Commodities Technical Trading Setups for Gold, Crude Oil and Natural Gas ETF's

Commodities / Commodities Trading Jul 27, 2009 - 02:31 AM GMTBy: Chris_Vermeulen

Commodities are trying to hold their ground and could go either way quickly. There is a lot of chatter going on about gold and silver. I am hearing extreme theories from everyone I talk with. Generally when I see the market get jumpy we tend to see volatility increase which translates into sharp rallies or sell offs.

Commodities are trying to hold their ground and could go either way quickly. There is a lot of chatter going on about gold and silver. I am hearing extreme theories from everyone I talk with. Generally when I see the market get jumpy we tend to see volatility increase which translates into sharp rallies or sell offs.

My finger is on the trigger for Gold

Below are two charts of gold (GLD fund). The first one is what I would like to see before we have a low risk setup. This chart will not only lower the overall risk but increase the odds that the rally will provide more profit. Buying after a pullback actually helps to lower the down side risk because many sellers have been flushed out.

The chart below shows what could very likely happen tomorrow. If prices move higher and the intraday price action generates a low risk entry point I will be sending out an alert. This type of setup has a lower win rate but many times the rallies from these are quick and powerful. Locking in a profit is crucial when trading steeper trend line rallies.

My finger is on the trigger for Silver

Silver has already started to move to the upside but the intraday price action did not generate a low risk buy signal. It was very close on Friday but not enough. This chart below shows what I would like to see happen to silver.

The Silver chart below is currently trying to start a new rally higher and just may happen on Monday. I will be sending out an alert if we get the proper price action tomorrow.

Crude Oil

Crude oil has had a solid rally higher and is now trading at both Trend line resistance and price level resistance. Currently we are not near a setup.

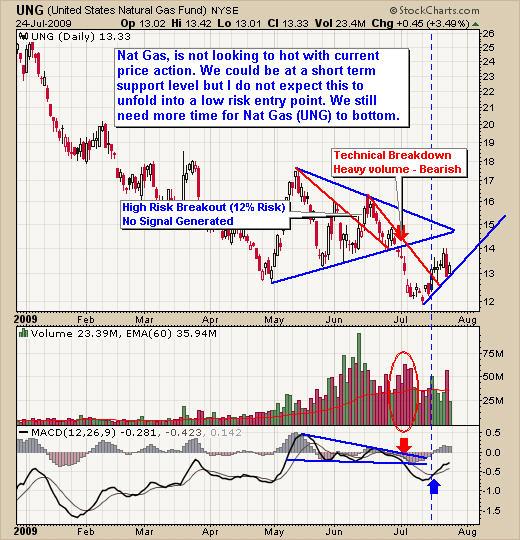

Natural Gas

Natural gas had my attention several weeks ago but is now an underdog. We need more time for this commodity to bottom before we can get anything good from it.

Technical Trading Conclusion:

Overall commodities have made up some lost ground in the past couple weeks but are now trading at short term resistance levels. What does that mean? Well the odds are in favor that we will see some profit taking pulling prices down a little and allowing for a low risk setup before taking another run higher.

Gold and Silver could be exciting tomorrow depending on the intraday price action. I will keep members posted as the day unfolds.

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.