Hope for a Dismal Economy & Stock Market?

Stock-Markets / Stocks Bear Market Nov 15, 2008 - 09:56 AM GMTBy: Joseph_Dancy

The ‘page one' story last month was simple. If you owned stocks in any market in the world you suffered a serious decline. Year to date the S&P 500 index is down 34% and the Russell Microcap index has declined 33.7%. For the one, three, five, and 10 year periods all the major indexes we track yielded negative returns. An investment in those major market indexes for each of those investment periods would have lost money.

The ‘page one' story last month was simple. If you owned stocks in any market in the world you suffered a serious decline. Year to date the S&P 500 index is down 34% and the Russell Microcap index has declined 33.7%. For the one, three, five, and 10 year periods all the major indexes we track yielded negative returns. An investment in those major market indexes for each of those investment periods would have lost money.

Stories on page one also note that the credit crunch continues to adversely impact businesses. General Motors and Chrysler discussed a merger with thousands of layoffs – or a potential bankruptcy filing. Real estate foreclosures hit new highs in many markets with real estate prices continuing to plummet. Credit default swaps, collateralized debt obligations, and other illiquid securities continue to haunt the markets.

The ‘page sixteen' story is more positive for investors. In fact, there are several positive stories for investors on page sixteen that are noteworthy - but are buried in the ongoing market panic:

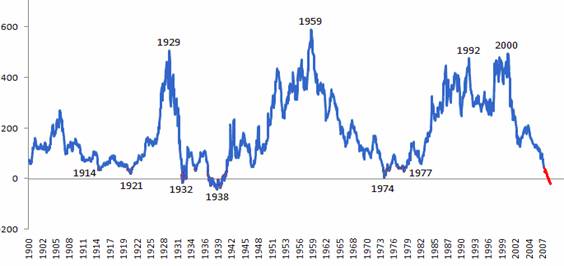

- Long Term Market Returns Reach Near Record Lows . If we examine the rolling ten-year total returns of larger capitalization stocks we find that the return for the last ten years was one of the worst performance wise in the last 108 years. (chart courtesy of the Bespoke Investment Group).

![]() Only the decade ending in 1938 (1928-1938 period) delivered worse returns to investors.

Only the decade ending in 1938 (1928-1938 period) delivered worse returns to investors.

And only three times in the last 108 years has the market had negative rolling ten year returns—1932, 1936-39, and the trailing ten years ending today.

The historical average return for each decade is a gain of roughly 250%, so to have lost money over a ten year period in the market is a very rare occurrence. The ‘reversion to the mean' concept applies—in those 10 year periods where the market had negative returns most of these periods were followed by decades where the returns returned to normal levels—and usually returns trended to above average levels. Based on the historical rolling returns we think we are near bottom, performance wise, for the market.

The major indexes—S&P 500, Dow Jones, and Nasdaq Composite—now post negative returns for year to date, 1 year, 3 year, 5 year, and 10 year periods. An investor participating in the market by buying an ETF that tracks any of these indexes would have lost money over those periods. In light of the policy changes a decade ago to encourage stock ownership for retirement in defined contribution plans – and the discussion of possibly even investing Social Security funds in the stock market - who would have guessed this would have been the long term result?

