Will Platinum Be the Precious Metal Leader?

Commodities / Platinum May 01, 2019 - 03:08 PM GMTBy: The_Gold_Report

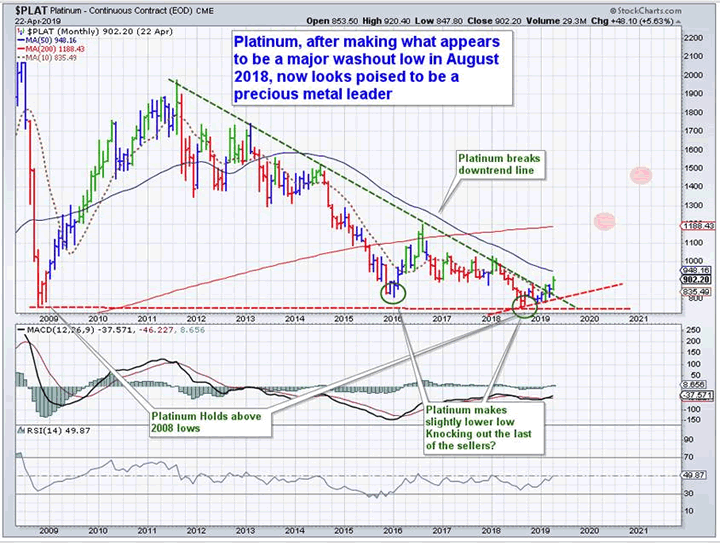

Platinum, after making what appears to be a wash-out low in August 2018, now looks poised to be a precious metal leader, writes fund manager John Newell at Fieldhouse Capital Management.

Platinum, after making what appears to be a wash-out low in August 2018, now looks poised to be a precious metal leader, writes fund manager John Newell at Fieldhouse Capital Management.

What is Platinum:

Platinum is a precious transition metal that has the chemical symbol Pt and an atomic number of 78 on the periodic table. Platinum is grayish white in color and is often mistaken for silver. Platinum is derived from the Spanish word, platina, which translates to "small silver." Once considered a nuisance mineral, it was often discarded by early miners. Platinum is thirty times rarer than gold, with annual production of 6 million ounces per year, compared to ~100 million p/a ounces of gold, and 850 million ounces p/a of silver.

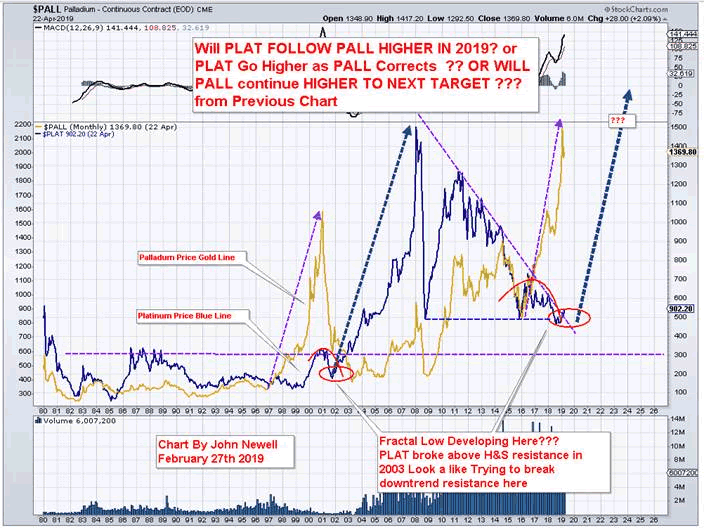

Chart courtesy of StockCharts.com.

Platinum Mine Supply:

There are less than 10 million ounces of aboveground platinum supply in the world; this compares to 165,000 tons of above-ground supply in gold. Currently platinum trades at ~70% of an equivalent ounce of gold, which is historically very inexpensive.

Platinum supply occurs naturally in South Africa (72%), Russia's Ural Mountains (11%), Zimbabwe (8%), the Western United States (6%), Colombia, China and Finland (combined 3%). It is often found in the presence of other metals from the platinum metals group such as palladium, ruthenium, rhodium, iridium and osmium. It can also be found near gold, silver, nickel and copper. In South Africa and Zimbabwe, platinum is mined as a primary metal, whereas it is produced predominantly as a byproduct of nickel in Russia. In North America, platinum is largely a byproduct of palladium mines.

