Economic Depression 2009 Will Not Prevent Inflation

Economics / Great Depression II Jan 23, 2009 - 01:28 PM GMTBy: Andy_Sutton

“Three Bears and a missing Goldilocks” - 2006 and 2007 were framed by financial pundits as a time when we could truly have the Goldilocks economy. Growth wouldn't be too fast or too slow, but just right. The Fed had both hands on the wheel and was goosing things just enough to keep the ship headed in the right direction. Of course all the while the same pundits chose to ignore raging inflation at the consumer level as energy and food prices headed for the stratosphere. The fall of energy prices has been spectacular, however, the drop in food prices has been virtually nonexistent. As in the story of Goldilocks, there were some bears who weren't too happy about Goldilocks and her plans for their porridge.

“Three Bears and a missing Goldilocks” - 2006 and 2007 were framed by financial pundits as a time when we could truly have the Goldilocks economy. Growth wouldn't be too fast or too slow, but just right. The Fed had both hands on the wheel and was goosing things just enough to keep the ship headed in the right direction. Of course all the while the same pundits chose to ignore raging inflation at the consumer level as energy and food prices headed for the stratosphere. The fall of energy prices has been spectacular, however, the drop in food prices has been virtually nonexistent. As in the story of Goldilocks, there were some bears who weren't too happy about Goldilocks and her plans for their porridge.

2008 was the year of the bear in many regards, but as we take a deeper look at the situation, it becomes very clear that there are several other angry bears out there that have yet to completely show themselves. The credit crisis, as many in financial circles affectionately call it, has been improperly blamed for the current economic malaise. In order to understand this concept, it is imperative that one be able to separate the financial economy from the real economy. The real (or producing) economy is the part that actually creates goods and services which are allocated by the markets, often with the use of credit from financial intermediaries. Those intermediaries make responsible loans based on a number of factors and intend to collect payments for the duration of the loan. Despite what we've been led to believe about securitization, a good deal of non-securitized lending was going on as well. This is the real economy. The financial economy is behemoth firms on Wall Street, which by and large produce almost nothing (except headaches recently).

This was not always the case. An economy does need financial intermediaries. Essentially what these intermediaries are supposed to accomplish is to bring savers and borrowers together in an efficient manner and take advantage of scale economies. For example, it is easier for a company to go to a bank for a million dollar loan rather than put ads in newspapers and solicit the loan a thousand dollars at a time. Likewise is it easier for someone who wants to save $1000 to head to their local bank than it is for them to seek out a borrower directly. In this both these cases, the financial agent or intermediary provides a valuable service by adding efficiency to the process. For this service, the agent is paid a fee. That fee comes from the difference between the interest paid and the interest collected (the spread).

Unfortunately, what has happened is the financial intermediaries have been engaging in other activities such as underwriting, trading for their own accounts (Wiki Glass-Steagall) as in the case of broker dealers, and providing investment advisory services, often times recommending stocks which they themselves own or have provided underwriting services for. Lastly, and perhaps most dangerously, the use of leverage and super leverage became commonplace. The largest financial intermediaries dabbled too much in the conflict of interest and risk business rather than tending to their role in the system.

