Food Inflation: The story of 2011 and Investment Strategy for Food

Commodities / Agricultural Commodities Jan 10, 2011 - 12:29 PM GMTBy: Justin_John

Quite clearly, there is nothing more important than understanding the charts for food in 2011, esp of the primary articles. We have seen the breakouts in Sugar and Wheat futures, have done to food inflation across the world as it has crept into core inflation thus forcing central banks in India and China to hike rate, thus almost ending the dream run of the equity markets over the last 24 months.

Quite clearly, there is nothing more important than understanding the charts for food in 2011, esp of the primary articles. We have seen the breakouts in Sugar and Wheat futures, have done to food inflation across the world as it has crept into core inflation thus forcing central banks in India and China to hike rate, thus almost ending the dream run of the equity markets over the last 24 months.

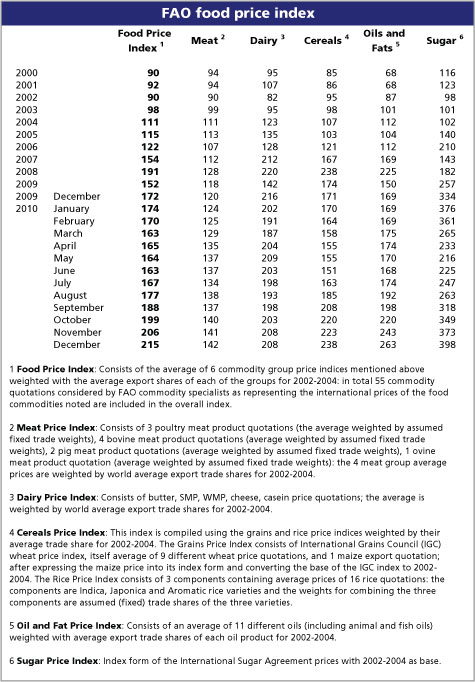

Food and Agriculture Organisation (FAO) published its latest reports on world agri output/demand and presented here is an excerpt.

We have also presented out internal thinking on Sugar and Wheat charts for 2011.

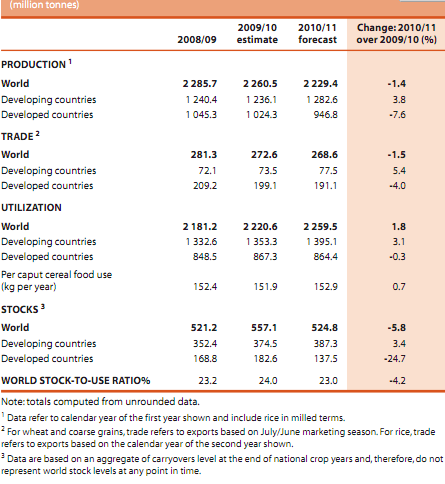

■FAO’s latest estimate of the world cereal production in 2010 stands at 2 229 million tonnes, slightly more than the previous forecast in November but still 1.4 percent down from the previous year.

■Most of the decline is among the major exporting countries whilein the Low-Income Food-Deficit countries (LIFDC), cereal output is forecast to increase by 2.5 percent, marking a third consecutive year of sustained growth. The largest increase is estimated for Africa, with record crops in all subregions except North Africa.

■Early prospects for the 2011 global wheat production are uncertain. Winter wheat plantings in the northern hemisphere are tentatively estimated up marginally from the previous year but crop conditions are mixed in some main producing areas. Overall, wheat production in 2011 will depend on the weather in the coming months. The bulk of the coarse grains and paddy crops are not due to be planted for several months.

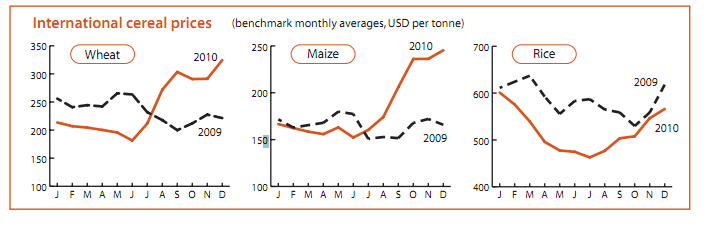

■International cereal prices continue to increase in the first half of December. Prices of wheat and maize are about 50 percent higher than a year ago. Rice prices have strengthened in recent months but are still below the level of a year earlier. Price developments in the remainder of the 2010/11 marketing season will depend greatly on prospects for 2011 cereals crops.

■The cereal import volume in LIFDCs as a group will decline in 2010/11 but their cereal import bill is forecast to increase by 11 percent because of higher international prices.

■In developing countries, domestic coarse grains prices have generally declined and are at low levels in Africa but in Asia prices of rice are increasing. Prices of wheat in importing countries stabilized in November.

■Despite record or bumper 2010 cereal harvests in most regions, 29 countries around the world face food difficulties and are in need of external food assistance.

