US in a Slow Motion Recession But May Avoid a Technical Recession

Economics / US Economy Oct 14, 2007 - 12:20 AM GMTBy: John_Mauldin

In this issue:

In this issue:

The GDP Equation

How Low Can You Go?

The Key Variable Problem

The Importance of Fiscal Policy

The Slow Motion Recession

New Orleans and More Birthdays

A recession is technically defined as two consecutive quarters of negative growth in the Gross Domestic Product (GDP). This week we look at how the GDP is actually calculated to give us an idea as to the potential for a recession. We re-visit my concepts of a Slow Motion Recession and a Muddle Through Economy. We briefly look at the sliding dollar and housing, and see how it all adds up. You'll need to put your thinking caps on, but it should be interesting.

But first, If you want to search for an idea or concept in my letters, you can go to the Frontline Thoughts website and click on the archives and in the top right portion of the page is a place you can type in your key words and then search for them. And in the next few weeks and months, we will be announcing cool new web sites and services, so stay tuned.

How Low Can You Go?

The dollar is continuing its slide. In a recent article in the Financial Times, Fred Bergsten suggested the dollar could slide another 15-20% on average. Dr. Woody Brock (see more on him below) sees the potential for another 5-10% drop.

Bergsten writes: "The good news for Europe is that most of the remaining decline of the dollar should take place against the currencies of the East Asians and the oil exporters. They are running the counterpart surpluses to the US deficits. They have piled up massive foreign exchange holdings that already far exceed any plausible needs. They are enjoying rapid economic growth that could most easily accommodate the reductions in external surpluses."

China has allowed its currency to drop about 10%. But that has not helped Europe, where the dollar has dropped more than 10% in recent years. This week, we started to hear a small chorus of European finance ministers complaining about the manipulation of the Chinese currency. Expect that chorus to grow even more pronounced as the euro rises to $1.50 and beyond.

China will allow their currency to rise faster in the future, not that it cares about European or American concerns. It needs to do so to counter its own inflation and asset bubble problems, and it will, although the process will be slower than is liked by the West. A tsunami of Chinese money is going to start heading into the world. China announced August 17th that they are planning on allowing Chinese investors to invest money offshore in Hong Kong. Since that announcement the Hang Seng Index has soared by over 40% as foreign investors jump on board before the anticipated avalanche of Chinese money falls into Hong Kong stocks.

Below is a graph from Roth Capital Partners, which shows the rise. Interestingly, they have split the Hang Seng Index into two components, one which has just Chinese stocks and the second which is composed of non-China companies (mostly companies that listed in the days before Hong Kong became part of China). The China companies are up by 65% and the non-China companies are up only half that, by 32%. ( www.rothcp.com )

The Shanghai market is up 237% over the least year, and Hong Kong is up 64%. Chinese investors currently have no where else to invest but in China. However, the market capitalization and choices are relatively small given the demand. Given the opportunity to go elsewhere, they will diversify. Hong Kong will not want to see an asset bubble and given China's predilection for doing things gradually, they will likely put limits on how much can go out, and increase the limits over time. The Chinese investor will also learn about currency risk when they go offshore.

As the Chinese allow their currency to rise, the other Asian countries which also manipulate their currencies in order to maintain a competitive advantage will also let their currencies rise as well. 15-20% appreciation in certain Asian currencies is not unreasonable over the coming years.

How can you invest in the trend? Trading currencies is fraught with problems as most trading involves futures and leverage. Not something I would recommend for anyone but professionals.

One way for US investors to take advantage of the falling dollar is to buy foreign currency denominated certificates of deposit (CDs) from my friends at Everbank. They have CDs denominated in the currencies of 15 different countries at all different rates. You get no interest on a CD in Japanese yen and 11.63% in the Icelandic Krona. They also have 8 different groupings of currencies featuring various themes, like Pan-Asian, energy or commodity (currencies of 4 countries with high commodity exports like Canada and Asutralia).

