Stocks Advance But Irish Bond Spreads Hit Fresh Highs on Debt Crisis

Stock-Markets / Stock Markets 2010 Sep 20, 2010 - 10:23 AM GMTBy: PaddyPowerTrader

Stocks Advance but Irish Bond Spreads Hit Fresh HighsThe big story Friday related to a research report by Barclays Bank (actually published Thursday morning) stating that Ireland MAY require external aid If unexpected banking losses emerged or economic conditions deteriorated further. This assertion was picked up in the most tabloid fashion imaginable by the Irish Independent in a clear case of scare mongering in what smelt of a Fox News make the facts fit the underlying editorial line (i.e. to heap more pressure on the FF / Green’s coalition) and then amplified in a game of worldwide financial Chinese whispers that went viral.

Stocks Advance but Irish Bond Spreads Hit Fresh HighsThe big story Friday related to a research report by Barclays Bank (actually published Thursday morning) stating that Ireland MAY require external aid If unexpected banking losses emerged or economic conditions deteriorated further. This assertion was picked up in the most tabloid fashion imaginable by the Irish Independent in a clear case of scare mongering in what smelt of a Fox News make the facts fit the underlying editorial line (i.e. to heap more pressure on the FF / Green’s coalition) and then amplified in a game of worldwide financial Chinese whispers that went viral.

One just wishes more people would take the time to read the original report. The result for Ireland Inc. was that the cost of insuring Irish sovereign debt against default hit a record high, as did the Irish/German spread. So we’re all the poorer. And the haemoraging has continued today with Portugal leading the way today (out by 26bp’s) with Ireland’s spread ballooning to yet another all time high relative to Germany ahead of supply tomorrow.

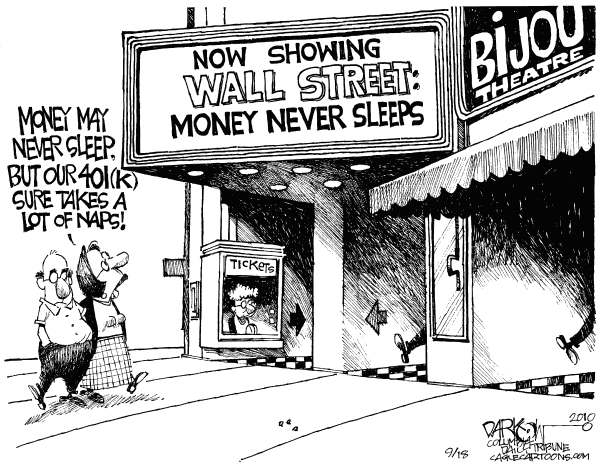

Extended trailer for the movie

Market Moving Stories

•Turning to equities and stocks on the move in Europe today include mining & basic resources names which are bid with Rio Tinto up 1.5 percent, while Xstrata (the largest exporter of coal used for power) is ahead by 1.4 percent as Aluminum, copper, lead, nickel and zinc all rose on the London Metal Exchange.

•And Segro has rallied 1.4 percent leading a gauge of European real estate shares to the biggest gain among 19 industry groups in the Stoxx 600. The U.K.’s biggest owner of warehouses and business parks was raised to “neutral” from “sell” at Goldman Sachs.

•In Europe SGS, the world’s biggest goods inspector, gained 4.7 percent on news that the company also aims for earnings per share of about 140 francs by 2014, helped by “strong organic growth,” it said today in a statement.

•And Suedzucker has climbed Monday 3.3 percent after the world’s largest sugar refiner said it expects full-year operating profit to increase to more than €450 million from €403 million last year.

•In France Safran is up nearly 4 percent after the he company said it still wants to buy Zodiac Aerospace, Chief Executive Officer Jean-Paul Herteman said on a conference call today. Safran, which today said it’s buying most of the assets of L-1 Indentity, sees synergies of $30 million from the purchase.

•Turning to automakers, Fiat has climbed 3.7 percent, its highest price since April on a broker upgrade over at Sanford C. Bernstein who upgraded the Italian carmarker to “outperform” from “market perform.” The brokerage, which increased its price estimate to €15 from €12, said in a note that “the key to performance is whether Fiat can deliver earnings progress and upgrades into 2011 and 2012, irrespective of whether it is structured as one company or two.

•French bank Credit Agricole rose 1.4 percent Monday after Credit Suisse raised its recommendation for France’s second-largest bank by assets to “outperform” from “neutral.”

•But Halfords Group has tumbled 5 percent marking a seventh day of declines for the longest falling streak in 15 months. The U.K.’s biggest seller of car parts and bicycles was downgraded to “neutral” from “buy” at broker Redburn Partners who are a little late for the wake.

