ECB Will Hike Interest Rates In June But Second-Half Policy Outlook Is Still Unclear

Interest-Rates / Euro-Zone May 10, 2007 - 10:52 PM GMTBy: Victoria_Marklew

As expected, the European Central Bank (ECB) kept its Refi rate unchanged at 3.75% this morning, but signaled that it expects a rate hike at the June 6 meeting. Trichet stated that "strong vigilance is of the essence in order to ensure that risks to price stability over the medium term do not materialize."

As expected, the European Central Bank (ECB) kept its Refi rate unchanged at 3.75% this morning, but signaled that it expects a rate hike at the June 6 meeting. Trichet stated that "strong vigilance is of the essence in order to ensure that risks to price stability over the medium term do not materialize."

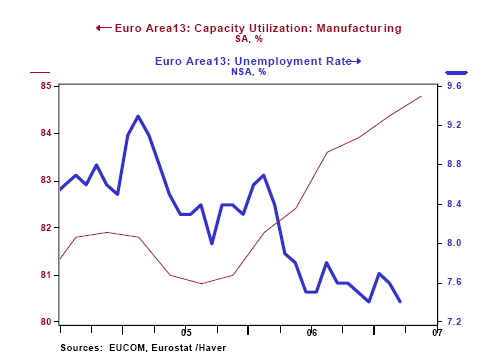

Once again, the policy statement and subsequent press briefing talked about the ongoing strength of the Euro-zone economy and about upside risks to inflation - including buoyant money supply and credit growth, higher oil prices, and potential wage developments. Interestingly, the statement also noted a new source of upside risk - high capacity utilization.

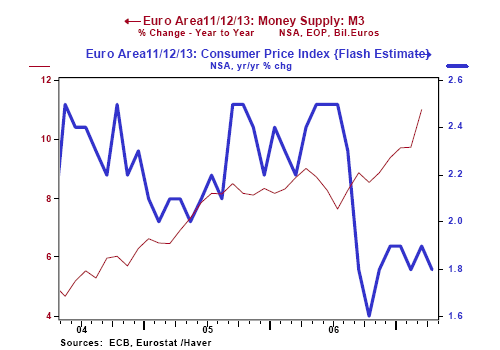

The headline rate of inflation has been below the ECB's 2.0% target for the past eight months, but money supply growth is certainly robust, with the annual increase in M3 accelerating again in March to hit a 24-year peak of 10.9%.

Chart 1

Chart 2

Today, the ECB remained tight-lipped on the policy outlook for the second half of the year, and Trichet refused to be drawn on whether he thought rates would still be "accommodative" after the June meeting. Much will depend on the euro - a continued rise in the currency will help to keep imported inflation in check. However, with the ECB apparently more focused on domestic drivers of inflation, the currency's climb toward $1.40 is unlikely to be enough to keep rates from rising to 4.25%, or even higher, before the year is out.

By Victoria Marklew

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Victoria Marklew is Vice President and International Economist at The Northern Trust Company, Chicago. She joined the Bank in 1991, and works in the Economic Research Department, where she assesses country lending and investment risk, focusing in particular on Asia. Ms. Marklew has a B.A. degree from the University of London, an M.Sc. from the London School of Economics, and a Ph.D. in Political Economy from the University of Pennsylvania. She is the author of Cash, Crisis, and Corporate Governance: The Role of National Financial Systems in Industrial Restructuring (University of Michigan Press, 1995).

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.