U.S. Political Leaders Playing Dangerous Game with Nation’s Debt Rating

Interest-Rates / Credit Crisis 2011 Jul 25, 2011 - 12:04 PM GMTBy: Chris_Ciovacco

Leaders from both parties in Washington are playing a dangerous political game with the nation’s AAA credit rating. The first self-imposed deadline of July 22 to have a framework of a debt-ceiling deal in place has already passed. The second and firmer deadline of August 2 is a little more than a week away. Despite Standard and Poor’s warnings of a possible debt downgrade if realistic deficit-reduction plans are not agreed upon, the Wall Street Journal included the following in their update from Sunday night:

Congressional leaders from both parties were developing competing deficit-reduction plans, but they released only broad outlines and few details. Several aides stressed the plans were still evolving.

‘Broad outlines’, ‘competing’, ‘few details’, and ‘evolving’ are not terms that build confidence in the minds of market participants. Although volatility has picked up, the financial markets have thus far remained relatively calm in the face of ever-increasing uncertainty about the outcome over the next eight days. The term default speaks to missing scheduled payments to holders of U.S. Treasury bonds. Like many markets during these uncertain times, the market for U.S. debt has been giving some mixed signals.

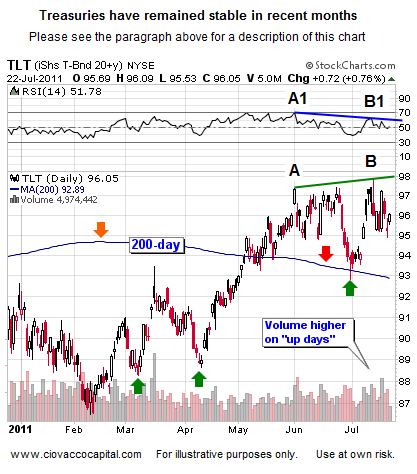

The long-term Treasury exchange traded fund (ETF) is shown below; it trades under the symbol TLT. Market sentiment can change quickly, especially when credit ratings are involved, but at the end of last week the Treasury market was not foreshadowing impending earth-shattering doom. The intermediate-term trend for Treasuries remains up (yes, up), as indicated by the series of higher lows (see green arrows). However, the longer-term outlook is showing some cracks. The negative slope of the 200-day moving average (orange and red arrows) is a yellow flag for the price of bonds. The importance of the 200-day, in all markets, is covered in this video. The price of bonds recently made a higher high (see A and B), but the Relative Strength Index (RSI) made a lower high (A1 and B1), which indicates waning short-term interest from buyers of U.S. debt.

The last noteworthy item in the chart of Treasury bonds above is the increasing volume on “up days”. These positive spikes in volume tell us market participants believe some form of a debt deal will get done before August 2. Obviously, that belief is subject to change over the next eight days. Our concern is that the tone in the bond market may abruptly shift in a negative manner if the bickering and political posturing in our nation’s capital does not subside soon (very soon). Our leaders may not fully respect that once the market for U.S. Treasuries makes a sharp bearish turn, it may be difficult to repair the damage.

How does all this help us? The state of the bond market heading into this week questions the validity of the calls for the end of the world as we know it. The markets are in relatively good shape given the problems of the day. Markets that can digest bad news tend to be markets that surprise on the upside. Until the evidence begins to shift (and it may), we will continue to give the bull market in U.S. stocks (SPY) the benefit of the doubt, while holding some gold (GLD) and silver (SLV) as insurance against poor leadership from our elected officials. We will pay close attention to all markets in the next eight days with an open mind.

By Chris Ciovacco

Ciovacco Capital Management

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.