LinkedIn Shares Poised to Drop

Companies / Company Chart Analysis Jul 27, 2012 - 12:03 PM GMTBy: Chris_Vermeulen

Last night Zynga tanked, dragging down Facebook with it. There’s been a lot of hype regarding everything social, but not exactly a lot of follow through regarding earnings. Recently a new member of our team here at TTT, Brennan Basnicki, put out a fundamental piece on LinkedIn that I think merits a good readover as it is applicable to many of the high flying tech stocks we’ve seen get absolutely crushed lately. Further, if we look at some more of the fundamentals and technical indicators I think we may have found a prime shorting candidate.

Last night Zynga tanked, dragging down Facebook with it. There’s been a lot of hype regarding everything social, but not exactly a lot of follow through regarding earnings. Recently a new member of our team here at TTT, Brennan Basnicki, put out a fundamental piece on LinkedIn that I think merits a good readover as it is applicable to many of the high flying tech stocks we’ve seen get absolutely crushed lately. Further, if we look at some more of the fundamentals and technical indicators I think we may have found a prime shorting candidate.

On the fundamental side:

■A P/E roughly at 700. This is astronomical. While not alone a reason to short a stock, it definitely has to raise caution to the long side

■Heavy insider selling: management has sold more than 20% of their pre-IPO ownership while the early venture capital firms have already exited half their position.

■Net profit margins very low, ranging between 4% and -1% over the last five quarters

■Rising sales, general, and administrative costs with decreasing growth in revenue

On the Technical Side

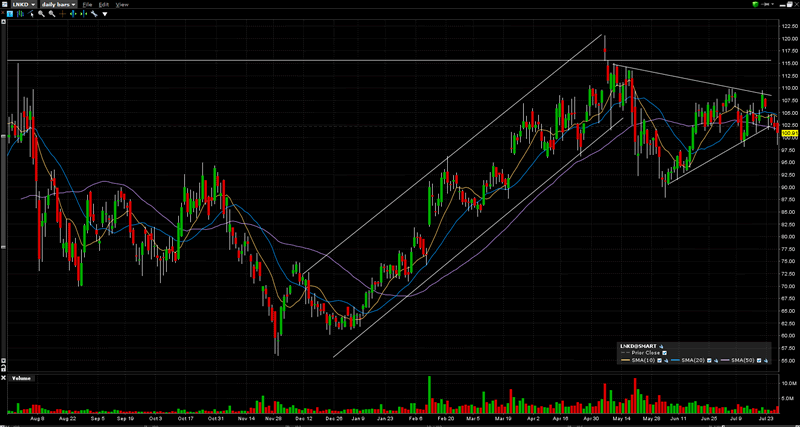

■This is an interesting one. We currently see an extended uptrend that entered a consolidation period over the last three months. While a consolidation after an uptrend is typically a continuation pattern, a closer examination leads me to believe that LinkedIn will, or already has begun, to breakout to the downside

■There is also a very clear double top formed that will act as resistance. The one pop above it failed to hold which often means a reversal is likely to follow

■Moving averages are all aligning in the same direction: down

■We can also take the perspective that the recent price action has been a bear flag, not so unlike the rest of the equity markets. Notice the recent rise in price on lower volume, followed by an increase in volume over the last two days accompanied by lower prices. Clear signs that a breakout may be starting

■Further, take a look at the heavy selling on the first significant pullback in May. This looks to be a large distribution and likely some of the insiders taking advantage of the loft stock price

I don’t typically advocate positions on single stocks as you’re always prone to news events and what not that can have serious implications. That being said, the fundamental and technical stories both seem to point downwards on LinkedIn. With a beta of 1.6, the direction of the market will likely be the single most important factor for LinkedIn up until its 2012 Q2 earnings announcement on August 2nd. Keep in mind too that if you do enter a short to keep a stop in, and I would be cautious taking any position during the earnings report. LinkedIn is very volatile and has already caused a lot of shorts quite a bit of grief. That being said, the timing may finally be right. Stay tuned to my updates and if you’re looking for a little more action, maybe take LinkedIn short on one of our next short plays.

If you would like to receive my free weekly analysis like this, be sure to opt-in to my list: http://www.thegoldandoilguy.com/free-preview.php

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.