Intel Stock Market Dynamics

Companies / Company Chart Analysis Jun 15, 2012 - 03:35 AM GMT They say the proof is in the pudding. Upon first encountering the proposed market cycle matrix of the late market analyst PQ Wall, from the Kondratieff long wave down to the 20-week cycle, it was dismissed by this author and fellow market cycle researcher. It simply could not be true. The conclusions were clearly the results of an obsessive-compulsive disorder in an otherwise gifted financial market analyst. Years later, coming to a frustrating dead end with the work of Harvard economist and cycle theorist Joseph Schumpeter, and his smaller cycle work presented in Business Cycles, PQ's claims were studied more closely. The results of further inquiry into the mind and market matrix methods of PQ Wall were shocking. PQ Wall has changed market cycle theory forever, and his maverick thinking may hold the keys to even greater mysteries of the universe.

They say the proof is in the pudding. Upon first encountering the proposed market cycle matrix of the late market analyst PQ Wall, from the Kondratieff long wave down to the 20-week cycle, it was dismissed by this author and fellow market cycle researcher. It simply could not be true. The conclusions were clearly the results of an obsessive-compulsive disorder in an otherwise gifted financial market analyst. Years later, coming to a frustrating dead end with the work of Harvard economist and cycle theorist Joseph Schumpeter, and his smaller cycle work presented in Business Cycles, PQ's claims were studied more closely. The results of further inquiry into the mind and market matrix methods of PQ Wall were shocking. PQ Wall has changed market cycle theory forever, and his maverick thinking may hold the keys to even greater mysteries of the universe.

PQ was clear in his claims. If you could see past his always entertaining and endearing but bombastic style of presentation, his claims were clear. He viewed cycles as fields of human activity manifested in markets. He boldly claimed to have discovered the wave function of global economic and market cycles. He claimed that the cycles all fit together in a matrix of market action with divisibility by 144.

PQ Wall made a quantum leap in market cycle research. His discoveries apply to both major equity indexes and individual security analysis. To my knowledge, PQ was the first to recognize that economic and market cycles are actually a form of quantum field guided by wave functions. These fields are unfolding in human action that is priced in markets. Instead of space-time, market cycles unfold in price-time. Evidence is growing to support PQ's claim, as indicated in a chart of Intel (INTC) provided below.

First, a more detailed explanation is required. The Kondratieff long wave is a big cycle that explains the boom and bust cycle in the global economy. Wall proposed that the long wave ebb and flow of prices, corporate efficiency, profits and stock prices, when divided by 144, produces a miniature version of the long wave generational cycle. Investors and traders historically know this miniature long wave as the 20-week cycle. This cycle was rechristened the Wall cycle in the 1995 edition of The K Wave in honor of PQ Wall, now out in The K Wave (2012) eBook.

PQ made the radical proposal that every business cycle has nine Wall cycles. The 16 business cycles in the long wave make 144 Wall cycles. The current business cycle has been clicking through the expected Wall cycles. Central bank intervention lengthens the natural cycle. QE is a pesticide of sorts; it works temporarily but ultimately does a lot of damage to the soil of human productivity. By flooding the global financial system with liquidity, the central banks appear to have managed to grow the cycle and buy a higher low in the current Wall cycle #6 within the current business cycle. It appears as if a new global Wall cycle rally is developing.

PQ Wall's theory was tweaked using the 42-month cycle to determine that the ideal miniature long wave "Wall" cycle wave function is 141.9 days, but they fluctuate in price and time by degrees of freedom in Fibonacci ratios of this ideal length. Central bank intervention cannot stop the cycles, but they can make them run long. The most recent Wall cycle is a great example.