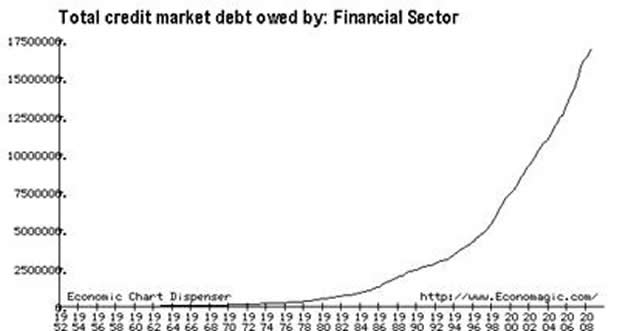

The Baby Bear has been the understanding that all of this would go well until the sea changed and the market moved against these intermediaries. This sea change, triggered by a strikingly small number of defaults on subprime mortgages and the avalanche of credit derivatives that followed has left a swath of destruction that has rendered our most venerable firms insolvent. What was Wall Street is now a giant zombie, requiring constant, ever-increasing, and ever-accelerating mountains of money just to keep it functioning. This is borne out in the news headlines as AIG, Citigroup, and Bank of America in particular have required steady infusions of cash. Not to mention the GSE's Fannie Mae and Freddie Mac. The above scenario is a pure example of the downside of leverage. If someone takes $100 and borrows $900 to make a $1000 investment and that investment loses 11%, the capital is gone. What is left is an underwater investment and no way to make good AND remain solvent. In many cases we witnessed leverage rates of 20, 40, and even 100 to 1. In these cases, miniscule market moves led to instant insolvency hence the ability of a small number of bad loans to trigger the crisis. (See chart below for an idea of how credit in the financial system has been growing over the past half century.)

(Total Credit marked debt owed by the financial sector – an indirect indicator of leverage)

However, were the defaults on those subprime mortgages caused by the credit crisis? Absolutely not. They were caused by the Mother Bear: overleveraged consumers. The ridiculous notion put forth by the media and financial pundits that real estate prices could accelerate forever was prima facie evidence of a bubble. What these pundits failed to recognize is that in any debt structure, there is an absolute point where it is simply not possible to take on more debt because expectations for even the servicing of that debt are simply unreasonable. To put it simply, what were the prospects for the now famous California strawberry picker to make continually increasing payments on a $750,000 condo? Silm and none and Slim's bags were packed before the ink was dry on the loan.

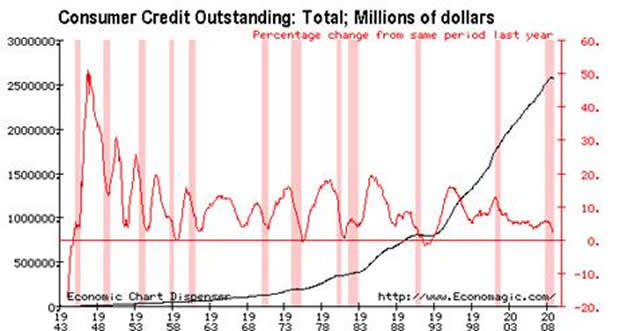

Unfortunately, it was not just housing; it was everything. A recession was avoided in 2001 by dropping interest rates to nothing, printing money, and blowing bubbles. We bought too many cars, too many computers, too much consumer electronics, too many swimming pools, too many granite countertops, and in general, too much of everything. Not until it was too late did we realize that we were saving nothing, spending well in excess of our means, and now the bill is coming due. Buying less was an obvious move on the part of consumers, and is in full swing. This pullback in spending is now rippling through both the manufacturing and service economies of the US and other OECD countries. This morning, the UK officially entered a recession although I'd venture to guess that, like us, they've been there for quite some time. China's output is falling as we (and others) consume fewer of their goods.

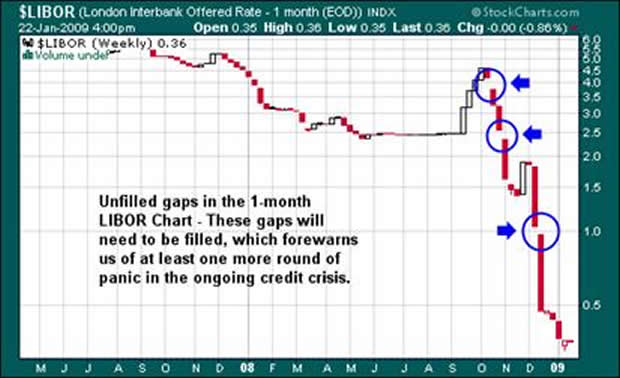

The Father Bear is time. Consider for a moment the trillions of dollars that have been thrown at just the banking system. These trillions have not fostered one iota of growth. They have barely unlocked the credit markets with regard to banks. The LIBOR Rate chart has more gaps on it than someone in dire need of an orthodontist, and the banking system requires unknown further trillions just to maintain a semblance of financial order.

