UK House Prices Appear to Shrug Off Credit Crunch in September

Housing-Market / UK Housing Sep 27, 2007 - 04:28 AM GMTBy: Nationwide

House prices defied gloomy expectations and showed another gain in September

House prices defied gloomy expectations and showed another gain in September

- But the trend growth of house prices is now the lowest since July 2006

- Credit conditions are now clearly tightening for leveraged borrowers

- The interest rate outlook has shifted from hawkish to dovish, which could provide some welcome relief to homeowners next year

| Headlines | September 2007 | August 2007 |

|---|---|---|

| Monthly index * Q1 '93 = 100 | 368.3 | 365.8 |

| Monthly change* | 0.7% | 0.6% |

| Annual change | 9.0% | 9.6% |

| Average price | £184,723 | £183,898 |

* seasonally adjusted

Commenting on the figures Fionnuala Earley, Nationwide's Chief Economist, said: “House prices recorded a reasonably strong gain of 0.7% between August and September, seemingly shrugging off the unsettled events of the past month. Despite this increase, the 12-month rate of house price inflation came down from 9.6% in August to 9.0%, as we are now entering a period during which house prices gains were particularly strong in 2006. This brought the average price of a typical UK property to Ł184,723. The 3-month on 3-month rate of price growth – often the smoothest indicator of underlying momentum – slowed from 2.0% to 1.6%, the lowest level since July 2006. Overall, house prices defied the gloomy predictions of some recent headlines, but their underlying growth is still on a decelerating trend."

Credit is tightening for leveraged borrowers …

“The financial turmoil that began in early August extended into September, dampening hopes that the uncertainty sparked by the crisis would blow over quickly. Higher wholesale funding costs are now clearly leading to a reassessment of the pricing of credit in the mortgage market. As expected, this has not had an immediate impact on house prices, but the longer-term effect will undoubtedly be to take some of the froth out of the market.

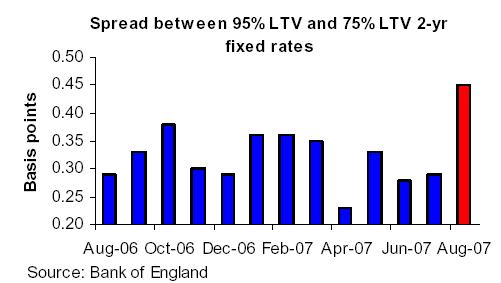

“Over the last year, borrowers who have wished to extend themselves to the limit have been able to do so relatively cheaply in comparison to more restrained borrowers. While some lenders are still willing to extend loans with little or no deposit, such products are now more expensive, reflecting the extra risk involved. The difference in rates available on 95% loan-to-value ratio (LTV) fixed rate mortgages and their 75% LTV equivalent soared in August. The average market rate for a 95% LTV 2-year fixed rate mortgage was 0.45 percentage points higher than the rate on a 75% LTV equivalent in August, compared with only 0.29 percentage points in July and a low of 0.23 points in April. The message from lenders is clearly that from now on, risk must have its price. As a result, highly leveraged borrowing will remain less attractive and lending volumes in this segment may decline.

“Over the last year, borrowers who have wished to extend themselves to the limit have been able to do so relatively cheaply in comparison to more restrained borrowers. While some lenders are still willing to extend loans with little or no deposit, such products are now more expensive, reflecting the extra risk involved. The difference in rates available on 95% loan-to-value ratio (LTV) fixed rate mortgages and their 75% LTV equivalent soared in August. The average market rate for a 95% LTV 2-year fixed rate mortgage was 0.45 percentage points higher than the rate on a 75% LTV equivalent in August, compared with only 0.29 percentage points in July and a low of 0.23 points in April. The message from lenders is clearly that from now on, risk must have its price. As a result, highly leveraged borrowing will remain less attractive and lending volumes in this segment may decline.