Everbank is a US bank, so it does have FDIC insurance up to $100,000. But your currency risk is NOT insured. If the dollar goes up, you will lose some of your principal. You can call good friend Chuck Butler or his staff at (800) 926-4922 for more information, or click on the link for their website. http://www.everbank.com/001WorldCurrencyCD.aspx?referid=11966

The GDP Equation

I read a rather remarkable memo from Dr. Woody Brock on GDP this week and it triggered several thoughts. First, I want to discuss how the GDP number is actually created, then look at length at Woody's insights and then offer some of my own.

GDP, or Gross Domestic Product, is one way of measuring the size of a country's economy. The GDP of a country is defined as the total market value of all final goods and services produced within a country in a given period of time (usually a calendar year). The most common approach to measuring and understanding GDP is the expenditure method:

GDP = consumption + investment + government spending + net exports

Consumption is simply what we spend on goods and services. Investment can be said to have two components, residential and nonresidential investment. The investment part of the equation does not include what we normally think of as investments, such as stocks or bonds. It is business investments in capital, such as building a new mine, buying software, purchasing machines and so on. When you buy a stock, you are not adding to GDP. Residential investment is new home construction and adds to GDP. Buying an existing home does not add to GDP, as it does not produce anything new.

Net exports are really exports minus imports. Wikipedia has a good illustration of the process. If you buy a chandelier for your house from China, it is included in imports and subtracted from GDP. If you make a chandelier to be installed in a foreign country it would count as an export and add to GDP. Remember, what we are trying to do is measure domestic production. If you buy a chandelier made in the US for your house it would be accounted for in the consumption part of the equation.

Government spending is the sum of government expenditures on final goods and services. It includes salaries of public servants, purchase of weapons for the military, and any investment expenditure by a government. It does not include any transfer payments, such as social security or unemployment benefits.

There are some problems with comparing the GDP of different countries. Among other things, currency fluctuations will change the relative value. European GDP has risen by over 50% in dollar terms with the rise of the euro in the last five years, but would anybody contend that Europe is 50% bigger? Of course not. GDP is only really useful for looking at your own country's growth. Purchasing power parity and standard of living may make a more reasonable basis for comparison of actual economies.

GDP does not measure the standard of living of a country. A country may produce oil and other commodities and thus have a large GDP, but if the money is kept in a few hands it does not really raise the standard of living except for a few. (Think Nigeria.)

There are some other issues. The work to re-build New Orleans after Katrina counted in GDP, but would anybody contend that the US was better off as a result? If a company opens a division in Ireland and sells it products (say software) to the division at a low cost and then sells the product in Europe at a much higher price, keeping the profit in lower corporate tax Ireland, it adds the profit to the GDP of Ireland and does not add as much as it should to the US.

But with those and a few other caveats, GDP does help us understand whether the economy is growing or shrinking, and thus helps us get a handle on the business climate, where employment is headed, etc.

Now, I readily admit to being surprised that GDP for the second quarter was 3.8%, having been 0.6% the previous quarter. The economy certainly seemed to be slowing. And then along came Woody Brock's client memo, and the light came on. Woody is one of my favorite economic thinkers. His work is not standard issue economics that I so often read.

(Woody, through his firm Strategic Economic Decisions (SED), publishes memos like the one we are going to discuss as part of their excellent research service available by annual subscription. You may learn more about Dr. Brock, his research company, and how to subscribe to their publications by visiting their website at www.SEDinc.com . And I want to thank him for letting me use his work in this letter.)

The Key Variable Problem

Let's return to our equation but expand it a little given the discussion above.

GDP = consumption + (residential and nonresidential investment spending) + government spending + (exports - imports)

What Woody pointed out that most of us focus on consumer spending, which we all know is over 70% of GDP. But consumer spending is remarkably stable over time. The other components, though, can be very volatile.

First, let's look at this table labeled Figure 1.