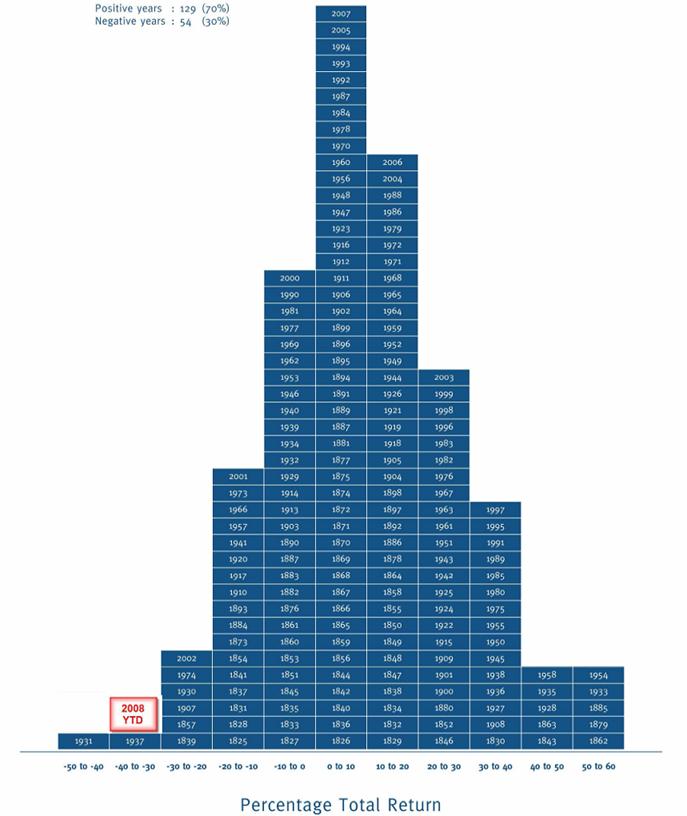

Another chart of the yearly returns of the S&P index, courtesy of Value Square Asset Management, Yale University, indicates how far on the ‘tail' of the distribution curve we now sit when we compare total returns versus frequency of occurrence.

- Stock Appreciation Potential Is Attractive . Each week since the late 1960's Value Line Investment Survey has rated the appreciation potential of the 1,700 stocks it covers. It assigns a number to the estimate of the median three to five year appreciation potential of the firms it follows. The last time the Value Line appreciation potential was this bullish was in 1990, just before the bull market of the 1990's.

The Value Line median appreciation potential now stands at 135. This represents the forecasted median stock return in four years, 135% – or an average return of roughly 8% per year. Over the last 20 years the low value for the median appreciation potential was 30 and the high was 135 (where the appreciation index stands now).

Some analysts have used this measure as a long term market timing system, only investing money when the value exceeds 100. The appreciation indicator has only reached the century level two times in the last decade, and both times the indicator foretold excellent returns four years later.

The Value Line indicator is not a short term indicator – it is looking for appreciation three to five years in the future. Then again, it fits our needs since we have a long term portfolio focus.

Keep in mind that many of the stocks covered by Value Line are too large for the LSGI portfolio. In general the smaller the company the more inefficient the market, and therefore in theory over time the better the returns. Historically the smaller firms have outperformed the larger public companies and indexes.

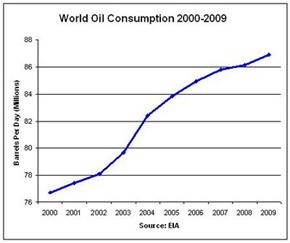

- The World Will Struggle To Meet Growing Energy Demand . Next month the International Energy Agency (IEA) will release it first-ever assessment of the condition of the world's largest 400 oil fields. It is expected to conclude that future crude supplies will be ‘far tighter' that previously believed. In addition, depletion rates in these existing oilfields are much higher than anticipated.

Experts have disputed the actual decline rates of existing fields for years. The consensus has been that on average crude oil production in existing fields declined three to five percent per year. The IEA found that existing fields declined on average at 6.4% per year if companies invested heavily to maintain production – and declined 9.1% without such investments. These decline rates are much higher than anticipated, a number some would describe as ‘stunning'.

Because the world produces about 74 million barrels of crude oil per day this decline rate means that at least 4.7 million barrels per day need to be found just to keep global production stable – and global demand has been growing at roughly 2% per year.

Adding to IEA concerns, energy projects are very capital intensive so the credit squeeze will reduce expenditures in both existing and new fields. This will make it much more difficult for crude oil production to grow in any meaningful manner in the near future. Global demand meanwhile is expected to continue to increase, with a gain of 0.8% expected in 2009 according to the IEA.

Adding to IEA concerns, energy projects are very capital intensive so the credit squeeze will reduce expenditures in both existing and new fields. This will make it much more difficult for crude oil production to grow in any meaningful manner in the near future. Global demand meanwhile is expected to continue to increase, with a gain of 0.8% expected in 2009 according to the IEA.

The chart at right by Chad Brand, using Energy Information Administration data, reflects the longer term demand trends (theoildrum.com). Keep in mind a severe global economic contraction may create a short term demand decline.

