Stock Market Indices Teetering at the Edge of the Cliff

Stock-Markets / Stocks Bear Market Nov 09, 2008 - 12:06 PM GMTBy: Richard_Shaw

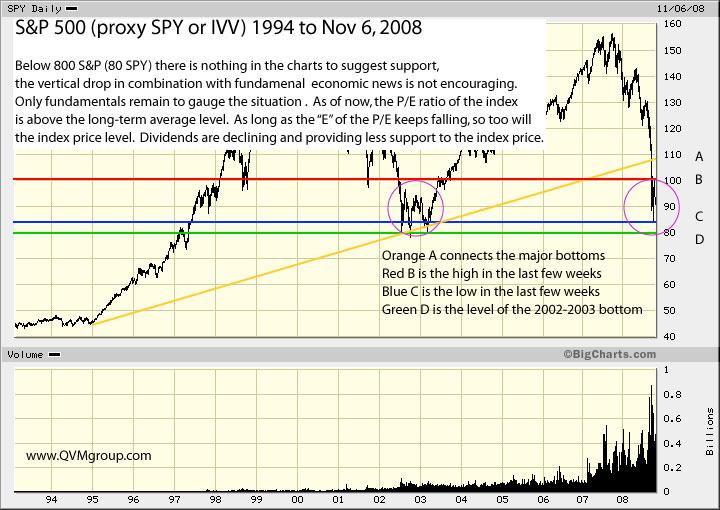

Wiley Coyote Suspended in Air Over a Canyon - There is nothing left in the charts to suggest support for the S&P 500 index if it pierces the approximate 800 level (roughly 80 for its proxy SPY).

Wiley Coyote Suspended in Air Over a Canyon - There is nothing left in the charts to suggest support for the S&P 500 index if it pierces the approximate 800 level (roughly 80 for its proxy SPY).

The index has been volatile within a range between generally 850 and 1,000 over the past few weeks.

Only fundamentals remain to gauge opportunity. The fundamentals of “E” stink. The fundamentals of P/E are not supportive, because the ratio is above the long-term average.

If the index pierces 800 (SPY goes below 80), it will resemble the Road Runner cartoon character Wiley Coyote when he would race off the edge of a cliff to find himself suspended in mid-air over a deep canyon.

Wiley's attempts to run on air back to the solid cliff never worked. We hope if that happens to the S&P index, it can catch a branch as sometimes happens in the movies to break its fall.

See our prior study of charts suggesting a possible 400 to 800 range for the S&P index , and our prior study comparing the long-term index “as reported” trailing P/E ratio to the current ratio.

We hope for the best, but have prepared for the worst. Admittedly, our mentality for some months now resembles the 1950's bomb shelter mentality. Not to worry though, we have plenty of canned food and water stored in our financial hideaway built of cash and bonds.

Accounts we manage are 80% to 90% cash, with most of the invested portion in corporate, Treasury and municipal bonds. We have made minor, but punishing test investments in equities since late summer, without success. We use trailing stops on all of our positions.

We have decided to be late to the party on the way back up to avoid destroying capital on the way down. In such an historic period of negative economic and stock market records, we think the math favors letting braver souls create the eventual reversal. We will invest later, unfortunately having to climb over the bleached bones of those who courageously went before us only to fall to the canyon bottom.

We will go back in, but not yet. Minimizing risk is more important than maximizing return for most of our clients whose portfolios are mature, and who cannot replace the assets within them. Better to avoid loss now and then do OK after a confirmed trend reversal, than to risk massive loss in the current market in an attempt to predict the trend reversal to capture all the potential on the way up.

Lottery operaters say to gamblers, “you can't win if you don't play”. We say to investors, “you can't play tomorrow, if you don't survive today.”

We hope our re-entry comes soon, but we have no way to predict when the time will be right. However, it should be possible to recognize when time is right when it arrives by focusing on fundamental measures of value, by waiting for mean reversion to be on our side, and for apparent levels of risk to be much smaller.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2008 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.