UK House Prices Fall by 0.8% In November

Housing-Market / UK Housing Nov 30, 2007 - 09:38 AM GMTBy: Nationwide

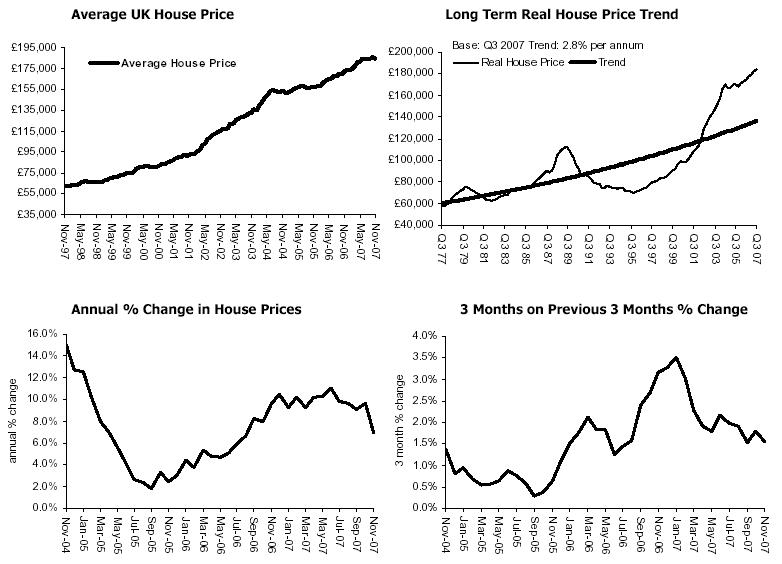

House prices fell by 0.8% in November, bringing the annual rate of increase down to 6.9%

House prices fell by 0.8% in November, bringing the annual rate of increase down to 6.9%- Sentiment in the market has weakened, but can be volatile

- Uncertainties remain, but underlying fundamentals continue to be supportive

- Introduction of final phase of HIPs may reduce available housing supply in the short term

| Headlines | November 2007 | October 2007 |

|---|---|---|

| Monthly index * Q1 '93 = 100 | 369.0 |

371.9 |

| Monthly change* | -0.8% |

1.1% |

| Annual change | 6.9% |

9.7% |

| Average price | £184,099 |

£186,044 |

* seasonally adjusted

Commenting on the figures Fionnuala Earley, Nationwide's Chief Economist, said: “House prices fell by 0.8% in November, reversing October’s surprisingly strong performance. This brings annual house price growth down to 6.9%. This is back in line with the softening trend we have seen in the second half of the year and is consistent with our forecast of house price growth of 5-8% in 2007. The 0.8% monthly fall is the first since February 2006 and the largest monthly fall since June 1995. However, monthly data can be volatile and the sharp fall this month is partly a reflection of the strength recorded last month and in November last year. A better picture of the underlying trend is captured in the three-monthly growth rate. This too fell back into line with its softening trend in November, returning to 1.5% from the 1.8% recorded in October. The price of a typical house in the UK is now £184,099, almost £12,000 more than this time last year."

Market now responding to weaker drivers

“November’s data confirms that the housing market is indeed cooling in line with the weakening in housing market drivers. Poor affordability, weaker house price growth expectations and the effect of earlier increases in interest rates have all affected demand in the market. House purchase approvals, a good barometer of real market demand have weakened from a peak of 128,000 a month in the final months of 2006 to 102,000 in September. We expect this activity to continue to fall back throughout the rest of this year, and into the next.

Sentiment is changeable…

“Housing market sentiment can itself be an important driver of the housing market, and at this point in the cycle it can easily swing on the back of every new morsel of data reported. There is a plethora of housing market indicators and looking at the headline figures alone can sometimes be confusing. Indeed at this point in the housing market cycle there can even seem to be conflicting messages in consecutive months of the same series. With sentiment so important to the housing market, an oversimplification of the headline data can have real effects. This highlights the importance of looking at overall trends, rather than focusing on one month’s data in isolation and more importantly, examining the underlying fundamentals. …

…and can be sensitive to interpretation of data

“New data from derivative trading in the City1 shows that within the space of one month expectations of house price growth over the next year have fallen from -2% to -7% without there being any really significant change in the underlying housing market conditions during the period. This rapid swing is likely to be a reflection of current financial market uncertainties and could be distorted by speculative or hedging activity, but it illustrates how quickly the mood can change and thus the importance of looking carefully at the real message key data is presenting.

