AAPL Stock, Why We Don’t Chase Buses

Companies / Company Chart Analysis Jul 22, 2010 - 12:39 PM GMTBy: David_Grandey

So AAPL reported earnings after the close Tuesday and what did it do Wednesday?

So AAPL reported earnings after the close Tuesday and what did it do Wednesday?

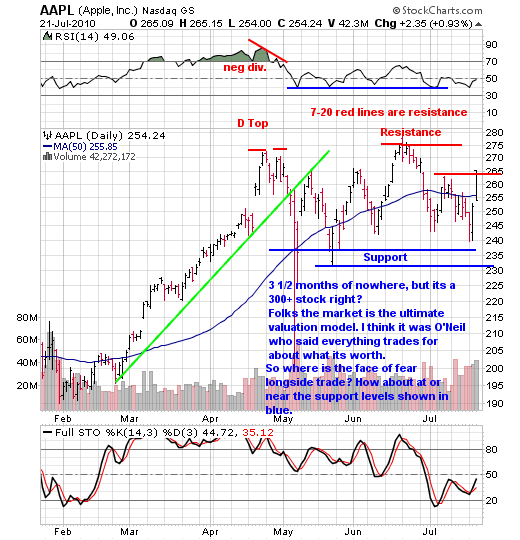

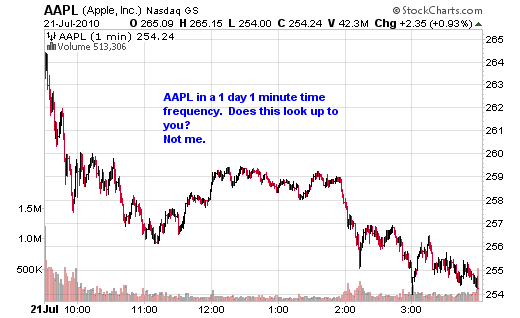

See that? Traded basically right up to the little red 265 line and backed away. Anyone who had to have it on those great numbers AFTER it popped is for the most part down for the day. What’s that we say? Don’t get emotional and make emotional decisions? And ohhh lets not forget about chasing buses either.

Let’s talk a little bit about Apple for a moment. What we want to bring to your attention is that in addition to helping you make money consistently in the market, you also pay us is to keep you out of trouble.

We’ve stressed time and time again the importance of NOT chasing buses, And Wednesday’s action on apple is a perfect example of that. By getting emotional and watching TV about just how great the numbers were (and yes they were) and listening to the analysts about how its a 300 dollar plus stock one who is not in control of their emotions and disiplined could have easily bought the stock thinking its going to 300. Folks the street and cheerleaders have been saying this for 6 MONTHS!

What’s that phrase? Let the stock tell you by the action it exhibits. AAPL hasn’t gone anywhere but range bound for 3 1/2 months, even with all the amazing hoopla over that period.

Let’s say you were one of those emotional investors that “Had To Have It” Well the market let you have it today that’s for sure. For those who bought in the first few minutes the results of NOT applying our discipline of “we do not chase buses, we do not make emotional decisions” they are now looking at a stock that has gone from 265 to 254 or $1,100.00 per 100 shares or $1,100 saved by keeping away from making an emotional decision. Money Saved Is Money Earned especially when it keeps you from making an emotional decision.

Sometimes what you pay for can’t be measured in the total value of your portfolio, only in what you kept away from.

Lastly, see that volume? It’s shown as an up day, but here is the catch. From the open it was down all day. So is it really up volume? or is the volume defaulted to whether the stock is up or down from the prior close? We’d venture to say from the prior close.

Classic example of buy the rumor sell the news. To the herd I might add.

If you follow the herd and the herd goes off the cliff you are going along with them.

By David Grandeywww.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.