The Connection Between Stocks and the Economy is not What Most Investors Think

Stock-Markets / Stock Markets 2020 Sep 19, 2020 - 11:05 AM GMTBy: EWI

You've probably heard the phrase, "leading economic indicators."

In the U.S., they refer to a core set of data points, including the Consumer Price Index, the Producer Price Index, employment, manufacturing activity, housing starts and consumer confidence.

But, interestingly, the most important economic indicator is usually not referred to as such, and it's none other than the stock market itself.

That's right, despite the widespread belief that the economy drives the stock market, it's the stock market which leads the economy.

This is not a new idea to Elliott wave fans and those familiar with the new science of social prediction called "socionomics." The logic behind this idea is sound: When people are optimistic about the future, many of them buy stocks and can do so almost immediately. But that same optimism takes time to play out in the economy. It might take months to draw up plans to expand a business, hire new employees and so forth. The same applies in reverse when people turn pessimistic about the future. It takes time for business owners to cut back. So that's why the economy lags the stock market. Examples abound: Just think back to the 2009 bottom in stocks, or the bottom in March of this year -- both occurred despite the worst economy in decades, and the economy followed; it didn't lead.

However, as suggested, even seasoned financial observers are puzzled when the stock market does not behave in a way that matches the latest economic news.

For example, consider this August 15 news item from the UK Guardian:

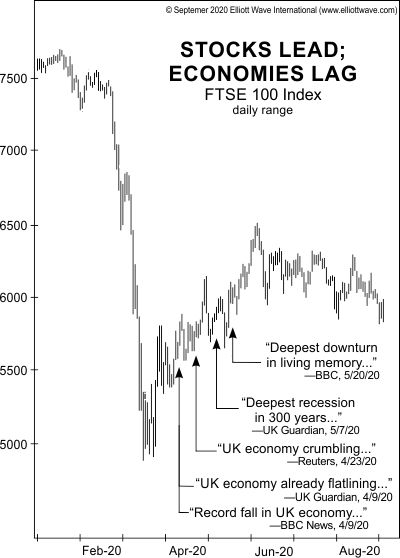

FTSE rises despite economic collapse

Surge in shares contrasts with Covid-related downturn and growing unemployment

Elliott Wave International's September Global Market Perspective, a monthly publication which covers 40-plus worldwide markets, had that news article in mind as it showed this chart and said:

According to the authors, share prices in London are "largely detached from the UK economy. Never has the disconnect between financial trading and economic fundamentals appeared so extreme." The confusion here stems from the fact that pundits have placed the economy's cart before the stock market's horse. ... The connection between stocks and the economy remains rock solid, with a steady parade of dire economic headlines following the FTSE 100's 36% crash from January 17 to March 16.

So, consider any future British economic data a reflection of the stock market's current performance. In other words, any improvements in the UK economy in the weeks and months ahead will come as a result in people's growing optimism about the future today -- which they have already expressed by putting their money in the stock market.

As for the market's future performance -- that hinges on the Elliott wave model, which you can learn about by reading, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter.

This quote from the Wall Street classic provides a broad overview:

In the 1930s, Ralph Nelson Elliott discovered that stock market prices trend and reverse in recognizable patterns. The patterns he discerned are repetitive in form but not necessarily in time or amplitude. Elliott isolated five such patterns, or "waves," that recur in market price data. He named, defined and illustrated these patterns and their variations. He then described how they link together to form larger versions of themselves, how they in turn link to form the same patterns of the next larger size, and so on, producing a structured progression. He called this phenomenon The Wave Principle.

You can read the online version of Elliott Wave Principle: Key to Market Behavior for free when you join Club EWI, the world's largest Elliott wave educational community. Club EWI membership is also free.

Just follow this link: Elliott Wave Principle: Key to Market Behavior -- free access.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.