The Next Big Trades From Leading Stocks

Companies / Company Chart Analysis Feb 13, 2011 - 09:24 AM GMTBy: David_Grandey

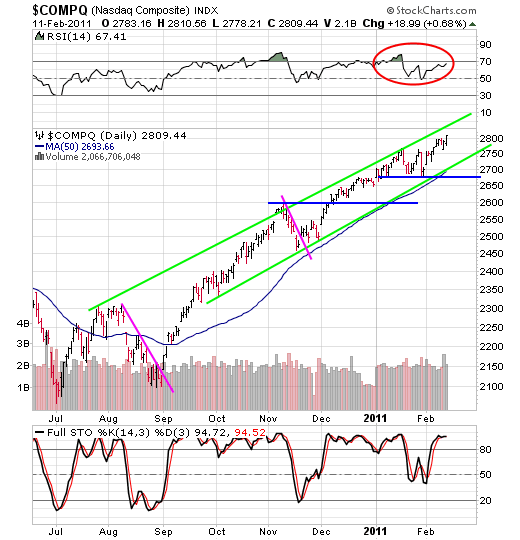

When looking at the indexes:

When looking at the indexes:

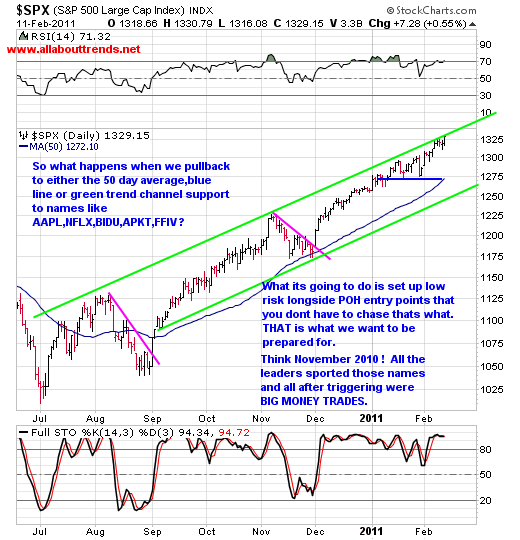

In the S&P 500 chart above we said:

So what happens when we pullback to either the 50 day average, the blue support line or the green trend channel support line to names like AAPL, NFLX, BIDU, APKT and FFIV?

Good question so let’s look at that as it falls in line with our centering statements of:

“What do I need to see to make me take a trade on the long side”

Remember on the long side of the market it’s all about Pullbacks Off Highs (POH’s) — they are the only pattern you’ll ever need to know and learn.

