Hit And Run Trades Give Good Stock Trading Profits

Companies / Company Chart Analysis Oct 31, 2010 - 12:04 PM GMTBy: David_Grandey

Elections, QE2. Do news driven events like this matter?

Elections, QE2. Do news driven events like this matter?

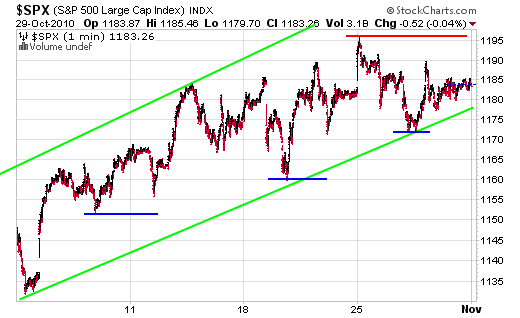

From a technical standpoint they don’t. Although those events are most likely going to get us unstuck from the current trajectory of our current trend channel that we will say.

If we are going higher then we need to break 1195.

If we are going lower we need to break trend channel support as shown in the short term index charts below.

Short term, the markets are at trend line support and that is holding for the time being. The big question is will trend line support hold. IF so then the next barrier is 1195. If we can get through that then it’s a retest of the 1220 highs. But watch out for a retest of 1195 and failure as that would fall into the realm of nice uptrend, puts in a double top and see ya later to the downside. That is your what to watch out for next week.

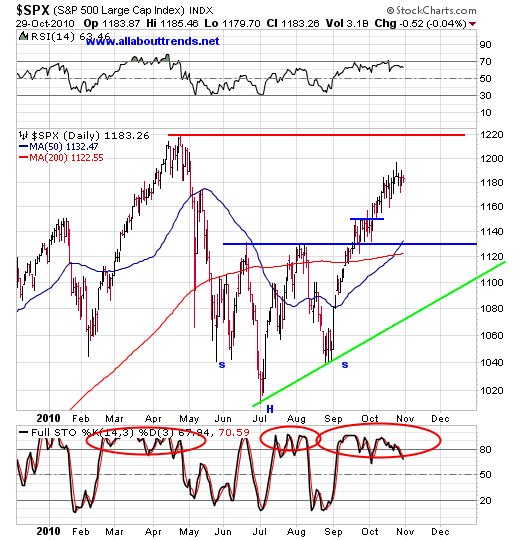

All of which leads us to IF we are going lower. If so then how far and what should we be watching for right? We mean after all inquiring minds want to know. Well if you look at the chart below you’ll see numerous levels of technical supports.

We’ve got the neckline (long blue line) of the head and shoulders bottom which also just happens to be the 50 day average and one could say spitting distance away from the 200 day average as well. Then we’ve got the little blue line as another support level to contend with as well. These are all serious levels of technical support that initially will be defended. So we say bring it on!

Should that happen it’s a huge opportunity on the long side for an into the end of the year push in the indexes. So if the markets get slammed to the technical levels mentioned above? GREAT as we’ll be ready for it with leading stocks to buy in the face of fear mind you. THAT is where the big trades between now and year end are going to come from on the long side.

Better to be aware of it now and be prepared in advance so when and if it occurs that’s where you can play catch up and make your whole year if you play it right. In the meantime? We’ll pick off a few here and there while we wait for the big trades to come our way.

In the meantime we are in the middle of the road on the indexes and in an uptrend albeit an accelerated one with very small consolidations along the way. By the way those little consolidations in a sell off in the market will get cut like a hot knife through butter so be aware of it should that occur.

In the meantime, the real action is in individual stocks. It’s a market of stocks, not a stock market. Last week was a good example of that. All last week we could have went either way with all the gyrations yet in the end for the indexes the net result was throw me a rollaids and they went nowhere for the most part.

However that all said we had enough in the hit and run department to get in get our gains and call it a week. Going forward expect more of that until we test either of the levels mentioned above.

