Hydro-Fracking Boom or Bust?

Commodities / Natural Gas Jun 12, 2013 - 06:30 PM GMTBy: BATR

The economics of oil or natural gas hydrofracking are seldom analyzed from the perspective of the American consumer. Most discussions focus upon the investment opportunities of specific companies, royalties to leaseholders, windfall tax revenues that state governments will benefit from and the bonanza that local communities will enjoy from the added business activity. Missing is a clear understanding of the pricing points and factors that will determine the actual selling charge and total all inclusive retrieval costs in the domestic market. Will the price of energy drop precipitously or will the net effect be that the native end user sees no direct benefit from the rush to drill?

The economics of oil or natural gas hydrofracking are seldom analyzed from the perspective of the American consumer. Most discussions focus upon the investment opportunities of specific companies, royalties to leaseholders, windfall tax revenues that state governments will benefit from and the bonanza that local communities will enjoy from the added business activity. Missing is a clear understanding of the pricing points and factors that will determine the actual selling charge and total all inclusive retrieval costs in the domestic market. Will the price of energy drop precipitously or will the net effect be that the native end user sees no direct benefit from the rush to drill?

The environmental risks of the fracking process are real. Policymic presents an assessment of the merits of Hydrofracking Fact and Fiction: What You Need to Know About the Controversial Practice.

"Hydrofracking uses a lot of water: it may take several million gallons of water to properly frack a single well. Water is the main ingredient in hydrofracking; the sand is used to help keep the fractures open once they are created, while the mix of chemicals helps the process along and eases the flow of gas/oil. It is hard to say what chemicals are used since most firms treat their frack mixtures as proprietary secrets, and thanks to industry lobbying efforts, the Environmental Protection Agency ruled in 2005 that companies do not have to disclose their frack mixtures. Much of the water used in hydrofracking eventually comes back up to the surface contaminated with hydrocarbons, sand and other chemicals. Treatment and disposal of this used water is a major challenge to any hydrofracking operation. Environmentalists are sounding the alarm over hydrofracking-related groundwater contamination, contending that methane gas and fracking chemicals are migrating up from the frack locations and into local water tables."

The next point starts with a specious assumption:

"The economic benefits of hydrofracking are obvious, but is the process too inherently dangerous to use, or can its environmental risks be mitigated? That is the question to ponder. Unfortunately both the oil and gas industry, and environmentalists are doing their best to make an informed debate on the issue impossible."

Who really reaps economic gains from this process? Clearly, the corporatists have a strategy that benefits from international sales, while burdening local jurisdictions with the reclamation expenses from the negative eco aftermaths. Also, the effect from actual greater production extraction costs results in selling in to markets willing to pay top prices for the oil or gas.

Opponents of hydrofracking warn of the Fracking Economics Revealed as Shale Gas Bubble, Not Silver Bullet.

The reports, Drill Baby Drill by veteran coal and gas geologist David Hughes and Shale and Wall Street by financial analyst Deborah Rogers, assess the economic sustainability of the tight oil and shale gas booms that are sweeping America.

Together, the authors conclude that rather than offering the nation a century of cheap energy and economic prosperity, fracking will provide only a decade of gas and oil abundance, at most, and is creating a fragile new financial bubble that is already starting to deflate. Additional research conclusions discussed at the briefing included:1.The shale gas and tight oil booms have been oversold. According to actual well production data filed in many states, shale gas and shale oil reserves have been overestimated by operators by as much as 400-500 percent.

2.Wall Street has played a key behind-the-scenes role in hyping the fracking boom through mergers and acquisitions and transactional fees, similar to the pattern seen in the housing boom that led to the financial crisis.

3.High productivity shale plays are not common. Just five gas plays and two oil plays account for 80 percent of production of those energy sources, while the most productive areas constitute relatively small "sweet spots" within those plays.

4.Production rates are already in decline in many shale plays. The high rates of per-well investment required to maintain production mean U.S. shale gas production may have already peaked and maintaining production will require high rates of potentially unsustainable, high-cost drilling.

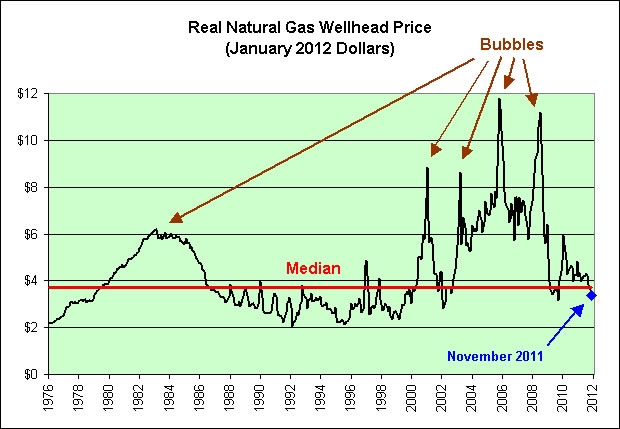

Deborah Rogers points out the most significant economic consequence from hydrofracking."Exporting is a last ditch effort to shore up a failing balance sheet. Exportation will drive the price higher in the U.S. There’s no doubt about it. The question is how high will it go. When you are producing a commodity and have produced it to such a high extent, you want to find someone who will buy it, and in this case, it will be the Asians."

Here is the key issue. If the energy resources from fracking are destined for an export market, sold at a dramatically higher price overseas, the pressure will increase to raise domestic prices when the oversupply vanishes.

"In recent months, however, production has begun to level off as the glut of natural gas keeps U.S. prices down. In response, producers have begun pushing to export the fuel to Europe and Asia, where prices are far higher.

Approval of all the projects currently under review by the Energy Department could result in the export of more than 40 percent of current U.S. production of liquefied natural gas, or LNG, which is gas that’s been converted to liquid form to make it easier to store or transport."

Energy internationalists, opportunistic politicians, Wall Street banksters and irresponsible developers would stash ill-gotten gain from the pillaging of our domestic resources, as our energy rich residents get to pay a higher price for their energy needs. Add into the equation the enormous environmental chemical pollution of our finite ground water and you have a monumental disaster in the making.

Since safeguards and less caustic additives can be substituted within the fracking technology, the bare minimum course is to protect the water supply. In addition, production from such development needs to have a direct benefit to the American consumer. No fracking for export sales is the national interest.

James Hall – June 12, 2013

Source : http://www.batr.org/negotium/061213.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2013 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.