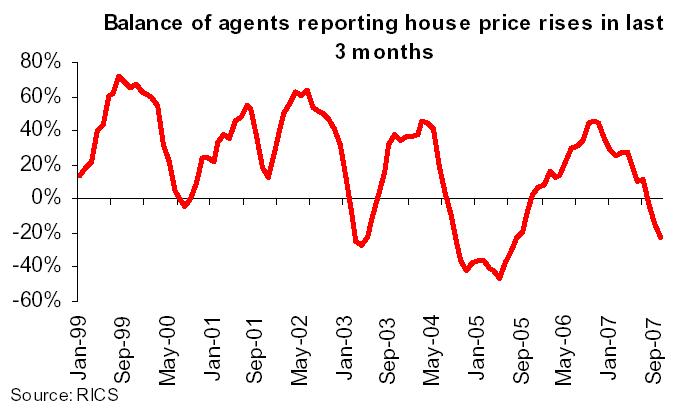

“Some data series report views about the movement in house prices. These can be a good indication of the direction of price movements, but can sometimes be over interpreted. A good example of this is the reports of estate agents’ views about the movement of house prices. The Royal Institution of Chartered Surveyors (RICS) surveys agents about whether prices have increased or fallen over the last three months and reports

the net balance of those reporting a rise. The latest data shows the net balance at -22%, sharply down from +11% only three months ago. The net balance is a good indicator of the trend in the movement in house prices. However the balance figure does not reflect how much agents think prices have changed, nor does this single number clearly convey the fact that a majority of agents think prices are unchanged over the period.

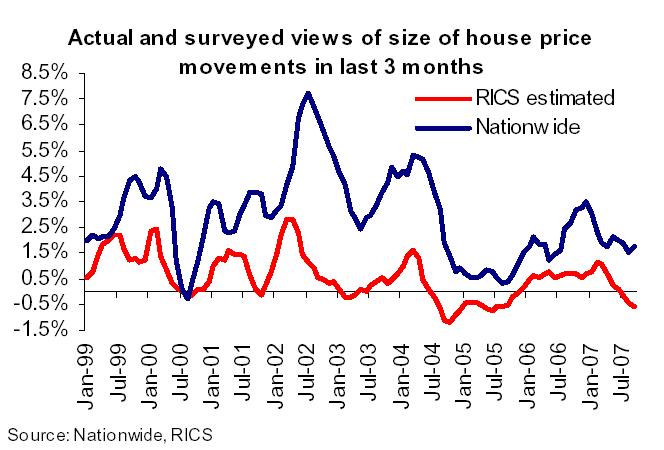

“When the underlying data is looked at in more detail the picture is a lot less startling. Looking at the distribution of agents’ opinions of the size of price movements, we can estimate how much estate agents think prices have changed on average2. This suggests a fall of 0.6% over the three months to October. This is much less than the actual change in prices of +1.8% over the same three month period, but agents’ opinions on this measure have historically tended to underestimate the strength of house price growth. Nevertheless, when looking at the amount prices have changed, the health of the market looks much less in jeopardy than the initial reading that may have been taken from the balance data and highlights the importance of not overreacting to a headline grabbing number.

Continued financial turmoil adds to uncertainty, but underlying housing fundamentals remain supportive

“Looking forward, it is clear that there are uncertainties in the market, not least from the continuing turmoil in the UK’s financial markets and the overall impact that this may have on the future performance of the UK economy. We already expect economic conditions to be more difficult for the housing market next year, but we do not expect a recession. Furthermore, with interest rates on the way down and the continued issue of undersupply of housing in the UK market, the underlying fundamentals are perhaps more positive than the recent swings in sentiment might suggest.

Extension of HIPs may affect housing supply in short

“The government has now decided to extend the Home Information Pack scheme to all December. This closes the final gap and all homes being sold will now be required to have date. It will be some time before the true impact of HIPs on the market becomes clear. speed up the process by removing those not serious about moving, but it is likely to reduce speculative sellers which could limit the available supply and make the house search process outcome is likely to depend on the importance of speculative sellers in the market, which Arguably there will be more of these in a rising market, so the introduction of HIPs at this may have less of an effect than at other times. But if the scheme does reduce the available purchasers, given existing issues of undersupply in the UK, it is likely to offer some further the short term.”

| Fionnuala Earley Chief Economist Tel: 01793 656370 Mobile: 07985 928029 fionnuala.earley@nationwide.co.uk |

Kate Cremin Press Officer Tel: 01793 656517 kate.cremin@nationwide.co.uk |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.