Gold, Silver, Crude Oil and Natural Gas Commodities ETF Trading

Commodities / Commodities Trading Oct 25, 2009 - 12:26 PM GMTBy: Chris_Vermeulen

The past week in gold, silver, oil, natural gas and the broad market wasn’t anything to write home about. We are seeing controlled profit taking which is making the market choppy. Many traders are getting very bearish on the market which is a good thing in my opinion. According to my market internals, sentiment and volume analysis we should get a shake out (sharp dip) which would make traders exit their positions before the market continues higher.

The past week in gold, silver, oil, natural gas and the broad market wasn’t anything to write home about. We are seeing controlled profit taking which is making the market choppy. Many traders are getting very bearish on the market which is a good thing in my opinion. According to my market internals, sentiment and volume analysis we should get a shake out (sharp dip) which would make traders exit their positions before the market continues higher.

Some trader’s say we are in a bull market, others say we are in a major bear market. Either way the trend is up on the daily and weekly charts and companies are making money. Buying on over sold dips has been very profitable this year. Until I see things drastically change, this is my strategy for the broad market.

Lets take a look at the commodity sector.

HUI – Gold Stocks Index

Recently we have seen money move out of gold stocks but with the majority of them trading at support trend line we could see some fireworks this week.

Gold Mining Stocks Trading

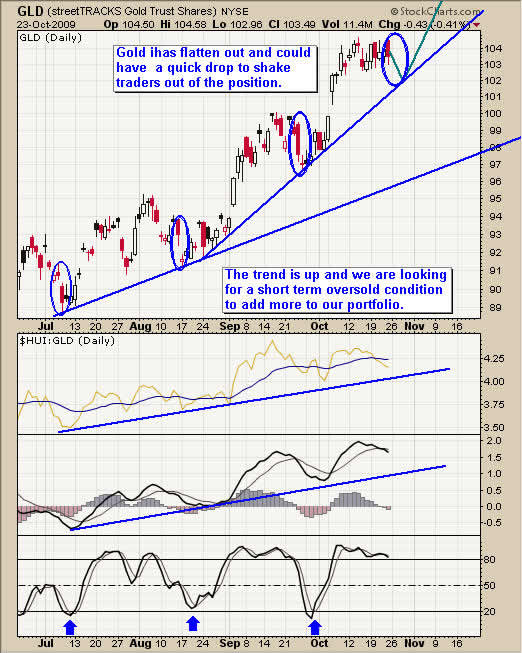

Gold – GLD Exchange Traded Fund

Gold has been trading sideways as investors and traders digest the previous rally higher. The recent price action looks similar to the September rally and consolidation. Lets hope for a another move higher without getting shaken out of our positon.

Gold ETF Trading Newsletter

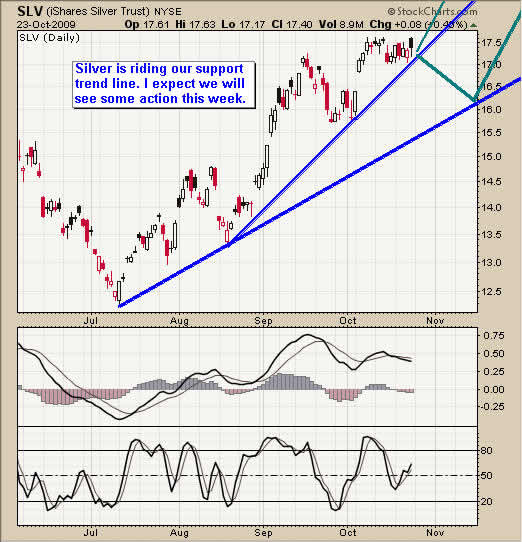

Silver – SLV Exchange Traded Fund

Silver is in much of the same situation as gold. We are waiting to see what happens here at these support levels.

Silver ETF Trading Newsletter

Crude Oil – USO Exchange Traded Fund

Oil has been making a strong rally after breaking out of is multi month consolidation pattern. We are now looking for some type of pullback or test of breakout for another low risk entry point.

Crude Oil ETF Trading Newsletter

Natural Gas – UNG Exchange Traded Fund

Natural gas is having some trouble breaking out above the multi month resistance trend line. Buying here is a 50/50 bet and I will wait for another entry point before putting our money to work.

Natural Gas ETF Trading Newsletter

Natural Gas, Oil, Silver and Gold Exchange Traded Fund Conclusion:

Overall, the market feels ready for quick snapback to shake traders out of profitable positions. I expect a resumption of the up trend as the market slowly creeps higher at a steady pace digesting each rally with sideways movement.

I know many people are shorting the broad market and that is not something I am willing to do yet. Until I see a drastic change, long positions are my bread and butter. Once the market does reverse, there will be plenty of time to play the short side using the Leveraged ETFs.

Commodities are taking a breather but with our support trend lines nearing I expect some movement this week.

If you would like to receive my Free Weekly Trading Reports like this please visit my website: www.TheGoldAndOilGuy.com

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.