Monetary Inflation and Supply Concerns Drive Commodities More So Than Demand

Commodities / Commodities Trading Feb 11, 2011 - 03:38 AM GMTBy: Jordan_Roy_Byrne

The mainstream press loves to talk about emerging market demand as a cause of inflation, rising prices and the bull market in commodities. Did emerging markets suddenly begin demanding food, energy and metals in 2001? What about five and ten years earlier? Its a rhetorical question. The conventional wisdom is wrong.

The mainstream press loves to talk about emerging market demand as a cause of inflation, rising prices and the bull market in commodities. Did emerging markets suddenly begin demanding food, energy and metals in 2001? What about five and ten years earlier? Its a rhetorical question. The conventional wisdom is wrong.

Inflation is driven by low interest rates and lax credit conditions. Severe inflation is driven by the inability to finance or grow out of debt.

Commodity bull markets are primarily driven by monetary factors. Secondarily, a lack of production eventually leads to much higher prices. Commodity industries are cyclical in the long-term. They go from periods of oversupply to periods of underproduction which then creates a lack of supply and a need for higher prices to stimulate new production. The big moves in individual commodities or sectors are driven not from demand but from a lack of supply.

There are numerous examples.

Let’s start with the rare earths. China accounts for 95% of the world’s supply and its projected that within a few years China will not be able to supply its own demand. This is why China is cutting export quotas and may form its own OPEC-like group to control the rare earths market. Sure, their demand is strong but the real problem is there is basically no production outside of China. Molycorp owns the only rare earths mine in the US (Mountain Pass in California) and it hasn’t been in production for years.

Does this industry have too much demand or too little production? Again, its a rhetorical question.

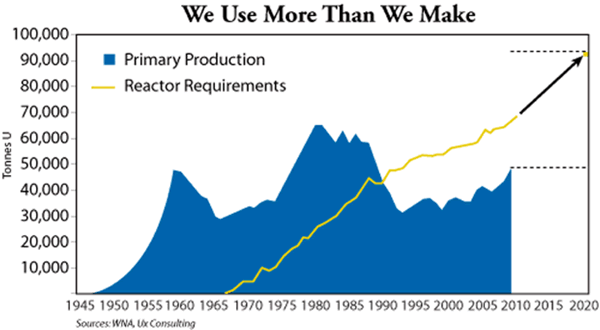

Consider uranium. Most know the story. Its an industry that has lived off of stockpiles for a long-term. That is going to end in 2013 with the end of the Russia/HEU agreement and so more production will be desperately needed in the coming years. Look at the picture below. Reactor requirements (demand) has risen consistently for decades. Obviously, its the supply/production picture which moves the market.

Precious Metals are actually the outlier. It is investment demand that moves the market. Some analysts like to mention global growth and more buying of jewelry but that has little impact on the major bull and bear cycles.

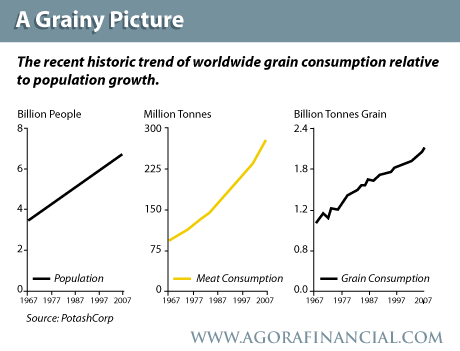

The most absurd theory is that food prices are rising because of rising demand. Did millions more Chinese suddenly begin eating now relative to five or ten years ago? Take a look at this graph from AgoraFinancial.

Growth in population, meat consumption and grain consumption is reliably steady. Food prices don’t rise because there is more demand. That is asinine. Food prices rise primarily because of supply and inventory factors along with monetary factors.

Monetary inflation creates artificial demand which triggers higher prices. Our monetary inflation is exported to China. China takes the incoming US Dollars and prints Yuan to maintain the currency peg. That causes inflation. China then spends money domestically and also abroad, triggering inflation in other nations. Furthermore, inflation raises the cost of production and bringing that supply to the market.

In the big picture, inflation is a major driving force for the commodity sector as a whole. In regards to specific commodities, the real commodities gurus like Jim Rogers and Rick Rule always look first at supply factors because they know that is the number one driving force behind the biggest runs. Presently, the uranium market is in a very large deficit and a surge in production is required over the next five to ten years. Growing demand is just icing on the cake.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.