Horrid US Economic Data on Housing Market, Jobs and Durable Goods

Economics / US Housing Sep 26, 2008 - 10:51 AM GMTBy: Mike_Shedlock

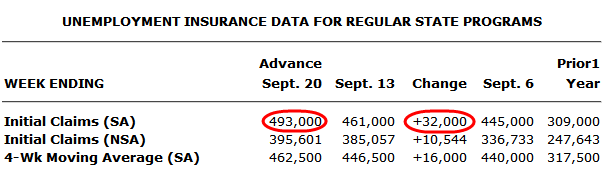

Inquiring minds are looking at weekly unemployment claims .

Inquiring minds are looking at weekly unemployment claims .

In the week ending Sept. 20, the advance figure for seasonally adjusted initial claims was 493,000, an increase of 32,000 from the previous week's revised figure of 461,000. It is estimated that the effects of Hurricane Gustav in Louisiana and the effects of Hurricane Ike in Texas added approximately 50,000 claims to the total. The 4-week moving average was 462,500, an increase of 16,000 from the previous week's revised average of 446,500. The spin above blames hurricanes. I do not buy it, at least to the extent claimed. The fact of the matter is this economy is rapidly falling apart.

In December 2007 I stated that every jobs report this year would be bad. So far we have had 8 consecutive horrid jobs reports. We have lost jobs every month this year. September will be the 9th month in a row. One cannot blame hurricanes for this data series.

August Home Sales Drop 34.5%

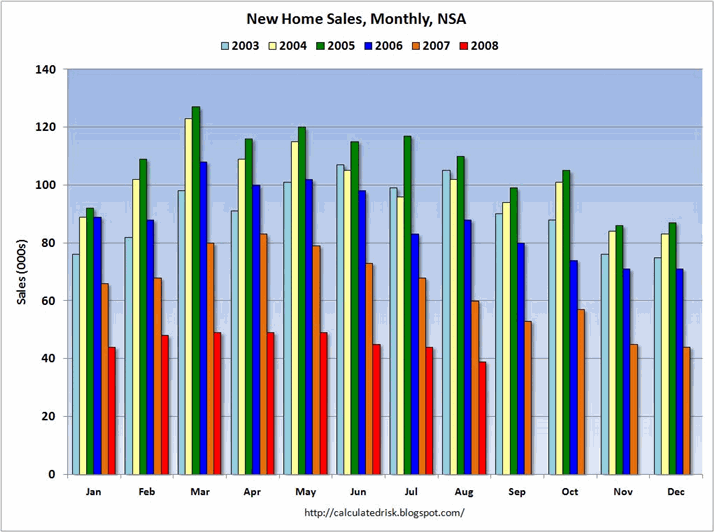

The disaster in home sales continues. The U.S. Census Bureau has just issued the New Residential Sales Report for August 2008. Let's take a look.

Sales of new one-family houses in August 2008 were at a seasonally adjusted annual rate of 460,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

This is 11.5 percent (±11.7%) below the revised July rate of 520,000 and is 34.5 percent (±7.3%) below the August 2007 estimate of 702,000.

The median sales price of new houses sold in August 2008 was $221,900; the average sales price was $263,900. The seasonally adjusted estimate of new houses for sale at the end of August was 408,000. This represents a supply of 10.9 months at the current sales rate.

Calculated Risk has a nice graph and commentary at August New Home Sales: Lowest August Since 1982 .

Notice the Red columns for 2008. This is the lowest sales for August since 1982. (NSA, 39 thousand new homes were sold in August 2008, 36 thousand were sold in August 1982).

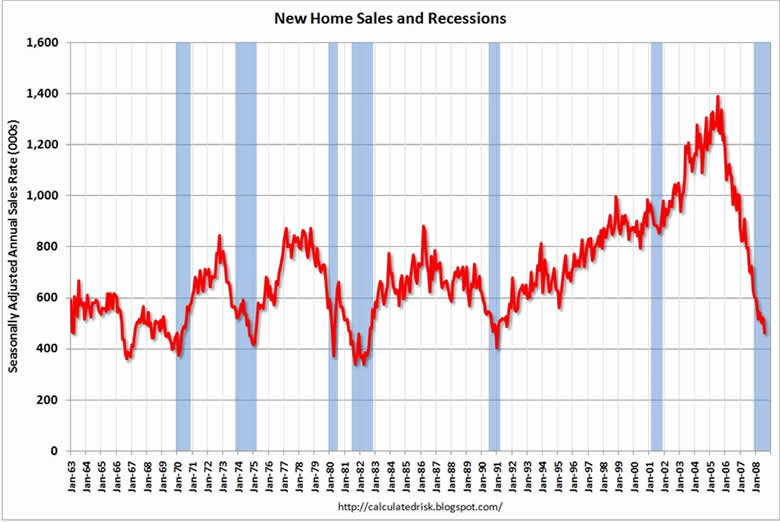

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Calculated Risk has two more charts on housing inventory and month's supply of homes that inquiring minds will want to check out.

Durable Goods Disaster

The Advance Report on Durable Goods Manufacturers' Shipments, Inventories and Orders August 2008 is out. Let's take a look.

New Orders

New orders for manufactured durable goods in August decreased $9.9 billion or 4.5 percent to $208.5 billion, the U.S. Census Bureau announced today. This was the

largest percent decrease in new orders since January 2008 and followed three consecutive monthly increases including a 0.8 percent July increase.

Excluding transportation, new orders decreased 3.0 percent. Excluding defense, new orders decreased 5.0 percent. Transportation equipment, down two of the last three

months, had the largest decrease, $5.1 billion or 8.9 percent to $52.3 billion.

Inventories

Inventories of manufactured durable goods in August, up thirteen of the last fourteen months, increased $2.4 billion or 0.7 percent to $338.5 billion. This was also at the highest level since the series was first stated on a NAICS basis in 1992 and followed a 0.9 percent July increase. Primary metals, up nine consecutive months, had the largest increase, $0.9 billion or 2.5 percent to $34.9

billion.

Capital Goods

Nondefense new orders for capital goods in August decreased $5.6 billion or 7.5 percent to $68.9 billion. Shipments decreased $2.0 billion or 2.8 percent to $67.2

billion. Unfilled orders increased $1.7 billion or 0.4 percent to $481.3 billion. Inventories increased $1.2 billion or 0.9 percent to $139.7 billion.

Defense new orders for capital goods in August increased $0.9 billion or 9.4 percent to $9.9 billion. Shipments decreased 0.2 percent to $9.1 billion. Unfilled orders increased $0.8 billion or 0.6 percent to $140.1 billion. Inventories decreased $0.2 billion or 1.2 percent to $19.1 billion.

The durable goods report was an absolute disaster. Orders plunged and inventories continue to rise.

Housing, jobs, and durable goods were all disasters. Expect to see production cutbacks and rising unemployment. Anyone who thinks the US is not in recession is in absolute fantasyland.

Kill The Deal

It's time to Take Back America from Paulson and the thugs attempting to hijack the country at taxpayer expense. Please keep phoning and faxing. The Paulosn plan will not create a single job, not a one.

I will have a new campaign later today. In the meantime please click on the above link and tell your Congressional Representative "No Deal, Start Over, The Paulson Plan Sucks"

My alternative proposal can be found in Open Letter To Congress On The $700 Billion Paulson Bailout Plan .

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.