Global Financial Crisis Could Lead to World War III

Politics / GeoPolitics Jun 14, 2010 - 08:48 AM GMTBy: Larry_Edelson

You know where I stand on just about all the markets. And not much has changed in them, or my views, since I spoke with you in my column last week, or even via my video update last Thursday.

You know where I stand on just about all the markets. And not much has changed in them, or my views, since I spoke with you in my column last week, or even via my video update last Thursday.

So today I want to change things up a bit, and address a very important topic. One that scares the heck out of me, quite frankly … and one that I know many people are thinking about.

Sadly though, there are very few even willing to discuss this topic. So that makes it even more imperative that I get the word out.

The topic, or perhaps I should say question, is the following:

Throughout history, major wars have often been triggered by financial crises. So the question is: Will today’s great financial crisis — the worst since the 1930s Depression — lead to World War III? And if so, when?

This is a very important topic for all of us, for a variety of reasons. And naturally, there’s no way I can do it justice in a singe column. Or even in a 400-page book.

But the least I can do is share my research on the subject with you, and more importantly, give you an idea as to whether or not the current financial crisis could lead to a major war, and if so, when.

To do so, I will borrow upon my original research on the topic of war, published, copyrighted and filed with the Library of Congress in Washington D.C. in May 1988.

It was a special report I put together in the mid-1980s — for the benefit of my advisory firm’s clients and investors in two privately managed commodity funds where I was the senior trader.

That report, and the research it contained, forecast political and cultural instability beginning in May 1989 and increasing into June 1990; in August of that year, Iraq invaded Kuwait, touching off Gulf War I. The data also helped me issue major forecasts for how the Dow Industrials would respond to the crisis. It turned out to be right on the money.

I have recently updated that report and it’s titled, like the first one, “The Cycles of War.” I’ve also copyrighted it and filed it with the Library of Congress in Washington D.C.

No doubt, the subject of war evokes a very basic and fundamental emotion. After all, “war”, or social conflict, is in a very real sense, the result of basic human emotions, just as love, hate, fear and greed are.

And, sad but true, the history of war is very much a part of the history of mankind. It is a cycle of life and death, of prosperity and depression, panic and serenity — and of the rise and fall of great powers and civilizations.

Unfortunately, based on my research …

The cycles of war — the natural rhythms that predispose societies to descend into chaos, into hatred, into civil and even international war — are building momentum again, and threaten to bear down on the world in short order.

When? Well, we’re already seeing the beginnings of the cycles, in the riots in Greece, Thailand, and elsewhere. I’ll give you more on the timing in a minute.

But first, please note: My message today only pertains to whether or not we face a high probability of a major war in the future, and when. In this short column, I simply cannot cover who will be at war, what the precise triggers and reasons will be, or how the markets will respond. I will cover that at a subsequent date in my Real Wealth Report.

Second, I have attempted below to make this as easy to understand as possible. Cycles are a complex subject, even more so when you are studying the cycles of war.

Some Background on My Research into the Cycles of War

I’m not the first to conduct research into the rhythms or cycles of war. There have been many before me, notably, Raymond Wheeler, who has published the most authoritative chronicle of war ever, covering a period of 2,600 years of data.

And Mr. Edward R. Dewey, the noted cycle theorist and founder of the Foundation for the Study of Cycles.

In 1964, after having worked extensively with Wheeler’s data, Mr. Dewey discovered a 17.71 year cycle in war. In other words, throughout 2,600 years of data, there seemed to be a natural tendency and high probability for societies to engage in conflict, every 17.71 years, on average.

Dewey’s work was way ahead of its time. But as I examined the data and cycles as they panned out in the 19th and 20th centuries, they often missed the mark by being too early or too late, and at other times, seemed to have no impact at all.

As a result, in my early years studying Dewey’s work and the Wheeler Index, I concluded that there seemed to be little correlation between events, and that something larger was impacting the cycles. So I set out to find out what that might be.

In short, I discovered that what was impacting the cycles Dewey and Wheeler had discovered was none other than the monetary system.

Effectively, when governments made changes to their monetary systems, the timing of the war cycle was often distorted, arriving early, or in some cases too late.

I then tested and re-tested my data and theories. And I concluded that …

A. When governments and central banks tinkered with the value of a country’s money, revaluing its currency (mostly devaluing), in the midst of financial crises, it could have either a positive or negative effect on the war cycle coming due. The determining factor seemed to be whether or not the country became protectionist, engaging in trade wars first.

B. In social phenomena such as war, just as in financial markets, cycle timing dates relate more to TURNING POINTS in time, than the amplitude of the cycle.

In other words, one could not forecast the intensity of war alone from the timing of the cycles, just when there would be a window in time where war was not only likely, but probable.

And …

C. Dewey’s original cycles were more accurate when defined as an 18-year cycle, but within the confines of a much larger 54-year cycle, which I labeled the 54-Year Socio-Political Cycle.

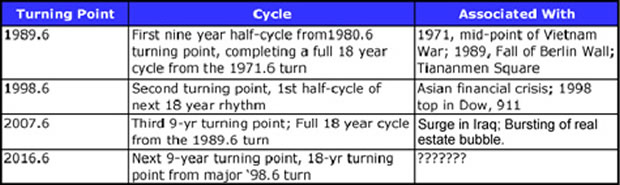

Here is a listing of the dates/turning points that resulted from my work … how they panned out and intertwined with major economic and geo-political events … and where those turning points lie in the future.

Shown next is a cycle chart of my 54-year Socio-Political Cycle, with the 18-year war cycle overlaid, as well as the 4.5- and 9-year economic cycles that I often work with for my forecasting methods.

|

Note the commentary at the bottom. I published this chart before North Korea allegedly sunk a South Korean warship.

ALSO NOTE: This mathematically generated cycle chart shows that for the period from 2014 through 2017, the world is, sadly, at a very high risk of a major, international war. A war that could be as significant as the Korean War, and quite possibly, World War III.

I hope I am wrong. I hope and pray that the leaders of the world recognize that times of financial chaos are also times that can lead to terrible consequences.

But whether they do, or do not, I hope that you take this information very seriously, and take the necessary steps to prepare your family … your loved ones … and your finances — by recognizing and acknowledging the potentially dire times that may lie ahead.

My 2010 edition of the Cycles of War report is available for $79 by clicking here.

Better yet, for just $99 — consider a 1-year subscription to my Real Wealth Report, where you can get the Cycles of War for free, plus two other free profit guides, and of course, 12 hard-hitting monthly issues of my core publication, and all the insights and recommendations I publish.

Best wishes,

Larry

This investment news is brought to you by Uncommon Wisdom. Uncommon Wisdom is a free daily investment newsletter from Weiss Research analysts offering the latest investing news and financial insights for the stock market, precious metals, natural resources, Asian and South American markets. From time to time, the authors of Uncommon Wisdom also cover other topics they feel can contribute to making you healthy, wealthy and wise. To view archives or subscribe, visit http://www.uncommonwisdomdaily.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.