Stock Markets Go Cliff Diving Again

Stock-Markets / Stocks Bear Market Mar 06, 2009 - 04:06 AM GMTBy: PaddyPowerTrader

It amazing what you can buy for a buck or two these days. The un-happy meal menu of stocks features Citibank at $1.02 and GM at $1.86 as the death spiral beckons. There are times when too much drink is simply not enough as the horror show continues unabated . Yesterday's laughable notion that the Chinese authorities are in control of events and would be able to turn their export driven economy around displayed the kind of naivety and misplaced optimism not seen since the Alamo. Where are they going to export to?

It amazing what you can buy for a buck or two these days. The un-happy meal menu of stocks features Citibank at $1.02 and GM at $1.86 as the death spiral beckons. There are times when too much drink is simply not enough as the horror show continues unabated . Yesterday's laughable notion that the Chinese authorities are in control of events and would be able to turn their export driven economy around displayed the kind of naivety and misplaced optimism not seen since the Alamo. Where are they going to export to?

Any respite today? Unlikely with non farm payrolls to be released, Citibank all but nationalised by default, genuine fears of GM bankruptcy, GE needing a massive capital injection, volatility spiking back above 50 and the US government increasingly seen as overextended.

Any respite today? Unlikely with non farm payrolls to be released, Citibank all but nationalised by default, genuine fears of GM bankruptcy, GE needing a massive capital injection, volatility spiking back above 50 and the US government increasingly seen as overextended.

Today's Market Moving Stories

- Another very bad day for financials yesterday, post Aviva's dreadful results. Aviva's share price ended up falling a third and took UK life insurers Prudential and Legal & General with it. The two latter insurers have yet to report full year results although both have made somewhat comforting statements about their year end capital positions. Trouble is that plunging equities, falling property values and wider credit spreads can only spell out a much weaker Q1.

- Barclays' share price was on the skids yesterday, down 24%, after a particularly negative equity report predicting two years of losses. Its market cap is now down to £5.5bn so if the government does need to come to the rescue, there won't be a lot left on the table for shareholders due to the dilution.

- In related developments, the BBC is reporting that the UK government are on the verge of upping their stake in Lloyd's to 60% (from 43%). The FT has a different spin on this story putting the taxpayers holding at 70% while they get the dubious honour of insuring £258bn of toxic “assets”.

- At $1.02 Citibank shares are down 98% from the peak in summer 2007. The firm's market cap is now just $5.5bn, down from $277bn. Now that's what I call wealth destruction. There are rumours that their former chums in the sovereign wealth funds are considering now dumping their virtually worthless shares.

- And pineapple face, Hugo “Che” Chavez is at it again. Venezuela seized a 1,500 hectare plot of land owned by Smurfit Kappa. Smurfit Kappa used the land to grow eucalyptus trees and the government will harvest the trees to plant other “more rational” crops like yucca and beans.

- Bloxham's Stockbrokers has a relatively bullish piece out on troubled drinks maker C&C this morning saying that they are impressed by the new down to earth management team who are not hell bent on world domination. In short they see the hangover as cured and the company getting back on the wagon with a floor in the share price at around the €1 level.

- The woes in Irish banking was further highlighted by results published by ACC, who are now part of Rabobank, which showed a steep rise in impairment provisions giving rise to a €244m loss. 2007 saw €40m profit.

- Other UK stocks making news today. WPP came in slightly ahead of expectations suggesting the TNS integration is going well. For once a stock that looks cheap! BT has been cut to a sell at Morgan Stanley. The company is cutting their final dividend due to a huge rise in their pension deficit. Wolseley is planning a £1bn rights issue (£270m from new shares at 120p and balance from existing shareholders at 40p) and is to exit its US based Stock Building Supply unit.

Watch Out For The Next Big Settlement Date

In money market circles, much is made of turn dates and funding requirements over the balance of month-, quarter- and year-end. However since the onset of the financial crisis it has actually been the quarterly International Money Market settlement dates which have been more problematic via their impact on the derivatives world in particular. The March (think Bear Sterns) and September (remember Lehman Bros) instalments have been particularly telling in this regard, corresponding with some major institutional failures and severe instances of market contagion. With the next of these landmarks approaching on March 18, the obvious question is whether this time will be any different? Whose turn might it be this time: Citibank, GE , GM, Bank of America, Chrysler?

What Will The US Non Farm Payrolls Number Be?

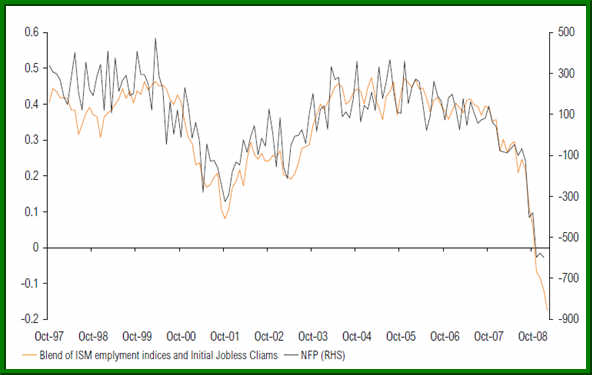

Non farm payrolls charts are flying all over the place at this time of the month, but nevertheless the chart below may be of interest. It shows a blended, normalised average of the two ISM employment indices and initial jobless claims. Suggests that today's number should be -850k, compared to market consensus of -650k. No model has ever come close to calling non farm payrolls correctly, which is a main part of why the market focuses on it so much, but the correlation isn't bad. We'll see.

Note the down move this morning in the Greenback because of a rumour of a -1 million print on the key US non farm payrolls number due at 13.30.

Mervyn Is Groping In The Dark

The Bank of England 's Mervyn King became the Buzz Lightyear of central banking with a decisive move to zero and beyond yesterday. Quantitative Easing (QE) is fast emerging as the philosopher's stone that might finally create credit at the stroke of a computer key and turn the global economy around. Against a background of low growth forecasts, the Bank of England launched its QE strategy (with a potential for £150bn) with a very clear indication of how it will be implemented and why.

The ECB instead emphasised the non-standard nature of the already enacted measures, especially the unlimited provision of liquidity against a wide range of collateral and argued that such “credit easing” is better suited to the Eurozone's financial system and economy. President Trichet said the ECB does not exclude further non-standard measures, but indicated that the Governing Council is not yet convinced that further measures are needed. This stands in stark contrast to the dramatic downward revisions to staff forecasts who are now predicting a deep recession this year, zero growth in 2010, and a substantial undershooting of the inflation target in both years. That said we are clearly heading for a 1% ECB rate soon as the hawks have thrown in the towel.

Data Today

We had the ISM and ADP appetisers earlier this week with grim reading from both from an employment perspective. Today is the main course. With the Fed's President Lockhart having spoken earlier in the week about big payroll losses, markets should already be braced for a bad number today at 13.30 (consensus circa –730k).

And Finally… A Nice Dig At CNBC

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.

© 2009 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.