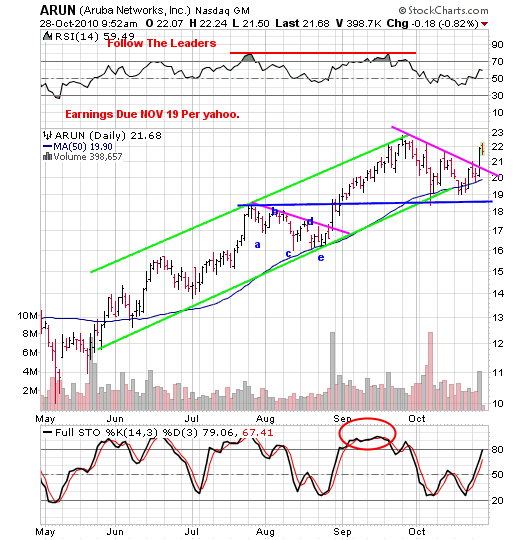

Our swing trades in ARUN and RAX are the types that all add up in the end and quite frankly to do that week in week out all year all makes for a stellar year, year in and year out for now through eternity. Now that’s a trading plan folks.

After all the indexes and most mutual funds that are really just glorified cookie cutter index funds in disguise anyway haven’t gone anywhere for the last 10-12 years and when all said and done probably won’t go anywhere for the next 3-4 years either in the end. So those looking for a trading plan there’s one for you to ponder.

So that said, we are focused upon 8 trades that are setting up right here and right now — just like the two standouts from last week.

DID YOU TAKE THESE TRADES?

ARUN — Aruba Networks

This is a classic Pullback Off Highs long side set up. Notice how it pulled back to support of the green trendline and the 50-day moving average? That’s what you want to see.

When this issue broke above the pink line, it triggered a long side trade and gains of close to 8% one day later!

RAX — Rackspace Hosting

Another classic pullback to support and then a launch higher and another quick gain of close to 8% on this one!

That’s what today’s market is all about. It’s hit and run, get in get out. The key is having the discipline to let the good trades come to you and to be prepared in advance. That’s what we help our paying subscribers do.

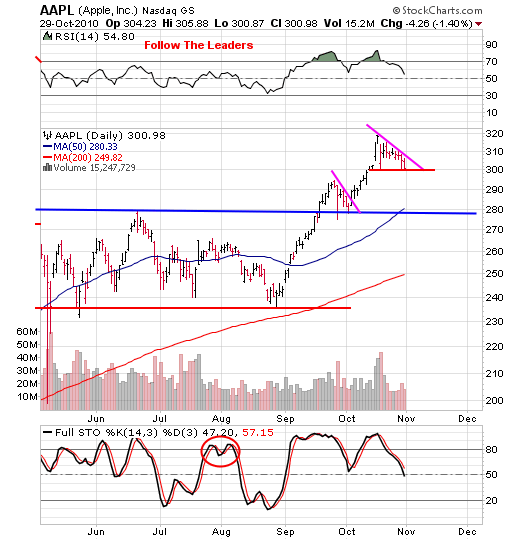

Take a look at how AAPL is setting up:

AAPL — Apple Computer

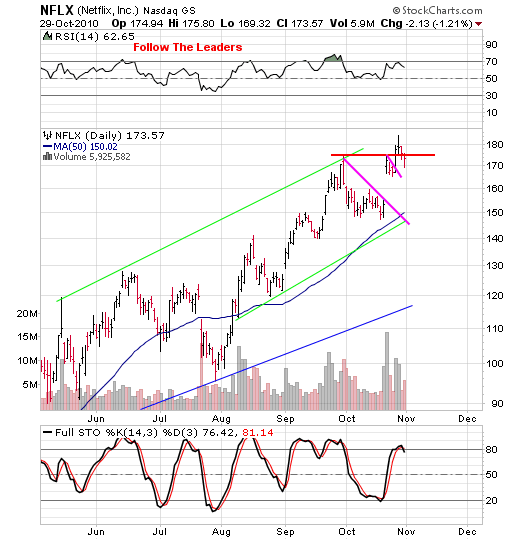

There is short-term support where AAPL closed Friday at 300 and there is better support at 280. As we saw with NFLX last week, it pulled back for just a few days and then pow — launched higher:

As a result, AAPL is high on our “hit and run” trade priority list next week.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.