The End of Apple Has Begun

Companies / Apple Dec 06, 2019 - 05:53 PM GMTBy: Stephen_McBride

When Apple CEO Tim Cook took the stage this September, nobody expected the shocking news he was about to deliver...

He unveiled the new iPhone 11—the most advanced phone Apple has ever made.

But it was not the triple-lens camera and lustrous finishes that stole the show. It was the phone’s price tag.

For the first time ever, Apple cut its iPhone price.

As I’ll explain, Apple made this move out of desperation… and it may well spell the beginning of the end of Apple’s run as a dominant company.

Apple is not a gambling company, but have worked a lot with gambling companies, read more and find some of them on FS Monster's casino list. But first, let's look at what Apple really is - a phone company.

Apple Is a Phone Company

Let’s get one thing straight…

Apple is not a computer company anymore.

Apple is a phone company.

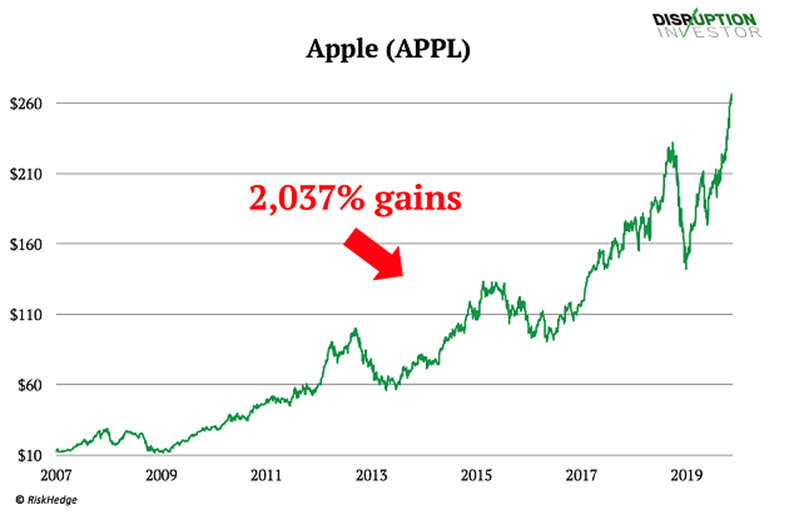

Since it introduced the iPhone in 2007, Apple has sold 2.2 billion phones raking in over a trillion dollars in sales—more than any other phone maker in history. Meanwhile, Apple stock shot up over 2,037%... and became the world’s largest publicly traded company.

iPhone Is Apple’s Golden Goose

Apple has earned a whopping $1.99 trillion since 2007. The thing is, more than half of it came from iPhone sales.

iPhone is not only Apple’s best-selling product by far. It’s also the company’s most profitable product.

For every dollar an iPhone brings into the company, Apple earns $0.60–0.74, according to PhoneArena. Compare that to the MacBook Air… Apple’s most profitable notebook...which earns a mere $0.29 on the dollar.

If it weren’t for the iPhone, Apple wouldn’t be where it is today. Without the iPhone, Apple would be a mediocre computer company like Dell at best.

iPhone Sales Stalled Out

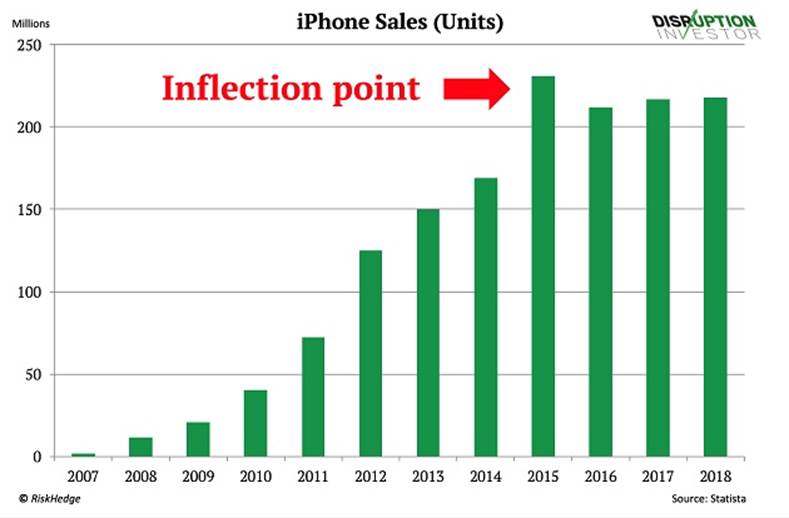

For years, iPhone revenues have sprinted higher at an exponential pace.

