International Stocks With Serious Investment Potential 2010

Companies / Investing 2010 Feb 09, 2010 - 10:16 AM GMT

This week we'll take a closer look at some actual stocks and company-related ETFs you can buy which capitalize on the strength of the company itself and that of its underlying currencies.

This week we'll take a closer look at some actual stocks and company-related ETFs you can buy which capitalize on the strength of the company itself and that of its underlying currencies.

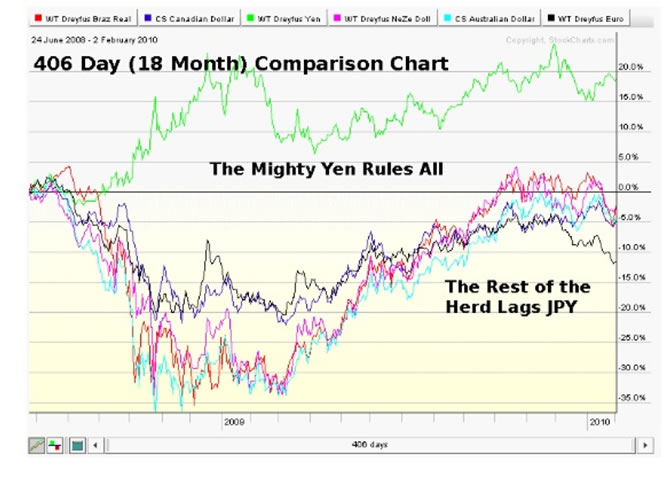

To help clarify what we looked at last week, here's two currency charts featuring the following currency ETFs ...

· WisdomTree Dreyfus Brazilian Real Currency ETF (BZF)

· CurrencyShares Canadian Dollar Trust (FXC)

· WisdomTree Dreyfus Japanese Yen (JYF)

· WisdomTree Dreyfus New Zealand Dollar ETF (BNZ)

· CurrencyShares Australian Dollar Trust (FXA)

· WisdomTree Dreyfus Euro (EU)

The first chart shows performance over 18 months of trading (406 days at 22 trading days per month on average). As you can see, the yen reigns supreme over its competition. The herd lags badly and is level since the start of the comparison. You've made (or lost) nothing if you've been holding BZF, FXC, BNZ, FXA, or EU for a year and a half.

From this viewpoint, the yen is the only game in town, right?

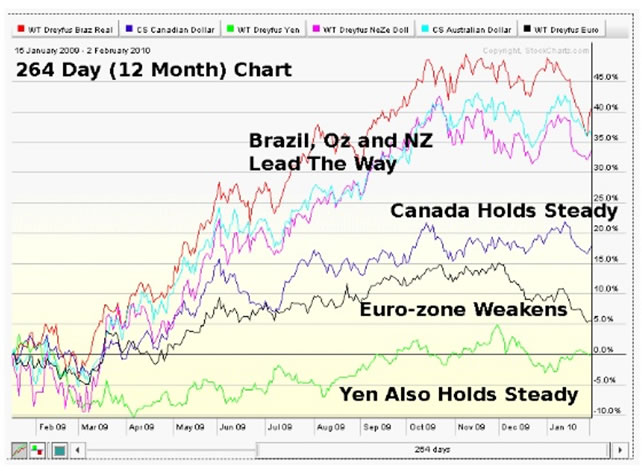

This second chart shows the last 12 months (as measured by trading days) and it paints quite a different picture. Now BZF, BNZ and FXA are the clear winners, and JYF is merely holding up, not outperforming. The Canadian dollar ETF (FXC) is also holding up, albeit at a 15% gain over the year.

The Euro is starting to fall away rather significantly, here represented by EU.

So what do these two charts suggest?

My interpretation is that the 'hot hands' are the commodities-based countries (or at least those which are perceived as such) while the others are too close to one financial crisis or another. Canada is supposedly well-oriented toward commodities, but as I suggested last week, Canada's economy is wedded to our own due to the heavy trade between the two nations. It is being weighed down by the American albatross of fiscal cowboy-ism even though its banking system is amongst the most robust and stable in the world.

The Euro is showing the PIGS effect, a result of troubles in Portugal, Ireland, Greece, and Spain.

So Why Isn't The Yen Doing Anything?

Is the Japanese economy that boring? (In this brave new world of ever-widening financial minefields, 'boring' is good.)

Of course, a strong yen helps Japan ETFs on U.S. exchanges as investors enjoy currency gains from the foreign stock exposure. However, Japan is extremely export-oriented and a strong currency makes it more difficult to sell to other countries. This was reflected in a severe economic contraction in the 2009 Japanese economy.

Keeping that in mind, it's safe to say that the Japanese want the yen much weaker, so why isn't it?

