Commodity prices begin to run

Commodities / Commodities Trading Feb 24, 2012 - 02:13 AM GMTBy: Donald_W_Dony

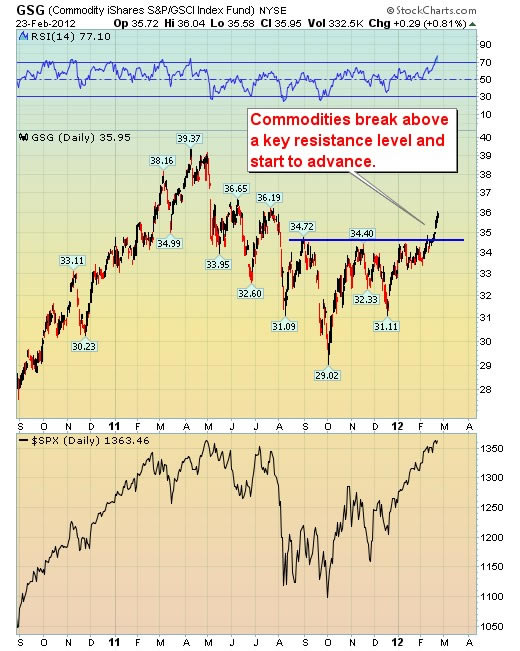

Commodity and equity prices have trended together for over a decade. However, recently the S&P 500 has bolted away to a 12-month high leaving natural resources to linger in the basement. That disconnect appears to have now changed with commodities quickly playing catch-up to stocks.

The Commodity iShares Index Fund (GSG) has just broken out from a multi-month consolidation and is now roaring upward. The $34.50 level has held the natural resource security down for about six months while the US stock index advanced more than 8% since January.

Raw material prices are starting to close the gap between stocks.

The quick advance in oil, both Brent and light crude, has been the main driving force. See the February 7th and 22nd Market Minutes for more detail about the rise in oil prices.

Base metals and gold are also starting to rebound which is adding to the upward pressure on GSG.

Bottom line: During the past decade, commodities and stocks have usually trended together. Over the last two months, the S&P 500 has advanced significantly whereas commodities have remained range bound. GSG is now starting to reconnect again with the US equity index. Higher price levels are now expected for the Commodity iShares Index Fund into Q2.

The first target for GSG is $40-$41.

Investment approach: Commodity prices are finally catching up with stocks. As the S&P 500 is anticipated to have a strong performing year (see the January 29, 2012 Market Minute titled "The January Effect and the probabilities for 2012"), materials prices should also see significant gains.

Investors may wish to now increase their commodity positions in their portfolios particularly in energy and base metals.

There are many ETFs that track these commodities and related sectors. I would look at USO, OIL, DBO, IYE and DBB in US$. In Canada, I would suggest CLO, XEG, ZCE, ZEO and CMW.

In Australia, look at ENY.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2012 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.