to the money we earn working a job. The fact that we don’t have to pay our employer back for the currency they pay us is lost. The inducements have gotten better. Firms regularly sell items for 25% off. They’re not doing that because they want to, they’re doing it to move the inventory. Retail is dying in many areas of the US, UK, and Europe.

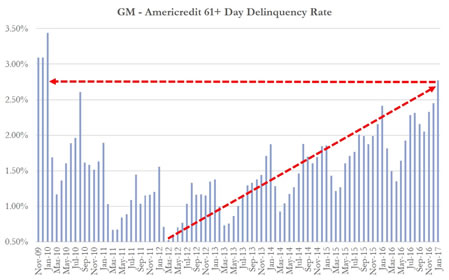

The most recent subprime mess was in auto loans. As of the beginning of 2017 (most recent comprehensive data available), the 61-day delinquency rate for GM financed vehicles was nearly on par with the delinquency rate back in 2010. As the above graphic demonstrates, there’s been a consistent trend of delinquency since 2012.

At the same time delinquencies are rising, so is the amount of money borrowed to finance even more purchases. We are wondering (and you should be too) how much of the money borrowed today is to pay off already existing debt ie: robbing Peter to pay Paul? It is hard to infer, but something to consider in the context of your circle of acquaintances. When you look at just the averages alone, the picture is downright ugly.

Remember, these are just averages and the average US family is around $170,000 in debt. Keep in mind this includes all those renting who have no mortgages, those who never went to college and have no student loans. It is hard to get exact data, but the trend is ugly no matter whose data we look at. There is a good deal of evidence both anecdotal and factual that indicates that the numbers in the chart above are significantly understated.

Having this little bit of information in your pocket, now consider this. Is anyone frightened of these trends? Probably a few people. Back in 2011, the stock market fell off a cliff because it was believed the Congress wasn’t going to extend the debt ceiling and the government wouldn’t be able to borrow ‘legally’. In case we hadn’t noticed, the government doesn’t care about what’s legal. There’s law in the books that, among other things, says that the government must balance its budget. We suppose it is balanced – it just takes massive amounts of borrowing to do so. We are certain, however, that wasn’t the INTENT of the legislation, passed in the 1980s, shortly after America piled up its first trillion in debt. Just 32 years later, we’ve added another $20.4 trillion and nobody is even talking about the debt ceiling, the national debt, or any of it anymore. It left the conscious thought of America. It brings up an interesting question: If a tree falls in the forest and nobody is there to hear it, did it make a sound? We could posit the following question: If the national debt continues its meteoric rise, but nobody is thinking or talking about it, do we still owe the money?

This is where the normalcy bias kicks in. According to Wikipedia, normalcy bias is described in the following manner:

“The normalcy bias, or normality bias, is a belief people hold when facing a disaster. It causes people to underestimate both the likelihood of a disaster and its possible effects, because people believe that things will always function the way things normally have functioned. This may result in situations where people fail to adequately prepare themselves for disasters, and on a larger scale, the failure of governments to include the populace in its disaster preparations. About 70% of people reportedly display normalcy bias in disasters.[1]

Journalist Amanda Ripley identified common response patterns of people in disasters and found that there are three phases of response: Denial, Deliberation and the Decisive Moment. The faster people can get through the Denial and Deliberation phase, the quicker they will reach the Decisive Moment and begin to act.

The normalcy bias can manifest itself in various disasters, ranging from car crashes to world-historical events. It is hypothesized that the normalcy bias may be caused by the way the brain processes new information. Stress slows information processing, and when the brain cannot find an acceptable response to a situation, it fixates on a single and sometimes default solution. This single resolution can result in unnecessary injury or death in disaster situations. The lack of preparation for disasters often leads to inadequate shelter, supplies, and evacuation plans. Thus, normalcy bias can cause people to drastically underestimate the effects of the disaster and assume that everything will be all right. The negative effects of normalcy bias can be combatted through the four stages of disaster response: preparation, warning, impact, and aftermath.

Normalcy bias has also been called analysis paralysis, the ostrich effect,[2] and by first responders, the negative panic.[3] The opposite of normalcy bias is overreaction, or worst-case scenario bias,[4][5] in which small deviations from normality are dealt with as signals of an impending catastrophe.”

The question we’d like to place before you is where do you stand with regards to the goings on in your country. We’re not just talking about America; this is a cancer that plagues nearly the entirety of the first world. What we have noticed anecdotally is that people were supremely vigilant in the wake of the Lehman crisis and that state of hypervigilance lasted for around 4 years. We’re not referring to the entire population. There are many people who have absolutely no idea what Lehman was, what the leadup meant, nor did they care in the aftermath. Most will tell you it just had something to do with housing and mortgages. That is the extent of the average global citizen’s awareness and understanding of events. Granted, if you’re not really a financially oriented person or a history buff, why bother?

When we say people paid attention for 4 years, we’re talking about the vast majority of die-hards. People like us and we took a break too. Nobody can stay at financial DEFCON 2 indefinitely. Subsequent market shocks desensitized people just like geopolitical shocks desensitized people with regard to global events. The normalcy bias has kicked in globally yet the circumstances that causes Lehman are even more dire than they were a decade ago. Nations have gone bankrupt in the interim. People are buried under more debt than a kinder bunch of robber-barons would have allowed and our world is higher strung than ever.

It would seem that we have indeed inherited the Chinese curse of living in interesting times. Our plea is that you evade the normalcy bias. Engage what is happening. You won’t be able to change it except on a personal level, but knowing is certainly better than waking up Monday September 15, 2008 and finding out your world just changed forever.

Graham Mehl is a pseudonym. He is not an ‘insider’. He is required to use a pseudonym by the policies of his firm when releasing written work for public consumption. Although not an insider, he is astonishingly bright, having received an MBA with highest honors from the Wharton Business School at the University of Pennsylvania. He has also worked as an analyst for hedge funds and one G7 level central bank.

Andy Sutton is a research and freelance Economist. He received international honors for his work in economics at the graduate level and currently teaches high school business. Among his current research work is identifying the line in the sand where economies crumble due to extraneous debt through the use of economic modelling. His focus is also educating young people about the science of Economics using an evidence-based approach.

By Andy Sutton

http://www.andysutton.com

Andy Sutton is the former Chief Market Strategist for Sutton & Associates. While no longer involved in the investment community, Andy continues to perform his own research and acts as a freelance writer, publishing occasional ‘My Two Cents’ articles. Andy also maintains a blog called ‘Extemporania’ at http://www.andysutton.com/blog.

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.