The IEA concludes that elevated depletion rates,

increasing costs, the credit crunch, and demand growth all factor into a world that will have increasing difficulty meeting crude oil demand – and a world in which we could see sharply higher energy prices.

With regard to natural gas, production from the average unconventional shale well in the U.S. declines roughly 50% in the first year. A Barnett shale well produces around 65% of its gas in the first year and around 80% in the first two years according to industry estimates. The only way to replace that steep fall in production is to drill more wells – but the credit crunch and weak natural gas prices are causing many operators to scale back or cancel their drilling plans.

Storage levels for natural gas are 3.3% lower than last year at this time and 1.7% lower than two years ago at this time. Depending on the weather, history tells us that next week will be the last week for injections of any size. Canadian imports of natural gas, as well as liquefied natural gas imports – our two import sources of the fuel – have declined steeply.

Roughly one-third of the Gulf of Mexico's natural gas production remains shut-in after the summer hurricanes. Heating season – the major use for natural gas during the winter months – is just beginning.

Both the crude oil and natural gas futures markets are in steep ‘contango' – meaning that future production is more expensive in the market than current production. This condition is an indication that we do not have a glut of either commodity waiting to be sold, and is bullish for prices.

Warren Buffett has noted that his best investments have been in profitable, well positioned companies in attractive sectors. In our opinion, the long term trends in the energy sector make it a very attractive sector for investors.

- Market Volatility Is Extreme . Looking back to 1973 and 1974—a period many compare to the current market conditions—we find the S&P 500 declined 27% in 1974. Year to date the S&P 500 has declined 34%. The quick decline of the index qualifies as the steepest since 1931 – during the Great Depression.

Worse, pension and retirement funds are much more reliant on equities now than thirty-five or seventy-seven years ago. Recent articles indicate pension funds of publicly traded U.S. companies might be under-funded to the tune of over $100 billion due to the market's decline.

Behavioral finance studies indicate where uncertainty and fear is high pricing will be dominated by irrational investors with a “snowballing effect” of “self-reinforcing pessimism.” Harvard finance professors Malcolm Baker and Jeremy Stein found that: (1) small capitalization, (2) younger, (3) high-volatility, and (4) non-dividend growing companies ‘bear the brunt of panics' – all attributes of firms in the LSGI portfolio. After the irrational investors flee the market the professors found stock prices tend to substantially outperform historic averages.

If we look at Berkshire Hathaway's stock price in the early 1970's – it was a ‘small-cap' firm at this time - we find it rose from $40 to over $92 in 1972 then fell to $38 a share in the 73-74 decline—a decline of nearly 60%. The decline resulted in a zero return in 1974 from an investment in Berkshire Hathaway five years earlier in 1969.

Of course Berkshire Hathaway stock went on to perform very well over the next three decades, and closed last month at nearly $110,000 a share. Drops of this magnitude did not reflect on the ability of Mr. Buffett to find undervalued companies for Berkshire, or the underlying long term viability of these firms, or the long term value of Berkshire Hathaway stock.

The lesson is that Berkshire did not bemoan lower stock prices and viewed them as an opportunity to buy stocks at attractive valuations—as they did during the 1973-4 recession. Some of Buffett's best investments were made in the market decline in the early 1970's—like the Washington Post. These investments set the stage for the excellent performance of Berkshire over the next two decades.

- Forced Liquidations & Panic Selling . In what was stunning news last month the Chief Executive Officer of Oklahoma City based Chesapeake Production—the largest natural gas producer in the U.S.—was forced to sell 33 million shares of his company's stock (almost his entire holding) in a massive margin call. Since July it was estimated that the executive lost over $1.5 billion in stock value and most of his net worth (we expect he will no longer be included in the Forbes list of the 400 richest Americans). Forced selling of stock by executives to meet margin calls was more frequent then we have ever seen – possibly reflecting the severity and quickness of the market decline.

Richard Russell had the following comments in his Dow Theory letter on recent market activity:

. . . This bear market is a bloody brute. We've had 90% (panic) down-days on October 9, October 15, October 18, November 5 and 9, and again yesterday, November 12. From September 29 through yesterday, we have experienced ten 90% down-days. Now believe me, that's a liquidating market.