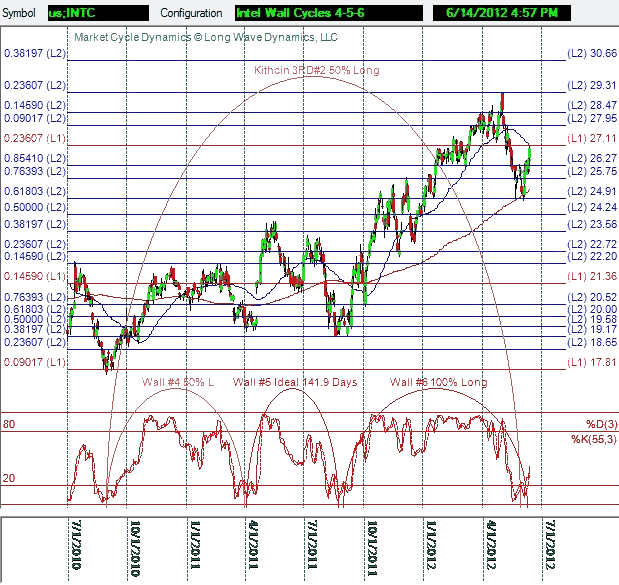

The chart below demonstrates price, time and sentiment in Wall cycles 4, 5 and 6 in the current business cycle in Intel (INTC). The chart was generated with Market Cycle Dynamics (MCD) software, which runs with Metastock, by Equis, a Reuters company. This business cycle started at the 2009 lows, so the chart below shows the middle three Wall cycles in this business cycle.

Remarkably, you are looking at Wall cycle fields of human action in Intel, which includes everyone, management, employees, investors, customers, suppliers, central bankers, politicians, etc. Cycles are produced by human action in pursuit of purpose. Large cap companies have hundreds of thousands, if not millions of scientists, accountants, investors, operations and management pursuing their purpose.

Market cycles are tracked in price-time instead of space-time. They are essentially a wave function in financial markets. Look at that chart closely. That Wall #4 cycle ran within a few days of a Fibonacci 50% degree of freedom longer than the ideal 141.9 day Wall cycle. The Wall #5 cycle was within days of a crowd pleasing ideal Wall cycle. The 141.9 day Wall cycle is a natural law of market cycles. Wall #6 was within days of a Fibonacci ratio 100% extension of the ideal Wall cycle.

All three of these Wall cycles fit nicely in a 50% extension of one-third of the business cycle, called a Kitchin 3RD. If you do not marvel at what you are observing on this chart, you do not understand probability theory and that investing at the right price and time is a game of odds, and you want to have the odds on your side as often as possible.

Speaking of price, you probably did not notice that recently Intel (INTC) hammered the Level 2 golden ratio in price at $24.91 and reversed nicely, in addition to the latest Fibonacci degree of freedom Wall cycle time target. Clearly, the truth is much stranger than fiction when it comes to market cycles. Physicists call this sort of field activity quantum weirdness. Investors and traders tracking cycles do not really care what you call it, as long as it works. PQ claimed he had discovered a grand unified theory (GUT) for markets, and beyond.

The deeper meaning of what he discovered are not entirely clear, but keep an eye on that Level 1 23.6% target at 27.11, now the 50-Day moving average in the early going of a new Wall cycle. If this is a fake Wall cycle break out, and a Wall #6 crash is in order, large caps like INTC at junctures like this will tell the story. If the Wall cycle #7 rally is for real, this chart will tell us shortly. You will be amazed at price action around the Level 1 and Level 2 grid targets. Of course, it is nice for investors and traders to have these price and time targets in advance. The grids track the trading algorithms of the quants coding program trading for hedge funds and high frequency traders (HFTs).

There are three more Wall cycles to go in this business cycle. It promises to get much more interesting for cycle trackers into the business and long wave cycle low in 2013. The same debt, corporate efficiency and stock price trends in major market indexes in the big cycles are evident in global franchise large caps like Intel (INTC) in the smaller cycles. Buckle up, it promises to be a wild ride on the cycles into this business cycle low.

As proposed by the value investor master, Benjamin Graham, the Wall cycle provides a formula timing plan for investors and traders, buyers and sellers. Take a look at any large stable global franchise company, the more dividends the better. You can track the Wall cycles, and their degrees of freedom targets in time, if you know how. You can identify buying and selling opportunities to increase your portfolio alpha.

You can use the ebb and flow of the Wall cycle to snap up bargains on large cap global franchise companies that pay good dividends on a regular basis. Using the Wall cycle as a buying signal reduces risks. However, the current Wall cycle is not a buy and hold cycle. Bigger cycle trouble is brewing in the long wave cycle wave function. Track the cycles to be prepared, but in the meantime use the smaller cycles, Fibonacci grids and stochastics as a formula timing plan in price, time and sentiment.

As far as determining whether PQ Wall discovered the wave function of the grand unified theory, this will have to wait for further research. It will require physicists to explore the mounting evidence in financial markets, but the market cycle dynamics clearly visible in Intel in price-time is a start.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2012 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.