QE and the Commodity Markets

Commodities / Commodities Trading Sep 25, 2012 - 12:30 PM GMTBy: Tony_Caldaro

QE and the Commodity Markets

After the recent announcements of the ECB’s OMT program, (outright monetary transactions), and the FED’s QE 3 program, (open ended asset purchases), we were forced to not only review the equity markets, but also the commodity markets. We updated the commodity charts last weekend. Those who review our public charts, on a regular basis, are one step ahead of this report. We will start with a review of the GTX (S&P GSCI Commodity Index), then all five of its sectors.

After the recent announcements of the ECB’s OMT program, (outright monetary transactions), and the FED’s QE 3 program, (open ended asset purchases), we were forced to not only review the equity markets, but also the commodity markets. We updated the commodity charts last weekend. Those who review our public charts, on a regular basis, are one step ahead of this report. We will start with a review of the GTX (S&P GSCI Commodity Index), then all five of its sectors.

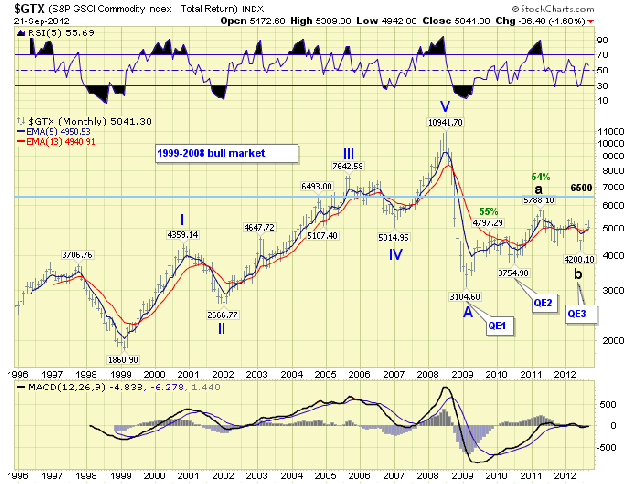

The GTX completed its five wave bull market in 2008. It then crashed into a Primary wave A low in 2009, and has been in a Primary wave B bear market rally since then. Initially, we suspected the 2011 high, GTX 5788, had ended Primary wave B. However, it now appears the recent Central Bank liquidity programs will extend the bear market rally. Notice the significant lows, over the past few years, all occurred prior to the FED’s QE programs. The first two programs resulted in a 50+% rise in the GTX. With this in mind we have upgraded the count to display a Major wave A high in 2011, a Major wave B low in 2012, and now expect Major wave C to carry the GTX to around 6500, to end Primary wave B and the bear market rally.

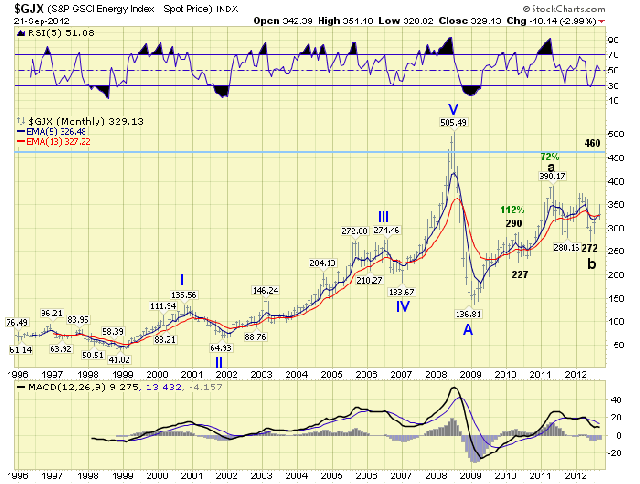

The GJX is the Energy sector. This is by far the largest portion of the weighted GTX index. Note the long term wave pattern is quite similar, yet it has greater percentage gains during each of the first two QE programs. Should the GJX follow the same pattern during QE 3, we would expect a Primary wave B high somewhere around the low 460′s.

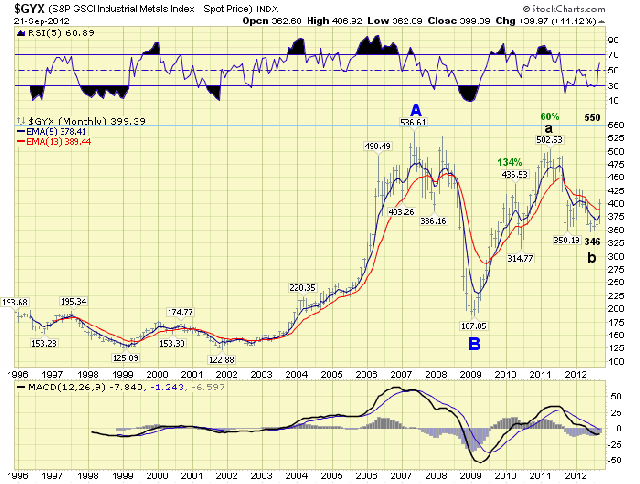

The GYX is the Basic Materials sector. This sector has a slightly different long term count. Notice the Primary wave A peak occurred in 2007, and the Primary B low in 2009. This is quite similar to the US equity markets. Initially we had counted the 2011 high as a failed Primary wave C. We now believe this was only the end of Major wave A of Primary C, and the recent decline into 2012 Major wave B. Using similar percentage gains of previous QE programs, we now project new highs in this sector to complete its ABC bull market from 2001.