But in 2015, Apple reached an inflection point. The growth of its iPhone sales has died out, as you can see below…

Last year, Apple sold 14 million fewer phones than it did three years ago.

That’s not unusual, though.

When Apple unveiled the first iPhone, the smartphone was groundbreaking technology. The typical lifecycle of a groundbreaking technology looks like this:

Sales skyrocket out of the gate… then flatten out as the market matures… and finally take an inevitable downturn.

Twelve years ago, only 120 million people had a cell phone. Today, over five billion people own a smartphone, according to IDC.

Apple Found a Way to Extend the iPhone Lifecycle

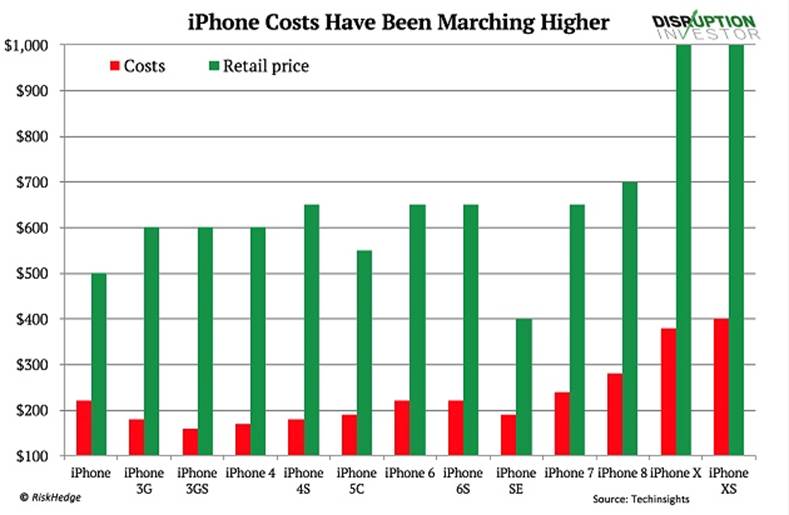

As I wrote earlier, Apple has found a masterful way to extend iPhone’s prime time. The company raised iPhone prices to offset slowing sales and keep its revenue figures growing.

Think about it… In 2010, you could buy a brand-new iPhone 4 for $599.

In 2017, you would have had to fork over $849 for the iPhone 8 and $1,149 for the iPhone X… Apple’s most expensive phone.

The price hikes kept Apple’s growth engine alive… and for this reason, its revenues have gone on marching higher since 2011.

But there was also another reason Apple was forced to hike its phone prices…

iPhones Are More Expensive for Apple, Too

Take a close look at the chart below. It shows how much it costs for Apple to make an iPhone...

With the exception of a few years, the cost of making an iPhone has been climbing higher since 2007.

The first iPhone cost Apple just above $200 to make. Meanwhile, iPhone XS (the latest iPhone Apple reported on) costs double that.

Apple has always set records with its phone prices. But as you can see, it did it for a reason. It had to offset the ever-growing costs.

But as I warned my readers before, it was just a matter of time before Apple had to pull back with its pricing.

It didn’t take long….

iPhone Has a New Feature: Lower Prices

Last September, Apple unveiled iPhone XR, a less advanced and more affordable version of the iPhone X.

It cost $749, a 35% drop from the iPhone X’s $1,145 price tag.

But in truth, it was almost the same iPhone X, only disguised as a budget phone. It was basically an excuse for Apple to release a cheaper phone to get its sales figures back on track.

This year, Apple went a step further. It slashed the price of its full-fledged iPhone. The newly released iPhone 11 started at $699, a price point not seen since 2017.

Apple did it as a last resort to spur lackluster demand. But in doing so, it has signaled the beginning of the end of its lucrative iPhone business.

The End of Apple

See what’s happening?

Not only is Apple selling fewer iPhones, it’s now earning much less on each one.

Recent financial reports show that iPhone revenues… which have been Apple’s lifeblood… are starting to sink.

Last quarter, Apple earned 10% less from iPhones than it did during the same period last year. That’s a loss of about $20 billion!

Apple has never earned so little from iPhones… and all this will start showing up in Apple’s financial reports very soon.

Let me make it clear: half of Apple’s business is going off the rails, and there’s no turning back.

While Apple admits the demise of iPhone and is looking into new business directions, these things don’t happen overnight. Meanwhile, Apple’s money-making machine is grinding to a halt.

As I warned you earlier this year, Apple is a ticking time bomb… and for this reason, I’d recommend staying away from this stock.

Written with the assistance of Dainius Runkevičius.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2019 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.