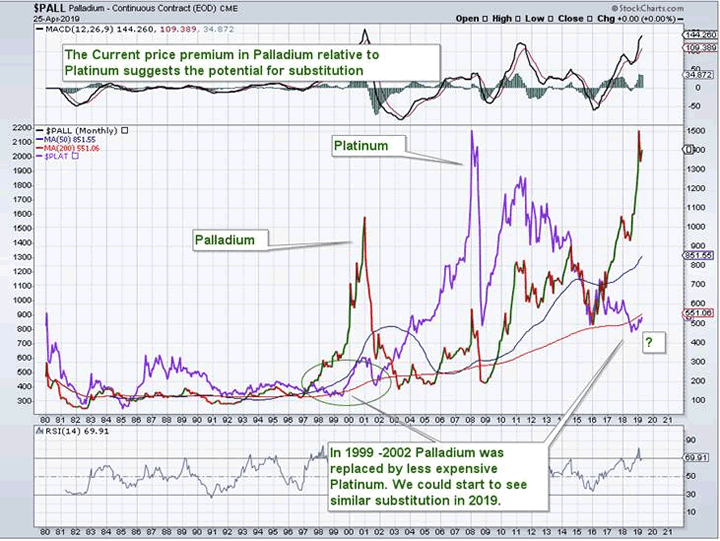

Palladium's price premium to Platinum reflects the tight supply and current deficit supply deficit and highlights the potential for substitution, such as what happened from 1999 to 2002.

With palladium reaching new all-time, never-been-higher highs, due to the headline-grabbing announcements of deficits in 2018 that are likely to grow in 2019 to greater than 1 million ounces, suggests that palladium's growing demand and depleted inventories will keeping prices historically high in the short term.

In the past, as shown on the charts below, when palladium enters a deficit that is long lasting, with sustained higher prices, the market experiences substantial demand substitution. We have highlighted this price action, as cheaper palladium was substituted for more expense platinum in the late 1980s and reversed in 1999–2002 period (see chart below), as palladium was replaced by the less expensive platinum. However, as was the case in the same two time periods, rebalancing among industrial users takes time.

Chart courtesy of StockCharts.com.

Platinum appears to be breaking a long downtrend line and breaking out, that could be signaling and closing of the large gap between the two similar metals.

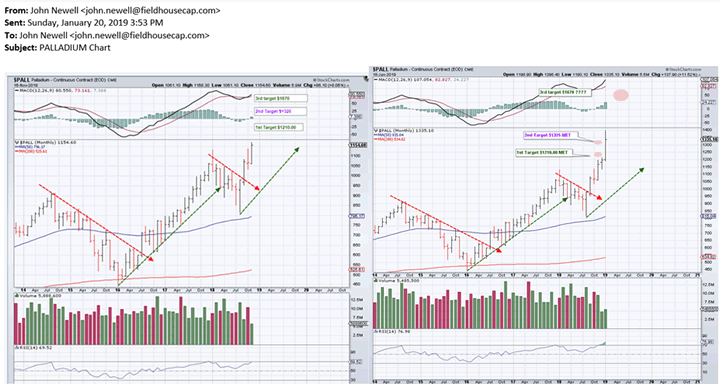

We believe that platinum could be in the same technical position we saw in palladium before it moved dramatically, hitting two of three projected targets, leaving the potential third target outstanding.

Chart courtesy of StockCharts.com.

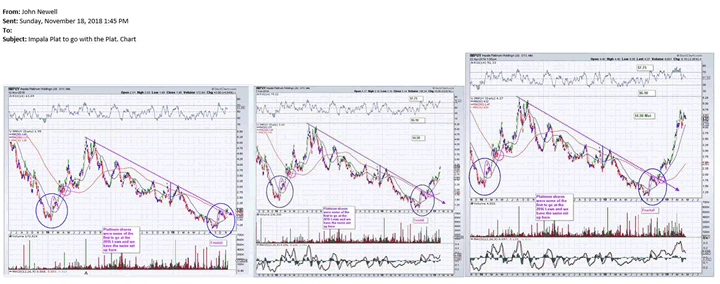

Impala Platinum Holdings Ltd. (IMP:JSE) gave investors a clue that platinum could be turning here as shares in producing companies tend to move before the physical metals, as speculators want the leverage that comes with owning the company shares.

