Discipline in Commodity Trading & Trend Following

InvestorEducation / Commodities Trading Jul 09, 2009 - 03:16 AM GMTBy: Andrew_Abraham

One of the most important aspects of commodity trading is discipline. I am a commodity trading advisor & trend follower. The real truth is most of the time nothing is really happening ( there are no trends) and our job is not to lose money. What reinforces my discipline is when I speak to fellow commodity trading advisors and we preach to each other. It helps to reinforce discipline..More so I am very lucky to have 2 colleagues who watch every trade I do and make sure it is exactly what our systems designates.

One of the most important aspects of commodity trading is discipline. I am a commodity trading advisor & trend follower. The real truth is most of the time nothing is really happening ( there are no trends) and our job is not to lose money. What reinforces my discipline is when I speak to fellow commodity trading advisors and we preach to each other. It helps to reinforce discipline..More so I am very lucky to have 2 colleagues who watch every trade I do and make sure it is exactly what our systems designates.

Besides that we have conversations all the time such as …you never know which trades will work…you don’t know the future so you have to put them on…you have to make yourself available for the times when there are the rare winners…and so on and and so..Besides the fact I have been trading since 1994 it is easy for thoughts to pop into ones thinking.. Or for an exact example…even though I knew I had to put on a trade… I really did not want to…nor did I think it would work.

I will give you an exact example of if I did not follow my system and methodology I would have missed a winning trade. The meaning of this is, when you are commodity trading.. you have to have an exact reason for buying..selling.. getting out with a loss..or with a profit…If you start second guessing yourself you will lose money..This is what I mean discipline.

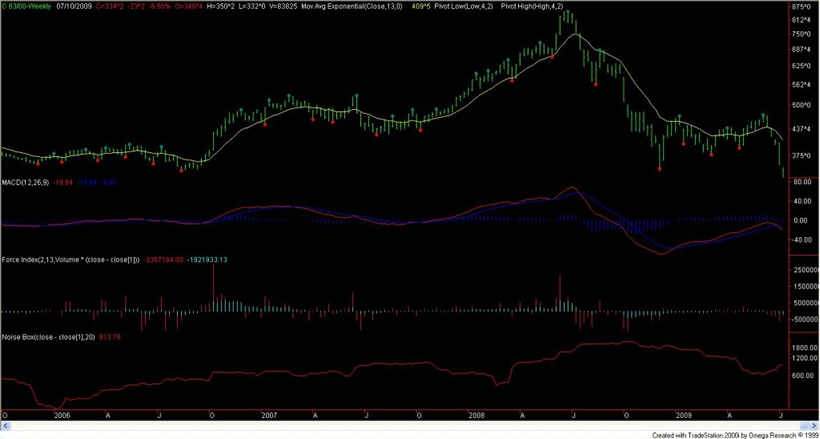

Using common sense ( which have cost me alot of US dollars).. In my mind…there are droughts all over the world..money has been printed like toilet paper which should cause inflation..Using this thinking I was not overly excited taking a corn trade. Add in the fact that corn was already down for the year more than 50%. There was nothing to think..but ok..here comes another loss in a slew of other trades… So here is the position from the statement

6/23/09 F1 2 GI DEC 09 CBOT CORN 4.09 US 7,475.00

* 2 * CLOSE PRICE 3.34 1/4 ** 7,475.00 *

AVG SHORT 4.090

If I had not taken the trade… I would have given up a nice potential profit. Lesson to learn here… Have a mechanical trading system or a commodity trading advisor that you understand exactly how it works or how the commodity trading advisor thinks. How the risk management..how the money management works.. Make sure the commodity trading advisor is beyond disciplined.. Make sure if you think you are going to do your own commodity trading you are disciplined.

Realize with what ever type of analysis ..Price is going to be right…No one knows the future…Know that you have to take every trade and be consistent. If you can not do this…don’t trade.. if you do not have a time window of at least 3 years to allocate to a commodity trading advisor don’t allocate..

Andrew Abraham

www.myinvestorsplace.com

Andrew Abraham has been in the financial arena since 1990. He is a commodity trading ddvisor and co manager of a Commodity Pool. Since 1993 Andrew has been a proponent of quantitative mechanical trading programs. Andrew's major concern is not only total return on investment but rather the amount of risk that one would have to tolerate in order to achieve returns He focuses on developing quant models that encompass strict risk adherence and correlation. He has been a speaker at conferences as well as an author of numerous articles. Andrew has spent years researching ideas that have the potential to outperform indices as well as maintain fewer draw downs.

Visit Angus Jackson Partners (http://www.angusjacksonpartners.com) Contact: A.Abraham@AngusJackson.com (mailto:A.Abraham@AngusJackson.com)

© 2009 Copyright Andrew Abraham - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.