Yesterday's [November 12th] 90% down day was accompanied by a 411 point smash in the Dow along with a 159 point drop in the Transports. Worse, yesterday's collapse drove Lowry's Buying Power Index (demand) to a new low, while Lowry's Selling Pressure Index (supply) rose to a new rally high. Those statistics could not look worse. . . .

Generally one or two 90% down days is enough for technical analysts to ‘call' a market bottom. Ten is highly unusual—in fact we could not find the last time the market has had ten 90% down days in a two month period. It is a very rare occurrence, a sure sign of investor panic.

Public mutual fund redemptions continued to set records last month from published reports. Fund managers needed to sell to raise cash to pay redeeming investors, adding to the selling pressure. Supply and demand for stocks remains out of balance—supply from selling has overwhelmed demand, short term anyway. Lowry's selling pressure index remained at record levels for most of last month—meaning lots of stock was waiting to be sold, and weak prices, short term.

And it turns out the largest U.S. public pension fund—CALPERS—has been dumping stocks as it received capital calls from hedge funds in which it invested. In good times the income from their portfolio was used to pay these capital calls. With the credit crunch that income has declined—and the number of hedge fund capital calls has multiplied with the credit freeze. To meet those calls CALPERS sold stocks wholesale—adding pressure on the markets.

Rumors are that leveraged hedge funds and investment banks with massive currency bets are being forced to liquidate positions, which is wrecking havoc with exchange rates. The Canadian dollar—at parity with the U.S. dollar several months ago—was selling for roughly 80 cents on the U.S. dollar last month. Latin American currencies and developing countries have also seen currency values decline sharply.

All said, once the liquidations subside the cash equivalent holdings now in investor accounts are at or near all time highs. Many managed portfolios ‘went to cash' – as did individual investors. This cash could be used to buy stocks and fuel a rally – once the current downtrend runs its course. As of last month investors held the equivalent of 27% of the value of the S&P 500 index in cash - no doubt cash levels have increased since then.

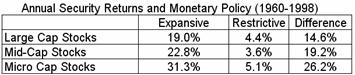

Favorable Monetary & Fiscal Policy .  The old market saying is “don't fight the Fed.” Historical market data over the last 50 years indicates that when the central bankers are easing monetary policy the stock market generally outperforms. Small firms perform especially well when monetary policy is easing.

The old market saying is “don't fight the Fed.” Historical market data over the last 50 years indicates that when the central bankers are easing monetary policy the stock market generally outperforms. Small firms perform especially well when monetary policy is easing.

In addition to monetary policy, fiscal policy has become very stimulative, another factor that historically has correlated with future stock out-performance. Government measures to address recent financial turmoil are aimed at sustaining economic growth. The cost may be depreciation in the purchasing power of the dollar and appreciation in the nominal price of energy and other goods and services.

Gerald R. Jensen, Robert R. Johnson, and Jeffrey M. Mercer, authors of “The Role of Monetary Policy in Investment Management”

By Joseph Dancy,

Adjunct Professor: Oil & Gas Law, SMU School of Law

Advisor, LSGI Market Letter

Email: jdancy@REMOVEsmu.edu

Copyright © 2008 Joseph Dancy - All Rights Reserved

Joseph R. Dancy, is manager of the LSGI Technology Venture Fund LP, a private mutual fund for SEC accredited investors formed to focus on the most inefficient part of the equity market. The goal of the LSGI Fund is to utilize applied financial theory to substantially outperform all the major market indexes over time.

He is a Trustee on the Michigan Tech Foundation, and is on the Finance Committee which oversees the management of that institutions endowment funds. He is also employed as an Adjunct Professor of Law by Southern Methodist University School of Law in Dallas, Texas, teaching Oil & Gas Law, Oil & Gas Environmental Law, and Environmental Law, and coaches ice hockey in the Junior Dallas Stars organization.

He has a B.S. in Metallurgical Engineering from Michigan Technological University, a MBA from the University of Michigan, and a J.D. from Oklahoma City University School of Law. Oklahoma City University named him and his wife as Distinguished Alumni.

Joseph Dancy Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.