Greece, Please Go Bankrupt, As Soon As Possible!

Commodities / Agricultural Commodities May 16, 2012 - 11:38 AM GMTBy: Ned_W_Schmidt

We have a request for the politicians in Greece. Please go bankrupt, as soon as possible! Let us have the pain done with. To the Euro zone: Throw them out. The world needs a good example of just how bad Keynesian induced poverty can be. The Western economies would probably be better off with the citizens of Greece living in absolute poverty as a clear example of how not to do it. Keynesian socialists will not save the pensions of the Greeks. They will insure that they end. Get it over with, so investors can move on to more important matters.

We have a request for the politicians in Greece. Please go bankrupt, as soon as possible! Let us have the pain done with. To the Euro zone: Throw them out. The world needs a good example of just how bad Keynesian induced poverty can be. The Western economies would probably be better off with the citizens of Greece living in absolute poverty as a clear example of how not to do it. Keynesian socialists will not save the pensions of the Greeks. They will insure that they end. Get it over with, so investors can move on to more important matters.

As a consequence of the Keynesian debt disease plaguing the West, only one major economy seems to have any hope of growth in the years immediately ahead, China. Perhaps their success can be attributed to ignoring worthless advice of the West's Keynesian economists. But yet, they cannot escape some of the downside of Keynesian mismanagement. Their businesses are too being hurt by slumping demand in the EU and the faltering U.S. economy.

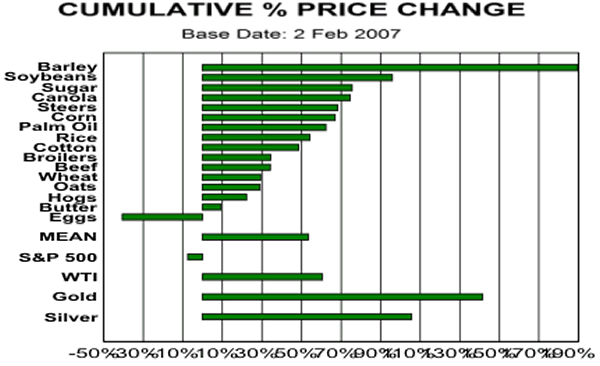

With the largest expansion of the middle class in all of history, China has had a dramatic impact on those goods which the middle class buys. Included in that buying has been a better diet. China's consumption of Agri-Foods has helped to push up Agri-Food price materially. Chart below portrays the cumulative percentage price change of major Agri-Commodities over the past 5+ years.

Barley has been in short supply since weather problems in North America last season. High quality barley is essential to the production of an important food group, adult beverages. More important are soybeans, canola, and palm oil which are near the top. These are all-important sources of edible oils, about which we have previously written. China is a major importer of all three. Consumption in that country has determined and will determine the price of those three grains as well as others.

Also note that the sources of animal protein, broilers, beef, and hogs, are in the lower part of the range. All animal proteins are under priced relative to the prices of grains used to feed the animals. In the decade ahead animal protein will likely be priced out of the affordable diet for many consumers. But yet, hogs outperformed the U.S. stock market. Do not remember one market strategist suggesting we put a hog in our retirement scheme rather than stocks.

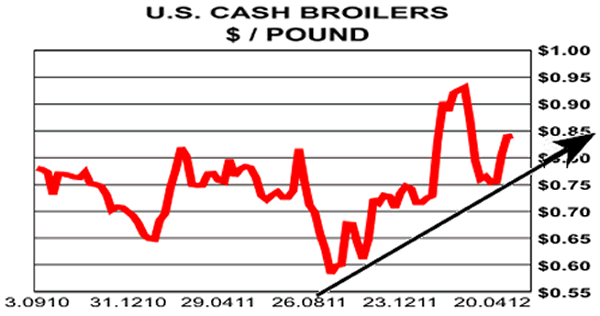

Prices for broilers, table chicken, are potted in the above graph. Those prices hit a 90-week high not too many weeks ago. That came after a major bottom was put in place in 2011. That low was created by the bankers and number crunchers finally having some success in forcing managements to rationalize production and pricing. The announcement of the NFL lockout also helped to create that low as chicken wings are an essential part of being an NFL fan. Given the financial results over the past few years of chicken producers more control will be exerted on production. We would not be surprised if broiler prices tripled from the low by sometime in 2013.

Will China's economy be hurt by the collapse of Greece into Keynesian poverty? Cannot help. Will China's economy have recession? Probably, all economies do. However, Agri-Foods are the first purchases when incomes rise. When incomes fall, Agri-Food consumption is cut last. Agri-Foods have both a growth story and a resiliency story due to China. The Asian Agri-Equities are well positioned to prosper during this period of Keynesian poverty in the Western economies. Since the end of March the Asian Agri-Equities we follow are up on average more than 4% while the S&P 500 is off by more than 6%.

Agri-Commodity Indices & ETF: An unexplored area has been how indices for ETFs and other passive commodity investments are structured. As we explored some of these indices, we were shocked by the design flaws in many Agri-Commodity indices. As a consequence, we initiated a research project on those Agri-Commodity indices. While early in this effort, we are now posting our thoughts as they are produced each month on our web site. If you own an Agri-Commodity ETF or passive commodity investment we recommend taking time each month to review these thoughts.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2012 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.