The Federal Reserve after Ben Bernanke

Politics / US Federal Reserve Bank Jun 26, 2013 - 04:01 PM GMTBy: BATR

Speculation is mounting that "Helicopter Ben" will exit the Fed at the end of his current term. When the Bernanke era ends, what expectation will the next head of the central bank face? Remember the In Greenspan We Trust experience, and the designed pump and dump, crash and burn markets that led to the need to inflate the debt bubble. Bernanke did not save the economy; he merely bailed out the international banksters at the expense of productive main street enterprises. Throwing money to the air currents, when the prevailing winds only blow to Wall Street is the true legacy of Ben Bernanke.

Speculation is mounting that "Helicopter Ben" will exit the Fed at the end of his current term. When the Bernanke era ends, what expectation will the next head of the central bank face? Remember the In Greenspan We Trust experience, and the designed pump and dump, crash and burn markets that led to the need to inflate the debt bubble. Bernanke did not save the economy; he merely bailed out the international banksters at the expense of productive main street enterprises. Throwing money to the air currents, when the prevailing winds only blow to Wall Street is the true legacy of Ben Bernanke.

"It will almost certainly fall to Bernanke’s successor to eventually unwind the extraordinary measures the Fed has taken in recent years to try and drag a sluggish economy out of its brutal financial crisis hangover. The end of easy money won’t come right away, but it will end, no matter who follows Bernanke."

But will the faucet tighten on cue, especially when the conventional wisdom rests upon the assumption that the economy will improve as advertized? Why would the Fed end the best theft scheme since Charles Ponzi perfected the con game? As long as the rest of the world treats Fed Dollar notes as the reserve currency, there is no need to pay savers a fair interest rate return on their rapidly diminishing capital.

Examine the popular rivals for the Fed Chairman and Central Bank Godfather position.

John Carney of NBC News chimes in along with the Gulf News essay, US Federal Reserve: Preparing for life after Ben Bernanke, gives the following rundown.Janet Yellen - A forceful advocate of the aggressive steps taken under Bernanke to spur US economic growth, earning her a reputation as a policy "dove" who would tolerate a bit more inflation to drive down unemployment that she deemed too high.Lawrence Summers – Is a Harvard economist who was Obama’s first National Economic Council director, a post within the president’s inner circle. Timothy Geithner - Tapped for Treasury, he was already at the centre of the nation’s emergency response to the financial crisis as head of the New York Fed.Roger Ferguson - Another Harvard-educated economist and lawyer who was Fed vice-chairman from 1999 to 2006, Ferguson was regarded within the Fed as a very smart and thorough policymaker. Donald Kohn - Retired as Fed vice-chair in 2010 after 40 years at the central bank and was a top staff lieutenant to then chairman Alan Greenspan.Christina Romer - Served as one of the principal architects of the Obama Administration's economic recovery plan and chairwoman of the White House's Council of Economic Advisers.

Alan Krueger - Is the chairperson of President Obama's Council of Economic Advisors.

Surely, an insider to protect the interests of the plutocrats needs to be willing to play ball with the Obama style of criminality.

Significantly, the New York Times publishes, "Mr. Summers and Shaw executives say his role there was to be a sounding board for Shaw’s traders. But interviews with friends and former colleagues suggest that Mr. Summers’s role at D. E. Shaw was wider and more complex." Review the entire details in the two-part article, Industrial Wind and the Wall Street Cap and Trade Fraud.

Alas, the Obama Chicago Mafia Outfit has an undaunted record of extortion and financial pillage. What better choice to head the supreme paper-printing machine, than a trusted associate, skilled in the working of crony corporatism?The presidential puppet has his strings pulled by the money interests that selected him in the first place. It stands to reason that member bankers want Obama to pick a bean counter, who is experienced in the way monetary policy actually operates. Moreover, it certainly makes sense to the Chicago gang to have a trusted capo in charge of the loot.Theorizing, comparing and contrasting credentials to head up the Fed after Bernanke, is reminiscent of the same exercise when Greenspan relinquished the reins. How many predicted "Gentle Ben", to get the nod? What is certain is that a fiat money practitioner will continue the paper roll over of government bonds as long as dollar coercion, upon world currency markets, is the only game in town.

Keep monitoring the progress of the BRICS Development Bank. Competition to the dollar-dominated monopoly banking system is the actual challenge to central banking after the Bernanke tour of duty.

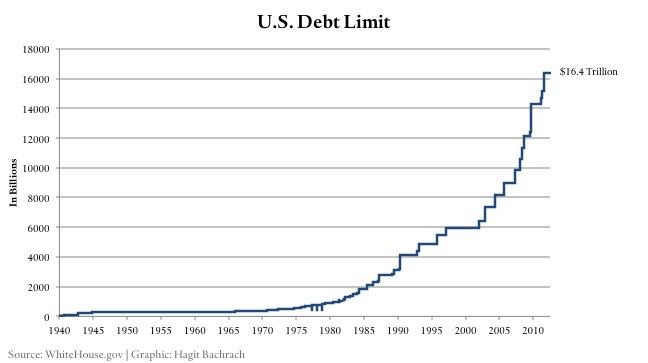

With the uninterrupted, increase in federal debt, much of which is held by the Federal Reserve, the prospects of achieving prosperity by growing the economy, when interests rates have been near zero, failed miserably. It becomes almost absurd to believe that higher rates on Treasury Bonds will succeed. The new chair of the Fed will be hard pressed shutting down Quantitative Easing.

What is the saying, caught "between a rock and a hard place"? Expect no other outcome until the entire fractional reserve banking system is abolished. The replacement must be based upon a sound money economy that is not dependent upon bank funding for public financing.

James Hall – June 26, 2013

Source : http://www.batr.org/negotium/062613.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2013 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.