“The cooling of activity among stretched borrowers is something that most commentators have predicted for some time, given the affordability pressures that have built up from rising house prices, higher base rates and weak earnings growth. The tightening of credit conditions may indeed be the trigger that causes this long-awaited trend to emerge.

… But the outlook for mainstream borrowers may be brighter“Yet the re-pricing of credit risk and the tightening of lending criteria is only one side of the credit crunch story. Events of the past two months now appear to mark a clear turning point in the interest rate outlook. In early August, most observers were still predicting that the MPC would move to raise base rates to 6% by November at the latest. However, sentiment has changed significantly as the potential adverse economic impact of the credit crunch has been acknowledged by the MPC. At the same time, inflation has trended well below the Bank of England's projections in the August Inflation Report , while the decision by the Federal Reserve to cut US interest rates by half a percentage point could raise the pressure on other central banks to follow suit. The likelihood is now that we will see a cut in base rates early in 2008, which is good news for mainstream borrowers and those coming off fixed rate deals.

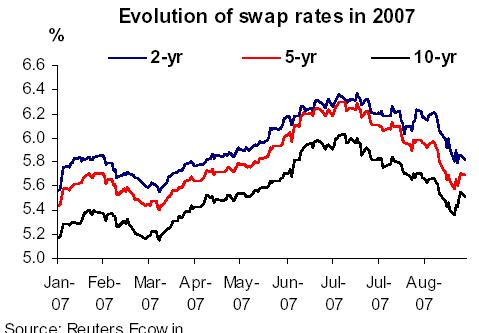

“The more dovish outlook for base rates is beginning to be reflected in swap rates, which are generally a good proxy for the cost of fixed rate mortgages. These have received relatively little attention recently, but have actually been trending down since peaking in July. Falling swap rates are an indication that upward pressure on mortgage pricing from the base rate environment is receding, at least in the short term. This implies that for mainstream borrowers with good credit quality and lower LTVs, credit conditions have not deteriorated as much as the headlines may suggest. It also suggests that payment shock for borrowers who need to re-mortgage in 2008 may not be quite as large as previously anticipated. Although many lenders are now increasing margins, it is reasonable to assume that at least some of the decrease in swap rates will be reflected in fixed rate mortgage pricing. 1

“The more dovish outlook for base rates is beginning to be reflected in swap rates, which are generally a good proxy for the cost of fixed rate mortgages. These have received relatively little attention recently, but have actually been trending down since peaking in July. Falling swap rates are an indication that upward pressure on mortgage pricing from the base rate environment is receding, at least in the short term. This implies that for mainstream borrowers with good credit quality and lower LTVs, credit conditions have not deteriorated as much as the headlines may suggest. It also suggests that payment shock for borrowers who need to re-mortgage in 2008 may not be quite as large as previously anticipated. Although many lenders are now increasing margins, it is reasonable to assume that at least some of the decrease in swap rates will be reflected in fixed rate mortgage pricing. 1

Wider economy and labour market still hold the key

“Looking further ahead, the development of the wider economy and labour market will determine the trajectory of house prices. A slowdown in consumer demand now looks likely to pull economic growth below its trend rate in the coming quarters and take further froth out of the market. A worst case scenario is for the economy to stagnate or fall into recession, with large job losses forcing homeowners into unwanted sales. This is still very much an outside probability, but it would be complacent to claim that the odds have not increased recently. In light of these uncertainties, prospective buyers would be wise to think carefully about their financial position and the risks around it before entering into a house purchase decision.”

| Fionnuala Earley Chief Economist Tel: 01793 656370 Mobile: 07985 928029 fionnuala.earley@nationwide.co.uk |

Kate Cremin Press Officer Tel: 01793 656517 kate.cremin@nationwide.co.uk |

1 Based on officially published average mortgage rates in August, an owner of a typical semi-detached property who took out a 75% LTV 2-year fixed rate loan in 2005 would have faced a payment shock of approximately £100. If one assumes that only half the decrease in swap rates between the end of August and today is passed on, the payment shock for this borrower would fall to £90.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.