Gold and Crude Oil Market Meltdown Analysis

Commodities / Commodities Trading Jul 30, 2009 - 01:27 AM GMTBy: Chris_Vermeulen

Everything is playing out exactly as we hoped and expected this week. We have been so close to a buy signal in gold and silver but Monday’s intraday observations saved us from a nasty trade.

Everything is playing out exactly as we hoped and expected this week. We have been so close to a buy signal in gold and silver but Monday’s intraday observations saved us from a nasty trade.

Those of you in love with oil just had a Kiss Good Bye! Better PUT some love letters together J pardon the pun.

Natural Gas is all bottled up. Can you smell that?

Gold ETF Trading – Gold Bullion Price Action

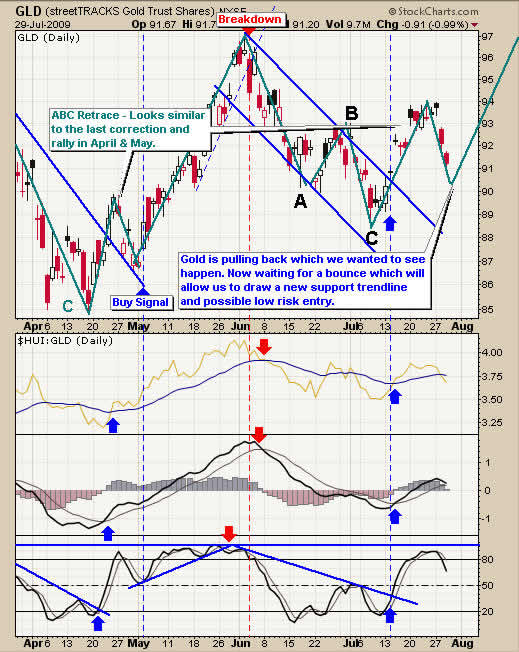

As mentioned in the last couple reports we are currently waiting for a correction which will hopefully provides us with a low risk entry point. Since June we have been in a short term down trend, but the longer term trend is still up. Which is why we are looking for a buy signal and not a short. The past couple days we have seen gold and silver sell down.

Looks like big floor traders are “running the stops” which is when the majority of the public is trading all in one direction (up) and the floor traders manipulate prices to trigger peoples stop orders and shake them out of the trade before continuing in the direction of the overall longer trend. This is explained in my Trading Manual for exiting trades for maximum profits, avoiding the floor traders from running your stops and how to take advantage of it report. This will all be explained once I have that report completely written. It is the one thing most traders don’t know, yet is the most crucial knowledge to trade with.

Anyways, for gold and silver we could see more downside but until the selling dissipates we will wait.

HUI Index – Gold Stock Index

In short, on Monday when gold and silver moved higher on weak intraday price action, gold stocks moved lower telling me smart money was unloading before bullion tanks. This goes to show how much attention should be made when trading. I know so many people went long gold Monday only to take a beating every day since. This is what I like to avoid.

Silver ETF Trading – Silver Bullion Price Action

Silver is in the same boat at gold. Popped higher on Monday as novice traders get sucked in and spit out a day or two later. The worst part is that PM’s could and should reverse soon and move higher. This is what frustrates people immensely. The average trader is normally right but at the wrong time. Getting shaken out of a trade only to see it reverse and continue in the direction you were ready for.

Natural Gas ETF Trading – Natural Gas Price Action – Weekly Chart

Natural gas stinks, not much to say here in my opinion. I think it is way over sold and do not want to short it. I would rather wait for a breakout and low risk buy setup.

Crude Oil ETF Trading – Crude Oil Price Action – Daily Chart

This is the same chart I posted last week of crude oil. Simple breakdown and retest of both support trend line resistance (The Kiss Good Bye!), and blue high lighted zone on the chart. Saw it coming and was planning on using DTO for a nice bear play but prices just ran not providing a low risk entry point. Great for day traders thought!

Overall I am still bullish on oil, but this just had a feel to it that selling was about to step in for a quick down draft. This is a high spec trade and would only last 1-3 days most likely for a quick gain if taken.

Trading Conclusion:

Overall it’s been a great week. Our golden rocket stock picks are up, and we are getting the pullback in price for gold and silver which will hopefully provide us with a low risk entry point shortly.

The energy sector is nothing special in my eyes technically speaking. Those of you who entered the market in Feb & March with me using XTR.TO energy dividend fund should be happy as we all received our quarterly dividend payments of 4%. With the energy sector currently on edge it could be a good idea to put in a small hedge against our long term dividend energy play here. Using a leveraged bear energy fund works well for the short term like HED.TO. Just a small position to counter balance movement of the long position. I like to hedge some of the long position so that if I am wrong and prices continue higher then my long position will still make money. But if I am correct and the market moves lower, my hedge will rise and cover most (not all) of my losses from my long position. The dividends cover the balance.

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

If you would like more information on my trading model or to receive my Free Weekly Trading Reports - Click Here

If you have any questions please feel free to send me an email. My passion is to help others and for us all to make money together with little down side risk.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.