Chart courtesy of StockCharts.com.

Chart courtesy of StockCharts.com.

Platinum appears to be cheap, trading at ~70% of the price of gold, building a series of recent higher lows and higher highs, after a washout low in August 2018 that traded a slightly higher low than the 2008 financial crisis low.

Chart courtesy of StockCharts.com.

Demand for Platinum:

Platinum is a rare metal with distinctive qualities that make it highly valued across several diverse demand segments. Platinum's unique physical and catalytic properties have established its value in industrial applications. There is growing demand for platinum in industrial uses, jewelry and as an investment. Platinum is an essential industrial commodity and is used worldwide to manufacture about 20% of all consumer goods. We believe this demand will continue, as new uses for platinum are being discovered all the time, due to the metal's resistance to corrosion, high melting point, electrical conductivity and durability.

The primary demand comes from the automotive industry, and with continuing tightening of emission standards worldwide, this trend will continue. Platinum is also used to catalyze the electricity-producing conversion of hydrogen and oxygen into water in hydrogen-based fuel cells, with water and heat the only emissions.

Platinum is particularly well suited as a fuel cell catalyst as it allows the hydrogen and oxygen reactions to take place at an optimal rate, while being stable enough to withstand the high electrical current density and the complex chemical reaction that take place in a fuel cell, performing efficiently over the long term.

Platinum-based hydrogen fuel cell electric vehicles are expected to see rapid growth, as both Japan and China have stated that it is an important part of their current plans for adoption of fuel cell vehicles for long-distance trucking, public transportation, as well as fuel cell cars. China's fuel cell adoption plans alone could require more than 300,000 ounces of platinum per year. Japan, with its commitment to delivering the greenest Summer Olympics in 2020, is also making large investments in in platinum-based hydrogen fuel cell vehicles to transport athletes and spectators. In addition, the Tokyo Metropolitan Government plans to invest in 100,000 hydrogen cars, 100 hydrogen buses and build 80 hydrogen refueling stations by 2025.

Platinum is also used broadly in manufacturing of high-performance glass, which accounts for ~15% of demand, and this industrial use appears to be increasing. Demand from the glass sector has averaged ~200,000 ounces per year over the past five years. This durable and versatile metal helps in the process to make everything from smartphone screens to the high-quality fiberglass to make wind turbines and reduce vehicle weight, making them reach fuel economy targets.

Platinum, although still not as popular as gold and silver investing, has seen investment demand increasing as exchange traded funds, pension funds, mutual funds, and private investors are realizing how rare and collectable this durable metal really is.

How to invest in platinum:

Probably the safest way to invest in platinum is to physically own the metal. Although there are fewer platinum products available than gold or silver, there are still numerous ways you can invest in the metal. Platinum bars are a common investment, and these bars typically sell in smaller gram sizes. Coins are another common type of bullion, and a government mint such as the United States Mint or the Royal Canadian Mint both make these coins. Some examples of platinum bullion coins include Platinum American Eagles, Platinum Canadian Maple Leafs, Australian Koala Coins and Platinum Chinese Pandas.

There are pure-play platinum ETFs, platinum and palladium ETFs, and others that have weighting in the Platinum Group Metals.

Investors can purchase shares in platinum mining companies, both producing and exploration companies, that carry different risks such as nationalism, performance of management and employees, environmental risk, and the ability to find and produce the metal profitably.

Conclusion:

Platinum has been in an overall downtrend since 2008, with some brilliant roman-candle like moves in 2009 and 2016, only to burn out quickly and fall back to earth. However, we see this changing technically as platinum is breaking the downtrend that has been in for now more than 10 years. The biggest fundamental reason this may happen now is the palladium shortage, which may cause the substitution of palladium by platinum.

We feel that industrial and investment demand will continue drive platinum prices to higher levels over the next 9 to 18 months.

John Newell is a portfolio manager at Fieldhouse Capital Management. He has 38 years of experience in the investment industry acting as an officer, director, portfolio manager and investment advisor with some of the largest investment firms in Canada. Newell is a specialist in precious metal equities and related commodities and is a registered portfolio manager in Canada (advising representative).

Disclosures: 1) John Newell: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures/disclaimer below. 2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. 3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.