•But todays ugly ducking award goes to Hikma Pharmaceuticals Plc sank 5.1 percent, the worst performance in the Stoxx 600. The Jordanian drugmaker listed in London was downgraded to “sell” from “reduce” at Numis Securities.

•And Actelion has dropped 4.1 percent after Switzerland’s largest biotechnology company said U.S. prosecutors asked for documents related to marketing and sales practices for the Tracleer lung medicine.

•Elsewhere this week’s main event is tomorrow’s Federal Reserve meeting and the markets have been flying since the beginning of the month on the expectation that the Fed will print more money to combat the slowdown.

in the US economy. Whether printing more money actually works is a moot point but the Fed believes that it does through the mechanism of lowering long-term interest rates. Extra liquidity has to find a destination and, with investors worried that printing money is a recipe for future inflation problems as a well as a devaluation of paper currencies, gold continues to go up as the US dollar weakens. Of course, investor sentiment has been notoriously fickle and volatile and it wouldn’t take much for the current rally in the prices of financial assets to stop dead in its tracks. Ultimately, the real economy depends on real things like investment and productivity, which is why the longer-term economic outlook for the debt-burdened ‘advanced’ economies doesn’t look so pretty.

•UK: Rightmove, which claims to capture 90 percent of all homes put up for sale across the England and Wales, said asking prices fell 1.1 percent in September, following drops of 1.7 percent in August and 0.6 percent in July. The annual rate of growth slipped to 2.6 percent from 4.3 percent.

•German banks need capital of around €50 billion says Der Spiegel. Germany’s 10 largest banks need additional equity capital of around €50 billion as a consequence of Basle III, Der Spiegel writes, referring to a secret Bundesbank document. Bundesbank experts have analysed the capital needs of banks with a core capital of more than €3 billionn, the magazine writes. It is estimated that these banks can accumulate equity capital of around €40 billion through retained earnings and rights issues until 2019, for the rest, banks have to seek “new sources of financing”. The situation is seen particularly critical at Landesbanks, Der Spiegel notes. The head of SoFFin, H Rehm, said in an interview with Euro am Sonntag that the German banking sector as a whole would need an additional €200 billion in terms of equity capital due to Basle III. The association of German banks, BdB, had estimated capital needs of €100 billion, but this estimate was withdrawn last week. It should be noted that in June 2010, the German banking sector’s equity capital – capital plus reserves, participation rights capital, and funds or general banking risks – stood at €367.2 billion.

Is the Game Up For Ireland ?

Irish eyes certainly are not smiling at the moment and indeed the country has likely reached the tipping point. With bond spread now 4.15 percent over their German equivalent the country risks, as was the case with Greece the situation spinning out of control and snowballing into a self fulfilling prophecy. The argument being made by banks like Danske today is now that Ireland should bite the bullet and activate the much stigmatized IMF and EU special vehicle tool called EFSF – , the mathematical logic being why pay 6.75 percent for 10 year bonds when you lend money to Greece at 5 percent and you have a drawing right via EEC bonds (the issuer for EFSF) at same levels ?

If the IRISH (and Portuguese) bond market does not stabilise, and if the market does not come to believe that Ireland’s fiscal position is manageable/ sustainable then the country is destined, sooner or later, to activate the EU-IMF bail-out package established in May so runs the argument.

And tomorrow will provide another big litmus test. Ireland’s debt agency, the NTMA has committed to putting at least €1 billion worth of Irish Government bonds up for auction (for bonds maturing in 2014 and 2018). If there were to be any serious problem with take-up, which I doubt as Primary Dealers are obliged to bid for at least 10 percent each, or if the auction result come out worse than already high yield in the secondary market, real consideration would have to be given to seeking help. Although it is by no means inevitable that a bail-out will be necessary, the chances of that outcome eventually coming to pass have risen last week, and not only because yields have increased to levels that create an uncontainable debt dynamic.

One of the main problems for Ireland is the tokenism of the ECB bond buying of late. It is VERY VERY clear at this point, that ECB will not exercise to the full its powers to intervene (using the SMP) in the bond market. If it was going to use all its powers, it would have used them by now.

Although there were the usual trader rumours that the ECB was buying Irish debt Friday, it was abundantly clear that the level of intervention was nowhere near enough, as evidenced by the yield blow in spreads Indeed despite the noise the buying since end June (when Greek bonds exited the major bond indices) has been tiny and totally ineffective

So is there an alternative ?

Yes the Irish Financial Community should don the green jersey and come together in some mutual understanding of what’s at stake – AND START BUYING IRISH GOVT DEBT. Ireland Inc. is what at stake here

Why are Irish Banks only holding €7-8bn of Irish Govt Bonds ?

