Switching Your Bank Current Account pays – Moneyfacts.co.uk experts practice what they preach

Personal_Finance / UK Banking Apr 18, 2007 - 12:38 PM GMTBy: MoneyFacts

Michelle Slade, personal finance analyst at moneyfacts.co.uk – the money search engine, comments: “If you don’t trust your bank, or feel it is not offering you the best customer service, products or rates then why not vote with your feet and switch providers?

“The current account war shows little sign of abating, with several providers battling to offer the best current account rates and deals. So why not reap the rewards from switching? You will certainly find some great rates and perhaps an additional financial incentive too.

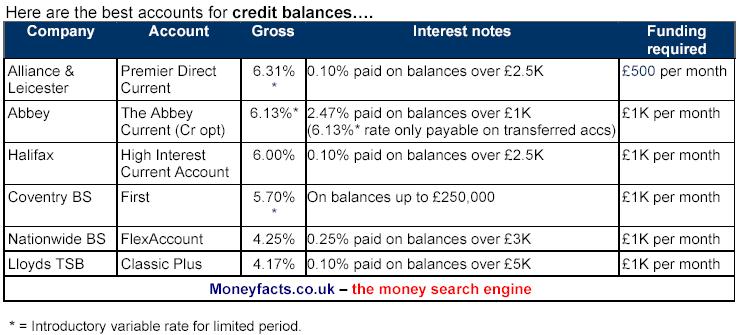

“In previous years Alliance & Leicester comfortably held the top spot for current account credit and debit interest rates, but more recently its position in the credit interest best buy tables has been hotly contested by the likes of Halifax, Abbey and Coventry BS.

“Last Friday Alliance & Leicester announced its Premier Direct Current account would now pay an extra 0.37% interest, pushing it back to the top of the charts. On top of this, it has recently increased its recommend a friend incentive from £25 to £50.

“With current account interest rates exceeding even the best savings rates, where will this battle end? Our current account business is great value to these providers fighting to win our accounts, as they are seen as a core product from which they can glean information about your financial situation. Banks and building societies look at a current account as a gateway to enable them to sell you further financial products that they feel will meet your needs, but at the same time earn them some revenue.

When opening the A&L Premier Direct Current Account for example, a savings account is opened automatically as part of the process, so it is looking to get you saving with them from day one.

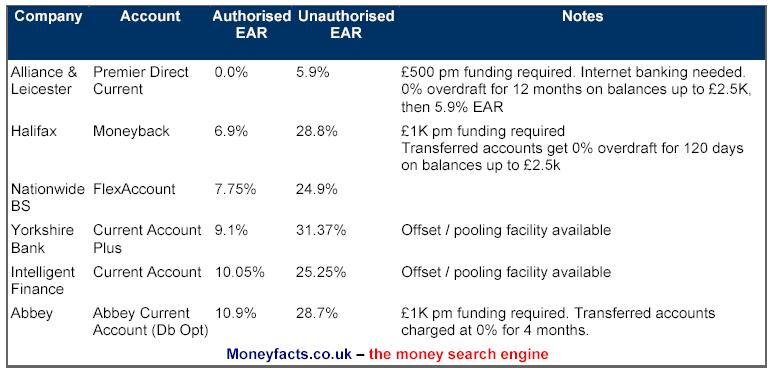

“If you do decide to switch providers it is a choice which you will probably stick with for some time. Thus it is vital that you do your homework and make the right choice. Are you someone always in credit, or do you rely on an overdraft? Do you prefer to use a branch, internet or telephone?

and debit balances.”

“The switching process is relatively simple, and in most cases you can either leave your new bank to complete it for you or you can control the process yourself. Whichever method you choose you need to keep close tabs on both your old account and new account whilst the transfer is in progress. Halifax, Abbey and Alliance & Leicester all offer interest free overdrafts to help protect against any timing discrepancies during the switch.

“Remember you will have to get your employer to switch your salary - also you will have new PIN numbers (which you can change), as well as new passwords for online banking.

“So whilst initially it can involve quite a bit of effort on your part, the rewards can be worth it. For a customer with an average credit balance of £2K, switching from an account paying 0.10% to one that offers 6.31%, could earn you almost £125 extra interest in a year – perhaps this figure is evidence enough that is worth the hassle.”

Follow in the footsteps of the Moneyfacts experts, who say ‘it pays to switch’….

Andrew Hagger of Moneyfacts says, "I recently switched my account to the Halifax HICA. After a couple of initial hiccups with the switching service, my account has been successfully been transferred and I'm now getting 60 times more credit on my current account - wish I'd done it years ago"

Lisa Taylor of Moneyfacts adds, “My new year’s resolution this year was to practice what I preach and get the best possible deal for my financial products. I chose to switch to the Alliance & Leicester Premier Direct Account, transferring my direct debits and standing orders myself. While it does take a bit of work and a careful eye, it is certainly worth it. I have immediately seen the benefits of a higher interest rate – before it was almost like giving my money away!”

By Michelle Slade,

http://www.Moneyfacts.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.