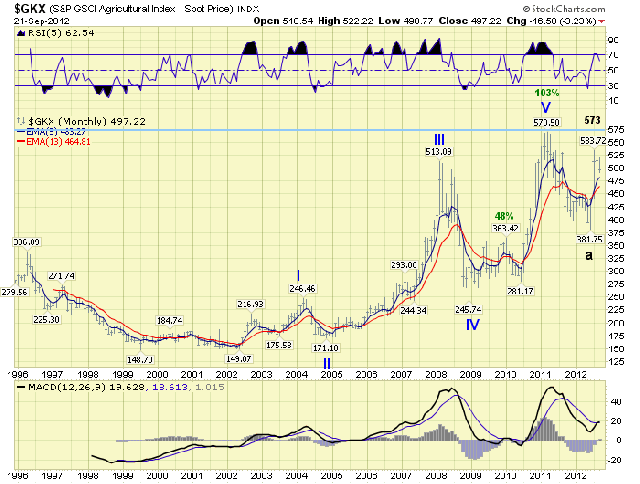

The GKX is the Agriculture sector. Its long term wave pattern is a bit different in that it completed five waves in 2011. The first decline from that high, Major wave A, ended when the drought hit the US this summer. We are counting the rally off that low Major wave B, and are currently expecting marginal new highs before it completes. This count remains unchanged from the last update.

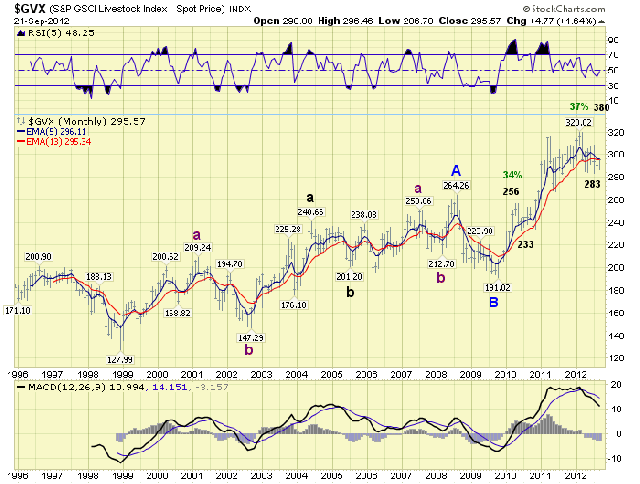

The GVX is the Livestock sector. Its long term wave pattern is quite different. A completed Primary wave A in 2008, followed by a Primary B in 2009, and Primary wave C still underway. We are expecting this index to top out in the low 380′s. This count also remains unchanged from the last update.

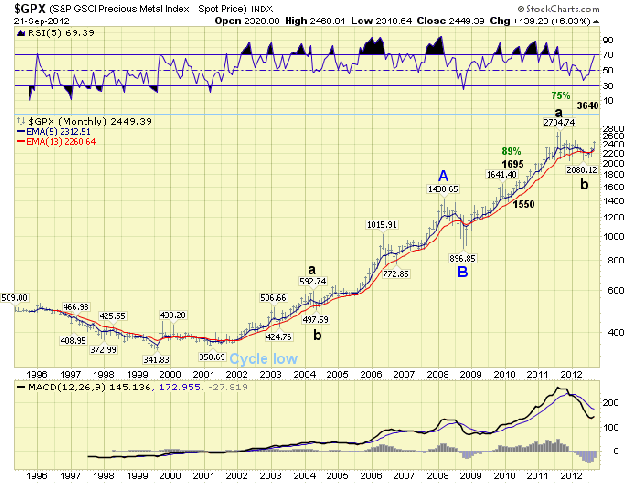

The last sector GPX, probably the most popular, is the Precious Metals. After careful review we are upgrading our long term count from a completed five wave bull market, to an ongoing abA-B-abC bull market. The reason for this is threefold. First, our Smart Money indicator never turned bearish during the entire eight month correction. Second, the recently announced, open ended, liquidity programs by the FED and ECB should be a catalyst to higher prices. Third, the 1968-1980 bull market was also an ABC pattern. Project, monitor, and adjust.

If we now apply the smaller of the two percentage gains, during QE programs, we arrive at a likely bull market top around 3640. Since Gold represents approximately 85% of this index, and Silver the other 15%, we expect Gold to make new all time highs and Silver possibly to double top at $50. To track these sectors, and Copper, Crude oil, Gold, Nat Gas, Platinum and Silver use the link below, pages 9, 10 and 11. Best to your investing/trading!

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2012 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.