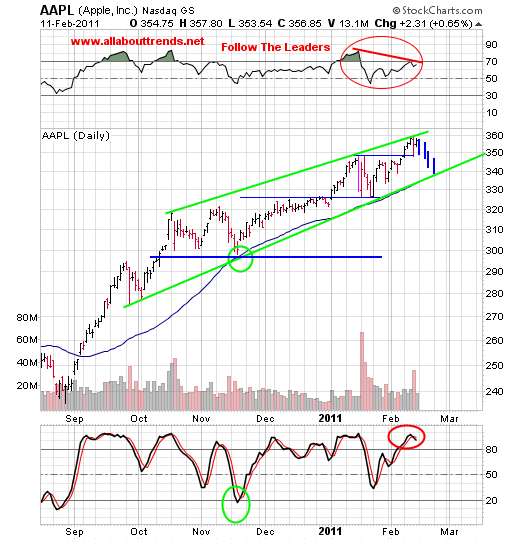

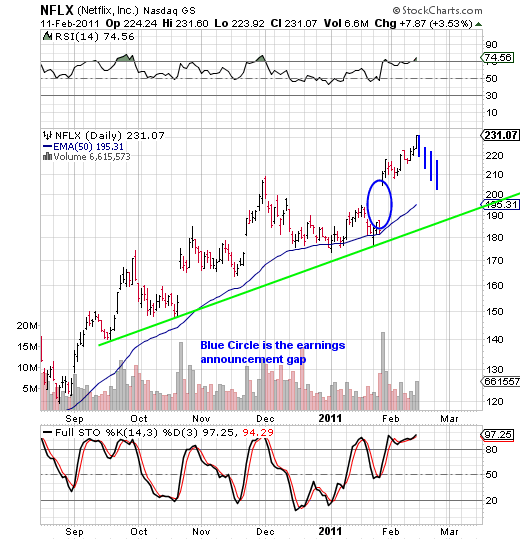

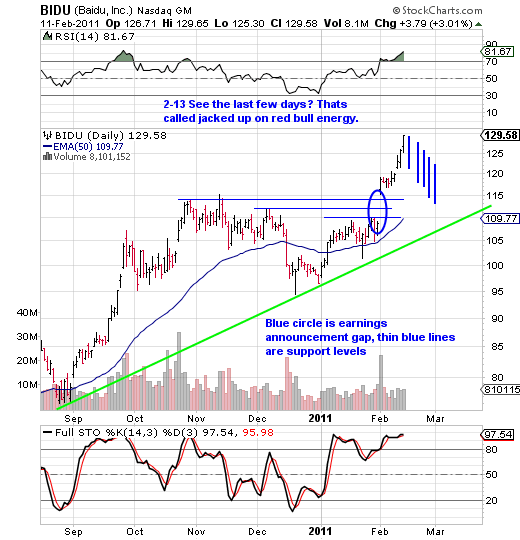

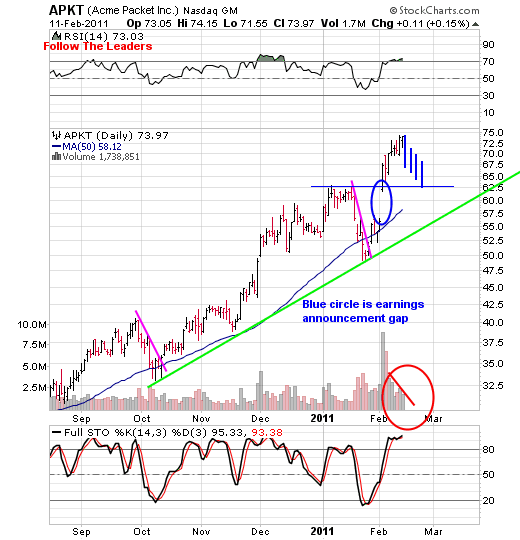

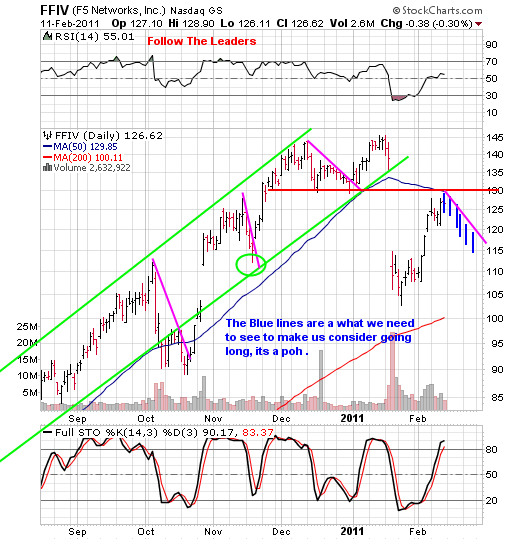

Below what we’ve done is take each of those names and highlight in blue the “What We Need To See Develop To Take A Trade”.

Look, we don’t know that this is what they are going to do mind you because the market is the boss but we know what we need to see and tha’ts what we want to be on the lookout for from here with any pullback in the indexes or even these names. It could take a week, a month or may never happen. Surely we won’t be buying them right here because we don’t chase red bull energy drink markets.

When one looks at NFLX, BIDU and APKT you’ll notice in each of those the earnings reaction WAS the move. Prior to earnings do you really see any low risk POH entry point to be had? Maybe APKT in the pink but that was a few days before earnings. We try not to trade ahead of earnings as it’s never the news, but the reaction to the news.

One of the reasons we don’t trade ahead of earnings is the chart below.

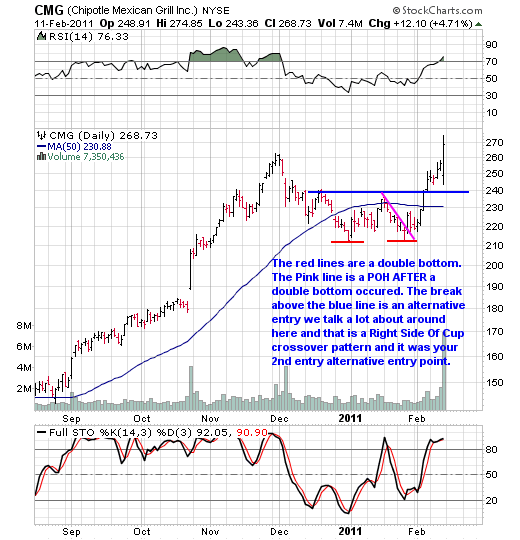

While we are on the subject of earnings, let’s talk about CMG — Chipolte and its wild habanero move Friday. Wicked huh! The stock closes at 256 ahead of earnings. After market, the stock goes to 278 then the next morning is in the 248 range. It trap doors to 243 at the open and POW! off to the races. All of which was a blink your eye you missed it moment. If that’s not hopped up on energy drink trade we don’t know what is.

IBD over the weekend talked about how this issue “cleared its buy point” of 262 and isn’t quite extended above the 5% limit. We say REALLY? NOW? YOU WANT US TO BUY NOW? AFTER this issue just cleared a double bottom about 50 points ago? Gimme a break!.

At All About Trends we are all for buying leading stocks BUT here is the catch, we use alternative entry points and technical analysis vs. the by the book, it’s one of the reasons this site was created as we got sick of buying breakouts only to see them turn tail shortly thereafter with us in the stock. This isn’t the 80′s and 90′s anymore where we were in a secular bull market.

So if we aren’t willing to buy the stock here just where WAS, with emphasis on WAS, the right time to buy the stock? Take a look at the chart below — it’s all spelled out.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2011 Copyright David Grandey- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.