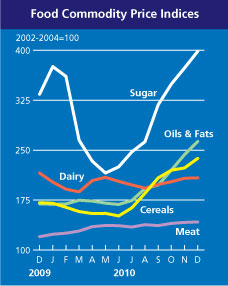

Inflation by Food items

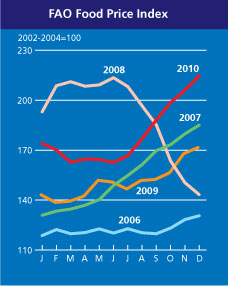

Food Price Index by Year

Monthly movement of Food Inflation

Cereals

■The estimate for world cereal production

in 2010 has been revised upwards slightlysince the previous update (released on17 November in Food Outlook) to 2 229million (including rice in milled terms).At this level, world cereal productionwould be 1.4 percent below 2009 butstill the third highest on record. Thismonth’s upward revision mostly reflects

higher estimates for production in a few countries, in particular Australia, Canada, Mexico and Nigeria that have more than compensated reduced estimates for India and Kazakhstan. This year’s decline in cereal production will be entirely due to lower output in developed countries while in developing countries production is forecast to rise by a significant 3.8 percent.

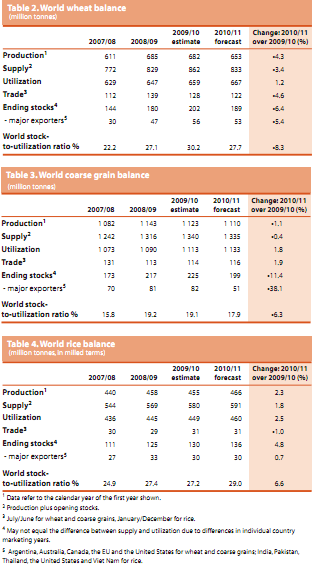

■World wheat production is currently forecast to reach 653 million tonnes, down 4 percent from the previous year. Global production of coarse grains is expected to register a small decline to 1 110 million tonnes, while rice production is put at 466 million tonnes, up 2.3 percent from 2009 but slightly less than was reported in November.

Cereals Forecast for 2011

■At this stage of the season, with less than half of the world’s 2011 cereal crops in the ground and the bulk of the coarse grains and paddy crops not due to be planted for several months, it is too early for even a preliminary forecast of output in 2011. An added element of uncertainty for the 2011 harvest will be the development of the current La Niña event, which has already affected some producing areas.

■Early prospects for winter wheat in the northern hemisphere are uncertain. Preliminary estimates indicate marginally larger plantings than last year but crop conditions are mixed. However, much will depend on the weather in the coming months.

■In the southern hemisphere where the main coarse grain crops have already been planted, early prospects are uncertain in South America due to lower plantings in Brazil and delayed sowing in Argentina. In South Africa, reduced incentive for maize production has led to lower plantings.

■In spite of the latest upward revision of this year’s cereal production, the world supply and demand balance for cereals is still expected to tighten considerably with total utilization exceeding world production in the 2010/11 marketing year. As a result, a reduction of some 6 percent (or over 32 million tonnes) in carryover stocks will be required to meet consumption needs.The tightening of the cereal market anticipated in the 2010/11 marketing year has already resulted in a sharp increase in world prices of all major cereals in recent months with wheat and coarse grains currently trading at around 50 percent above the previous year’s levels. The FAO Cereal Price Index gained nearly 5 points in November, to reach 225 points, its highest value since September 2008. Price developments in the remainder of the 2010/11 marketing season will depend greatly on prospects for 2011 cereals crops which are mixed so far. Any significant deterioration in crop prospects would add new impetus to the price spiral. World cereal utilization in 2010/11 is currently forecast to reach 2 260 million tonnes, up 1.8 percent from the previous season. The projected growth is slightly higher than was anticipated earlier, with food and feed utilization of major cereals keeping pace with recent trends.

■

■The tightening of the cereal market anticipated in the 2010/11 marketing year has already resulted in a sharp increase in world prices of all major cereals in recent months with wheat and coarse grains currently trading at around 50 percent above the previous year’s levels.

Early Signs for 2011

■Preliminary estimates indicate marginally larger wheat plantings than last year but crop conditions are mixed. However, on the assumption of normal weather for the remainder of the growing season, unlike last year when drought affected some major producing areas in eastern Europe and Asia, some increase in output could occur in 2011. For coarse grains, with the bulk of the crops not due to planted for several months, it is too early for even a preliminary forecast of output in 2011.

Investment Strategy

Sugar

Charts broke out last time in Jan 2010 and then in Nov 2010. It has formed an awesome Cup and Handle formation pointing to further gains to wards USc /lb 42 which is a near 35% upside in 2011. Sugar is clear buy for 2011.

Wheat

■We initiate a Buy rating for the entire cereal batch but specifically for Wheat, the charts look very strong for 2011.

Source : http://dawnwires.com/business/food-inflation-the-story-of-2011-and-investment-strategy-for-food/

By Justin John

Justin John writes for DawnWires.com and is a Director at a European Hedge Fund.

© 2010 Copyright Justin John - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.