Quoting from his memo:

"The Essence of the Key Variables Error: What we see here is that, whereas consumption growth fell in half from the first quarter to the second quarter of this year, GDP growth itself increased six-fold --surprising almost all investors. Moreover, the Fed had nothing to do with these changes in growth rates insofar as Fed policy had not changed at all for over a year. The essence of the Key Variables Error is thus to overlook the role played by other lesser variables that impact GDP.

"More specifically, and more analytically, a sound forecast of GDP should take into account (i) the variability (e.g., standard deviation) of each of the components adding up to GDP, and (ii) the covariances between all these components. Why? Suppose that three non-consumption terms swing much more than consumption does and are uncorrelated with consumption. Then in this case, we would expect the impact of consumption often to be offset by movements in the other terms. But is this generally the case? What do the data show?"

And that brings us to his second table.

Standard deviation measures the volatility of a series of numbers, whether consumption or mutual fund returns. The lower the standard deviation, the more stable is that series of numbers.

As it turns out, consumption is rather stable. But investment is not, and net exports from one quarter to the next can have very large swings. Woody goes on to show that there is almost no correlation between consumption and residential investment, net exports and government expenditures.

But as Woody points out, that means that quarterly predictions of GDP is more than simply difficult. Over a longer term, you may be able to make a reasonable forecast, but because of the volatility quarter to quarter of the three non-consumption components, you can see wide discrepancies, as we did last quarter. And to make investment decisions based upon one quarter of data would therefore be problematical.

Remember, the quarterly GDP recognizes the changes from quarter to quarter. So, even if exports continue to rise, we should not see such a large movement as we did in the second quarter. Investment spending is also not likely to rise by the fast pace in the second quarter. Similarly, government spending is not likely to grow at that pace, as the deficit is dropping each year.

The Importance of Fiscal Policy

This is a key point that Woody makes. We overestimate the importance of the Fed and monetary policy. And we underestimate the importance of fiscal policy. Let's quote Woody at length. This is going to be controversial to a lot of people. Please note that Woody is not arguing for deficit spending, just noting its effect upon the economy.

"The underestimation of the impact of fiscal policy along with the overestimation of the impact of monetary policy on GDP growth (discussed below) is the most surprising of the eight biases we are identifying in this essay. To begin with, monetary policy is a variable that does not appear anywhere in the GDP identities. Its influence on the real economy is thus indirect --and its impact on economic growth is significantly lagged, by the Fed's own admission.

"This is not the case with fiscal policy where the role of G (government expenditures) is explicit in the GDP identity, and where the lags between policy changes and response are much shorter. If policy makers wish to boost government spending tomorrow morning to offset a cyclical downturn, they can in principle do so. Analogously, they can slash taxes immediately, thus putting greater disposable income into consumers' pockets starting with next month's pay check.

"Are these points merely academic? Hardly. Consider the shock to many investors that no recession (defined here as two consecutive quarters of negative growth) accompanied the dual crashes of both capital spending and the stock market during 2000-2002. What saved the day? The answer is that the Bush administration managed to transform a Clinton fiscal surplus of 2.5% of GDP into a fiscal deficit of 3.4% between 2000 and 2003. This is a swing that pushed the level of GDP 6% higher than it otherwise would have been by the end of this period. This number reflected reduced tax revenues from decelerating income growth and policy-determined tax cuts and increased government spending.

"Yet this is rarely if ever cited when observers attempt to explain the events of this momentous period. Instead, economists erroneously attribute stability on Main Street to Greenspan's dramatic cut in the Fed funds rate to 1%. The reality is that the funds rate only reached 1% in June of 2003. Given the policy transmission lags involved, these lower rates cannot be said to have prevented recession in 2002. Fiscal policy played the key role here.

"In today's context, the federal deficit of the fiscal year ending October 2007 will have fallen to about 1.4% of GDP from 3.5% as recently as 2004. Moreover, without the war in Iraq, this year's deficit would be approaching 0%. Not only is today's US deficit much smaller than it was expected to be, but its contraction during past years has slowed GDP growth by as much as housing has. Yet this is never pointed out, partly because of our "key variables" bias, and partly because of the widespread belief that it is monetary policy alone that really matters.