(1-Month London Interbank Offer Rate (LIBOR) on a weekly basis)

All of this, and nothing has been done about the economy. And I've got news for the pundits – this will not go away by printing more money. This will not go away by lowering rates, which are already at zero in the US. This will not go away by handing out gift cards to consumers to force them to buy stuff (Suggested in 1/8's MTC article as a possible ‘solution' and mainstreamed by MarketWatch on 1/22). Creating more government jobs is not the answer. What has been lost in the analysis of the Great Depression is that despite FDR's New Deal programs, the US remained in a depression for another 7 years at a minimum. The country was pulled out of that depression by the onset and eventual entrance of America into World War II, NOT by government spending programs alone. This does not bode well geopolitically.

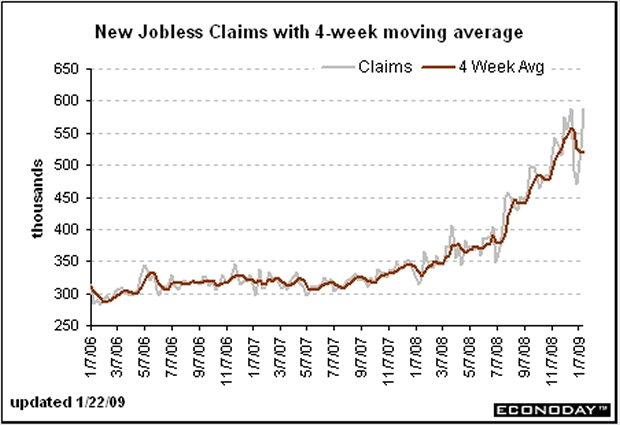

The take home message is don't expect this to end quickly. It will not. The Depression of 2008 and beyond is here, no matter what we choose to call it. Every week over one half million freshly unemployed individuals are filing for unemployment insurance. Sure that insurance helps them to stay in houses and buy necessities. That's about it though. I would not count on these people running up credit card debt to over-consume. So every week, one half million discretionary spenders are heading to the sidelines. This is a crisis of consumption, brought on by decades of overconsumption, facilitated first by sending a second wage earner to the workforce, and later by the introduction and rampant growth of consumer credit. These excesses were not created overnight, nor will they be purged overnight.

(New Unemployment Claims – weekly in gray, 4-week mean in brown)

(Total Consumer Credit in 2000 Dollars with y/y %change in red)

What is also going to become very obvious in the next 9-12 months is that inflation is a monetary, not an economic event. We have been riddled with talk from the financial press that prices cannot rise while the economy is weak so we should forget about inflation. They will be proven wrong. A growing economy actually causes prices to fall by creating efficiencies through scale and scope economies. Prices are much more a function of money supply than economic velocity or activity. Watch what happens to prices if the government starts handing out money or gift cards. Do you think flatscreen TV's will sell for 50% off if those TV's are flying off the shelves because you've got 300 million Americans armed with a Victory Card? I think not. Prices are a function of the supply of money and credit. The bad news here is that you can have inflation during a depression. Care for a recent example? Just go back to the 70's stagflation. What we've got now is just a more extreme version of an already established event.

What do to? Believe it or not, there are sectors, industries and firms that will do exceedingly well in this type of an environment. They're out there and we've been pointing them out to our subscribers and clients. Perhaps most importantly though, at a micro level, each person can clean up their own finances and temper their expectations of the future to whatever extent is possible. And if you happen to see Goldilocks, tell her to drop Ben a line; he's been looking for her for quite some time and is rather worried.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.