UK Commercial Properties Crash Looms as Property Investment Fund Frozen

Housing-Market / UK Housing Dec 21, 2007 - 02:23 AM GMTBy: Nadeem_Walayat

Britain's fourth biggest insurer, Friends Provident froze its Property Fund on Thursday, thereby denying over 110,000 investors the ability to liquidate their investments. The property fund has an estimated value of more than £1.2 billion or $2.5 billions. The insurance company stated that investors will not be able to gain access to their funds for a period of six months due to a sharp fall in its cash reserves as investors took fright from the collapsing UK housing market, both residential and commercial.

Britain's fourth biggest insurer, Friends Provident froze its Property Fund on Thursday, thereby denying over 110,000 investors the ability to liquidate their investments. The property fund has an estimated value of more than £1.2 billion or $2.5 billions. The insurance company stated that investors will not be able to gain access to their funds for a period of six months due to a sharp fall in its cash reserves as investors took fright from the collapsing UK housing market, both residential and commercial.

Over the last 20 years, I have repeatedly warned of the problems faced by unit trust holders in that in times of difficulty they may find themselves locked into depreciating assets without the ability to liquidate investments.

The first time I experienced this was during the 1987 crash, when I did hold unit trusts and the brokers would fail to pick up the phone, this has been reiterated throughout many articles regarding how to invest in funds, and that my preferred route has always been to invest in investment trusts rather than unit trusts.

Back on 22nd August 07, I specifically warned in the article - UK Housing Market Crash of 2007 - 2008 and Steps to Protect Your Wealth , The stock market is expected to be volatile since we are moving into a new risk climate. Despite a high probability of further sharp falls, and even a crash, there are plenty of long-term plays out there especially in the big cap oil sector. I would also look at bargain hunting metals and mining on further sharp falls or a crash. Similarly for the utilities sectors such as Water. The best plays are probably via investment trusts, of which there are many. I favor investment trusts over unit trusts as they are traded on the stock exchanges exactly as any stock is. Whereas, as I recall in previous financial crisis you may find the phone off the hook on the other end of the line when you try to call to buy or sell unit trust positions.

The reason for the freeze is clear, in that once the cash reserves have been consumed the funds would be forced to liquidate assets, which means sell properties. Do not imagine for a moment that the problem is restricted to Friends Provident. This applies to ALL commercial property funds that are seeing the smart money leaving the scene before the avalanche of redemptions begins resulting in sector wide freeze of unit trusts.

UK Housing Crash

The UK housing market continues to deteriorate and is expected to result in annualised UK House price inflation going negative for the first time since the early 1990's by April 2008. The buy to let sector rush for the exit to take advantage of the change in UK capital gains tax rules effective 1st April 2008 as well as buy to lets no longer remaining a viable investment in the face of falling house prices.

An additional sign of the housing slump accelerating was illustrated in my recent analysis of the sharp deterioration in the ability of houses to sell at auction, with the number of sales falling from 97% in January 2007 to 71% by November 2007, typical auction house.

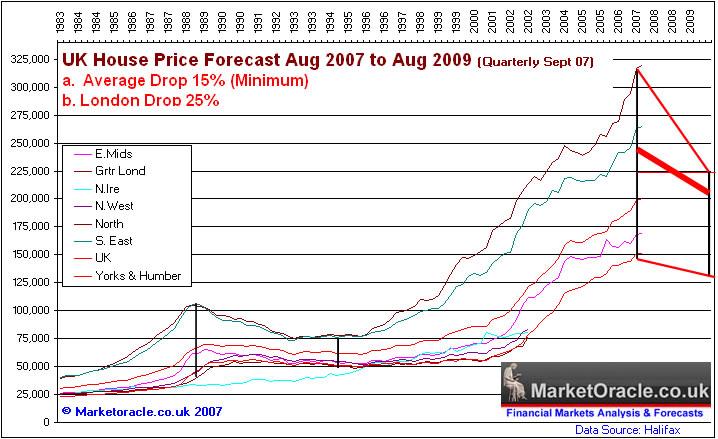

The Market Oracle forecast is for a 15% drop in UK House over the next 2 years with London expected to drop by as much as 25%, as of 22nd August 07.

The UK property market remains at historically high unaffordability levels as illustrated by the Market Oracle UK House Price Affordability Index.

Investors should not delude themselves into thinking that just commercial property unit trusts will be hit, the contagion could spread across the whole unit trust sector if investors realise that when the times come to sell, the won't be able to. The last time we witnessed such panic was just 3 months ago when savers queued outside Northern Rock Bank to withdraw savings.

Unlike savings accounts, I cannot imagine how the FSA and Bank of England could step in to guarantee investors ability to liquidate assets. It is just not possible.

Your 'renting' analyst watching the unfolding UK housing crash from the sidelines and preparing 7 additional 2008 inter-market forecasts in addition to the 3 already produced (UK house prices, inflation and interest rates). Next - UK GDP growth for 2008 and hence recession prospects.

By Nadeem Walayat

Copyright (c) 2005-07 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.