Why does the Irish Central bank hold little or no Irish debt as part of their reserves ?

Why are 85 percent of IRISH Govt Bonds held by foreigners (lowest proportion in the euro area) leaving spreads at the mercy of these holders.

Irish Banks could buy loads of Irish Govt Bonds and finance these via ECB tenders – this could be a way of recapitalising the banking sector – this is what Greek Banks (they hold 60bn € Greek Bonds) do – I can’t see what Bank of Ireland and AIB have to loose – if the state defaults – the banks would long be history.

The Government could liquidate the NPRF to buy Irish bonds in much the same way Spain use their pension fund.

Anglo Irish could start buying Irish Govt Bonds – that would be the Irish way of QE.

The Government sends to urgently get the hurry up on Allied Irish Bank to recapitalize as their sloth like efforts to date are a drag on the whole system & of course we need final CLARITY on the figure for Angle Irish.

Let’s see what happens – one thing is for sure – if nothing is done – it looks like carnage for Eurozone as Ireland would drag down Portugal and Portugal might drag down Spain (Spain has done very well recently) and if Spain is having the same punishment as Portugal and Ireland I can’t see any bright future for EuroZone.

One should be aware by now of the Irish funding situation and the huge €20 billlion in cash reserve – so Ireland is fully funded until Summer ‘11 and have no meaningful redemptions before Nov ‘11 so a “liquidity crunch” like the Greek one, for sure won’t happen. This also excludes the value of the stocks / other investments held by the Irish NPRF

So for Ireland the second option would be the preferred option but requires a degree of policy co-ordination which to date has been absent

In related news The Sunday Business Post has reported that AIB may alter its planned fund raising timetable. The report suggests that AIB could defer the sale of its other overseas assets until after a planned rights issue. Separately, the Tribune reports that Santander has reopened talks with M&T over a merger with Sovereign Bank. And this morning there is news that AIB has sold off its stockbroking arm, Goodbody’s for €24 million to FEXCO

Irish Central Bank governor Patrick Honahan has said this morning in a speech the cost of Anglo Irish would be

“less” than the numbers being “touted”.

Company / Equity News

•BAE Systems, Europe’s largest defense company and the U.K.’s Ministry of Defence have suspended flights of their Typhoon combat aircraft amid safety concerns. Separately, BAE said it will buy L-1 Identity Solutions Inc.’s Intelligence Services Group, including SpecTal LLC, Advanced Concepts Inc. and McClendon LLC, for about $296 million in cash.

•Barclays may create a subsidiary for its retail deposits as the U.K. Independent Banking Commission prepares to issue its first paper on Sept. 24, the London-based Times reported without saying where it got the information. The shares sank 3.2 percent at the open.

•BHP Billiton, the world’s largest mining company has obtained $45 billion of loans to back its bid for Potash Corp. of Saskatchewan Inc., the underwriters said on Sept. 17. Separately, the Globe and Mail reported that China is close to making a decision on whether to bid against BHP for control of Potash. The newspaper cited people familiar with the situation. The government, which may present a bid by the end of the month before national holidays start on Oct. 1, is considering offers from several state-owned companies.

•Apollo Global Management has teamed up with CVC Capital Partners Ltd. to make a fourth, sweetened offer for Brit Insurance valued at as much as £871 million.

•Hammerson , the U.K.’s third-largest real estate investment trust and Oman may try to sell their office and retail site at Bishop’s Square in London for about £550 million the Financial Times reported, without saying where it got the information.

•HSBC may appoint Simon Robertson, chairman of Rolls-Royce Group Plc, as a temporary successor to Chairman Stephen Green, the Sunday Times reported, without saying where it got the information.

•Royal Bank of Scotland, the U.K’s biggest government-owned bank expects to manage $7 billion to $10 billion of Gulf Arab bond sales next quarter, which will be the region’s best three months for debt offerings this year, a bank official said.

•Vodafone Group, the world’s biggest mobile operator may increase its dividends to shareholders by more than £3 billion if Verizon Wireless resumes payments to the U.K. company, The Observer said, citing unnamed bankers and analysts.

•BP has finally sealed off the Macondo well; with BP, the federal government scientific team and the National Incident Commander all concluding on September 19th that the “bottom kill” operation to seal the well with concrete has been successful. The cost of the response to date is now up at $9.5 billion, and this draws a line under the most complex operational part of the disaster response. This is a small positive, but attention will now move to the courts and whether or not BP was guilty of negligence.

•SABMiller CEO Graham Mackay confirmed at a Chicago conference press stories that the Company was interested in the beer business of Fosters, according to the Sydney Morning Herald. Fosters is intending to demerge its beer and wine businesses in May 2011.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.