The Slow Motion Recession

Last week I introduced the concept of a Slow Motion Recession. By that I mean a condition where the economy slows for a long period but does not technically enter a recession. I am thinking of growth in the neighbourhood of 1% GDP for four quarters. That would be lower annual growth than the recessionary period of 2001-2002. The reason that it will be "slow motion" is that the cause of the recession is the housing crisis, and that is going to take 12-18 months to work out. If it were not for the housing crisis, we would be talking about trend GDP growth of 3% or so.

Going back to Woody's first table, let's see how that works out.

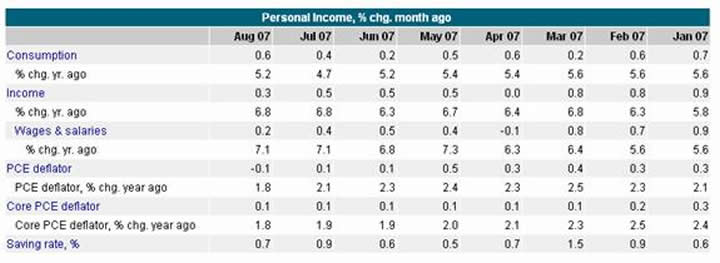

First, consumption is correlated with personal income, and growth in personal income has been quite solid in the last year, for the first time in a long time. Look at the following table from economy.com. Income is up 6.8% from a year ago, and that is helping maintain consumer spending in the face of the housing crisis. And that growth is way up from previous years, where we often saw low real income growth.

So, while consumer spending may slow somewhat due to rising unemployment caused by the housing crisis, for now rising incomes are offsetting the problems. Because of a rise in income, consumption might fall less than we would expect from the negative wealth affect of housing valuations dropping by 20%. We should never underestimate the ability of the American consumer to spend. Further, as the dollar falls, net exports are going to rise, providing some further help to GDP.

But housing is still an issue. We are very likely to see housing starts drop another 40-50% to around 800,000. Residential construction accounts for about 8% of US employment. We have not seen a great deal of job losses from the drop in housing construction that has already occurred, which is strange. There is good reason to think that the jobs have actually been lost, but that the first persons to lose their jobs were illegal aliens who do not factor into the data. I am reading of anecdotal stories that businesses which cater to Spanish language communities are seeing a noticeable slowdown in their business.

Further, we are starting to see lay-offs in financial sectors from mortgage bank blow-ups and from a slowing segment of housing related industries like furnishings, etc.

If housing related employment drops by only 15%, which is not all that difficult to see happening, we could see overall unemployment rise to well over 5% and maybe as high as 5.5% within a few quarters. That will hurt consumption and put a significant drag on GDP.

If nonresidential investment goes back to its lower trend in the next few quarters, that will also be a drag on GDP. The fiscal government deficit is also falling and that will tend to slow GDP.

Adding it altogether, this seems to argue, for me at least, an extended period of much slower growth, but not a deep recession, and maybe not even two quarters of actual negative growth, although I still think there is a good chance we will see that technical recession. It will indeed be a return to the Muddle Through Economy of 2002.

New Orleans and More Birthdays

I will be leaving next Sunday to go to the New Orleans Investment Conference. I have been going to this conference for almost 25 years, and look forward to it each year as I get to see a lot of friends and eat great food. If you are going to be at the conference, drop me a note.

Even though my birthday was a few weeks ago, we are celebrating it tomorrow, as the twins come down to Dallas and all 7 kids and their significant others jointly celebrate my birthday with son Chad who is 19 at the end of the month. It is always good to get the family together. I know in a few years they will start to spread out, and I am enjoying the time when we are all able to be in one room.

It is again late, but the kids are calling and telling me to come home and take them out, so I am going to hit the send button. Have a great week.

Your thinking life is not going by slow analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2007 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.