Shale Natural Gas, Europe Shakes Its Fist at Russian Energy Hegemony

Commodities / Natural Gas Apr 20, 2010 - 02:28 PM GMTBy: Marin_Katusa

Marin Katusa, Senior Market Strategist, Casey’s Energy Report writes: The latest buzzword on investors’ lips is shale, and it’s everywhere. Shale gas production is rapidly growing, and the domino effect of unconventional gas development on the global energy market is staggering.

Marin Katusa, Senior Market Strategist, Casey’s Energy Report writes: The latest buzzword on investors’ lips is shale, and it’s everywhere. Shale gas production is rapidly growing, and the domino effect of unconventional gas development on the global energy market is staggering.

North America has already seen the stampede of companies staking their territories and is now in the next phase: consolidation. However, buying into the American industry giants now, where even a major strike creates only a blip in share price, is like catching a ship that’s left the harbor.

But at Casey Research, we wouldn’t advise you to despair just yet, because the next big opportunity is just over the horizon. Coming up next – the basins of Europe.

The new techniques in drilling and well completion have transformed this formerly unprofitable source into a gold mine. Add that to the success that shale gas has enjoyed in North America, and you see why shale gas is creating a stir and intrigue throughout Europe.

Possibilities for shale gas production in Europe are endless – the American Association for Petroleum Geologists estimate a total resource of 510 trillion cubic feet (enough to power 27 European countries for over 30 years) of unconventional gas for Western Europe alone – and the rewards for investors in the right place could be huge.

In addition, unlike the United States, where major gas companies started snatching up land and smaller companies as shale gas became more popular, Europe’s shale market is still in its infancy. This puts the junior and smaller companies on the same playing field as the biggest players.

If commercial amounts of gas are found on a junior company’s land, it’s not inconceivable that its share price will multiply by ten. At the very least.

Taking on the Bear

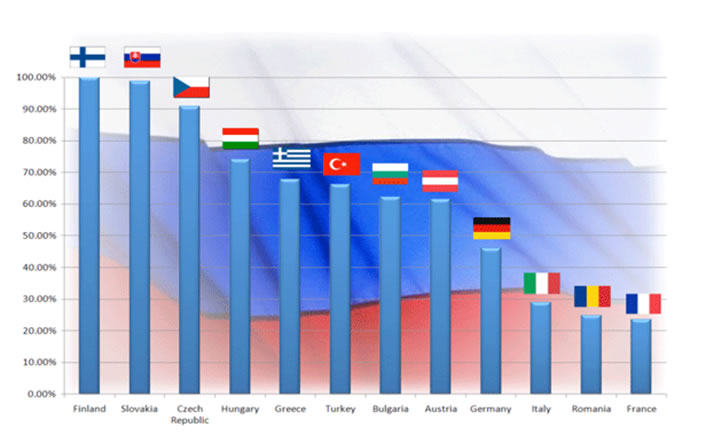

But the main attraction of shale gas in Europe, and what gives it government support across the board, is the increasing urge to break the stranglehold of the Russian gas giant Gazprom. Almost all of Europe is heavily dependent on the state-controlled Gazprom for the majority of their gas supply. Gazprom’s tap-twisting of Ukraine’s prices, through which flows almost 80% of Europe’s gas, has made it clear that Russia has a big stick and it is not afraid to use it.

With the installation of a pro-Moscow president in Kiev, Europe’s interest in a non-Russian source of gas has escalated, and should a U.S.-style shale phenomenon turn up in Europe, the energy landscape could drastically change.

Knowing Your Enemy: The Other Side of the Story

That is not to say that there aren’t any challenges facing the companies. The lack of equipment in Europe – 20 fracturing sets vs. 2,000 in North America – is a major obstacle and at millions of dollars each, companies aren’t exactly falling over fracturing sets.

Then there is the chance that the rush for land will lead to overstaking of territories, with more than one company claiming a piece of land. This will invariably lead to quarrels, even legal battles, which would delay exploration and create a mess for companies and shareholders alike. And after all this, no two shale basins are the same, and techniques that work on one may not translate to the other.

So companies looking for shale gas in Europe in largely unexplored regions face significant risks – the initial production rate, its sustainability, and costs of the well are all unknowns... and that’s precisely what makes it so exciting.

What Would You Do With a 670% Return?

Shale gas is the hot topic in Europe today, and we knew this would happen back in 2007. Our subscribers bought one 25-cent stock, then sold it at $1.80, netting a quick gain of almost 700%.

With the huge potential just waiting to be explored, investors need to have their ears on the ground to know about the “me too” companies, the ones that will hit the payload. For now, the watchwords are “oil shale in new markets.”

Casey’s Energy Report has its finger on the pulse of the world’s most exciting energy plays… and its readers are the first to know which companies have the equipment, the management, the property and the expertise needed to make the big returns in oil shale.

At Casey Research, we know the sector better than others, and we know who is strong and who is weak. Don’t miss out on the incredible opportunities that await investors in oil shale – subscribe to Casey’s Energy Report today with a generous three-month, no-risk, money-back guarantee. Details here.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.