In all my reading, I have yet to find a convincing answer. There are theories that the yen carry trade is still being unwound (hedge funds used to sell the low-interest yen to buy high-interest competing currencies, and therefore had to buy back yen to get out of these trades). I've also seen that Japan has (apparently) less exposure to credit crises in Dubai and elsewhere, though nobody seems to have firm evidence of this.

It may simply be that because Japan suffered its blowup a couple of decades ago, people think the worst is over in the Land of the Rising Sun.

This hardly makes a reassuring case for investment. After all, we can point to commodities being the focal point of Brazilian real as well as Australian and NZ dollar strength. The latter two are benefiting from selling to China and other large markets – more on this in a moment.

But if there's no apparent reason for yen strength (and it's hurting their economy in a bad way) then we can assume that the government will take serious action to knock it down.

In fact, the Japanese Ministry of Finance has historically been an active interventionist during instances of excessive Yen strength. Are they really that ineffective? Or is the Japanese government merely content to hold the Yen where it is now? No one knows, and for this reason I would be very cautious about piling into this supposed 'safe haven' for no readily identifiable reason.

Instead, let's look at a couple of currencies where we know why they're strong: commodities.

The Hot Hands of Brazil, Australia and New Zealand

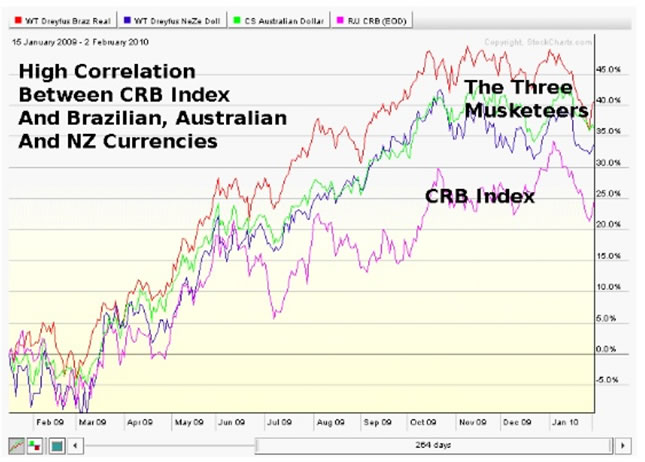

Here's a chart of the three ETFs – WisdomTree Dreyfus Brazilian Real Currency ETF (BZF), WisdomTree Dreyfus New Zealand Dollar ETF (BNZ) and CurrencyShares Australian Dollar Trust (FXA) – against the CRB Index over the last year of trading.

If you're not aware, the CRB index is is presently comprised of 19 commodities quoted on the NYMEX, CBOT, LME, CME and COMEX exchanges.

The 19 commodities in alphabetical order are aluminum ...cocoa ... coffee ... copper ... corn ... cotton ...crude oil ... gold ... heating oil ... lean hogs ... live cattle ... natural gas ... nickel ... orange juice ... silver ... soybeans ... sugar ... unleaded gas ... and wheat.

And as you can see, the CRB index is very strongly correlated to The Three Musketeers.It is, however, notable that each of the trio has outperformed the CRB index, not merely kept pace with it. Why are investors buying currencies more aggressively than the underlying commodities which are driving them?

The answer may very well lie in the catch-all of 'diversification', but in the next few columns I'm going to look specifically at key commodities companies and/or ETFs which are benefiting from their native currency appreciation.

Here's the reasoning: if the currency is doing well, and commodities are doing well, then how about the companies which are selling the products and reaping the profits in those currencies?

If you'd like a preview of that idea, I wrote a recent column on agricultural ETFs which you can find here

http://oakshirefinancial.com/2010/01/21/why-the-agriculture-sector-shows-renewed-promise/

That's the kind of material I'll be looking at more closely in the next week or two.

But don't forget that I expect the USD to continue its strong showing. Here's the weekly chart of UUP right now...

Note that UUP is still far from overbought (see the three ovals on the chart) and has a way to go yet before it will reach that level. I'm not saying that it's going to $27 again, but it looks likely to run up quite a bit more before it's done.

Once the U.S. Dollar is overbought and the bull run (or bear market rally, to be more correct) is over, then that's a good time to switch into the best of the foreign currencies, commodities and the companies that profit from them.

So there's plenty of time yet to get ready for investments in a world that isn't subject to the whims of the U.S. Government.

Good investing,

Nick Thomas,

Analyst, Oakshire Financial

Oakshire Financial originally formed as an underground investment club, Oakshire Financial is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2010 Copyright Oakshire Financial - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oakshire Financial Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Paul

09 Feb 10, 16:15 |

Investment potential? 2010?

Given the title I half expected to open the page and see only a blank sheet |