Meat-to-Feed Ratio: Feeding the Agricultural Commodities Bull?

Commodities / Agricultural Commodities Dec 06, 2011 - 01:45 AM GMTBy: Ned_W_Schmidt

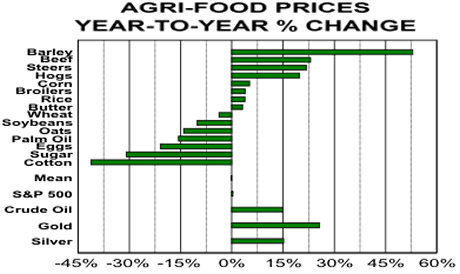

With 2011 about to be history, investor should be thinking about two matters. How did various market sectors perform during the year, and why did they do so? That task is part of the learning process. It allows us to refine our thinking, and shed thoughts that will not be productive in the future. Second, we are of course interested in the implications of current trends for investments in the coming year. 2012 is still a blank page. Thus far as 2012 is concerned, we have made no mistakes. To start this learning process the first chart portrays the performance of the various sectors of the Agri-Food market over the past year.

With 2011 about to be history, investor should be thinking about two matters. How did various market sectors perform during the year, and why did they do so? That task is part of the learning process. It allows us to refine our thinking, and shed thoughts that will not be productive in the future. Second, we are of course interested in the implications of current trends for investments in the coming year. 2012 is still a blank page. Thus far as 2012 is concerned, we have made no mistakes. To start this learning process the first chart portrays the performance of the various sectors of the Agri-Food market over the past year.

As is apparent from the chart, a wide range of returns was experienced this past year. Barley prices rose by more than 50% while cotton prices fell by more than 40%. In between was the U.S. stock market, which provided no price return. US$Gold was perhaps the best of the traditional asset classes with a gain of about 25%. An investor could very easily have had a good year or a bad year.

Our interest is in the winners of the past year, and whether they will be so in the coming year. At the top of the chart the meat sectors stand out. Beef and hog prices were up nicely in the past year. Rather than chasing silver, an investor would have been better off buying a hog for the back yard. Consider broilers, which are table chickens. A chickens in the freezer would have performed better than most stock portfolios, and one would not have had to pay a management fee.

These Agri-Food prices to us as consumers are part of the cost of living. Those prices to the producers of Agri-Foods are revenues. Price is an important component of the revenues received by producers of beef, hogs, and chickens. Those revenues are part of the equation that determines profits. High prices do not guarantee profits to producers of beef, hogs, and chickens, but they can often be a helpful starting point. As far as starting 2012, the prices for meats are generally the best these producers have seen.

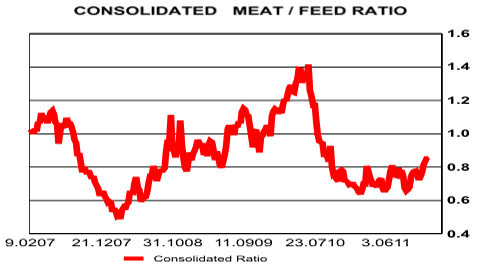

Other component of the profits of beef, hog, and chicken producers is largely the expense of feed. Pork chops are not produced in a factory. Animals must be fed until they reach marketing weight. That feed is largely grain, such as corn and wheat. The ratio of meat prices to the cost of feed is an indication of the profitability of those that produce animals.

Second chart plots a ratio of the price of beef, hogs, and chicken to the cost of feed, wheat and corn. We refer to it as consolidated as it combines the meat-to-feed ratios for hogs, feeder steers, and broilers in a proprietary manner. That ratio is a proxy for the profitability of animal producers. When low, feed costs are high relative to meat prices, depressing profitability. When high, meat prices are high relative to feed prices, expanding profitability.

In 2008, during the mad rush into commodities, grain prices rose dramatically. As a consequence of that, the ratio fell to a profit crushing low. When grain prices then retreated, the ratio rose dramatically. In the Summer of 2010 the Russian wheat embargo caused grain prices to again rise dramatically, and the ratio again turned down.

After being low and flat for months, the ratio is now moving up. Recent action might be interpreted as an upside breakout. That view is somewhat justified by the fundamentals. Beef prices in the U.S. have moved to record highs as supply of beef cattle has been reduced by the second round effects of the Southwestern drought. USDA does not expect U.S. beef production to expand until the Fall of 2012. At the same time grain prices are weakening.

Those firms producing beef seem to be starting 2012 with excellent fundamentals. Hog producers are also starting the year in good position. Chicken producers are not as well positioned, but financial necessity is going to ultimately improve that situation.

While corn farmers "owned" the past few year, producers of beef, pork, and chicken will likely "own" the next. Investors thinking about the hungry world of the future should be researching those firms that produce cattle, hogs, and chicken. A massive secular transfer of wealth to Agri-Producers is only in infancy, and the Agri-Demand/Agri-Supply situation is far more precarious than it ever was in oil.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2010 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.