Nike - The One Stock that Always Seems to Keep on Rising

Companies / Company Chart Analysis Jul 03, 2013 - 05:11 PM GMTMitchell Clark writes:

There are lots of benchmark stocks, but NIKE, Inc. (NKE) is an incredibly important one in retail.

It’s actually quite surprising that such a mature brand can continue to do as well as it does. Not only is the company succeeding operationally, but it continues to be an excellent stock market investment.

The company’s earnings results in the first quarter of this year were very good, and there’s been some worry that second-quarter numbers would be soft, commensurate with all the economic data we have been getting.

But that was not the case as the company’s second-quarter earnings were excellent.

Earnings season is always the most important time of year, and it certainly helps to divert investor attention from all the worries in the world. There’s been a real focus on what the Federal Reserve is going to do with quantitative easing. As odd as this may be, the stock market went up on weaker economic data in the hopes that quantitative easing would continue through to 2014.

NIKE said that its fiscal fourth-quarter sales grew seven percent to $6.7 billion, or nine percent on a currency-neutral basis.

The company experienced growth in all geographic regions except for Western Europe and China. Sales were stronger for running, basketball, and men’s and women’s training shoes, offsetting slightly weaker sales in sportswear, action sports, and soccer.

Earnings grew an impressive 25% to $696 million. With a two-percent reduction in average common shares outstanding, diluted earnings per share grew 27% to $0.76. This is an excellent performance from such a mature brand.

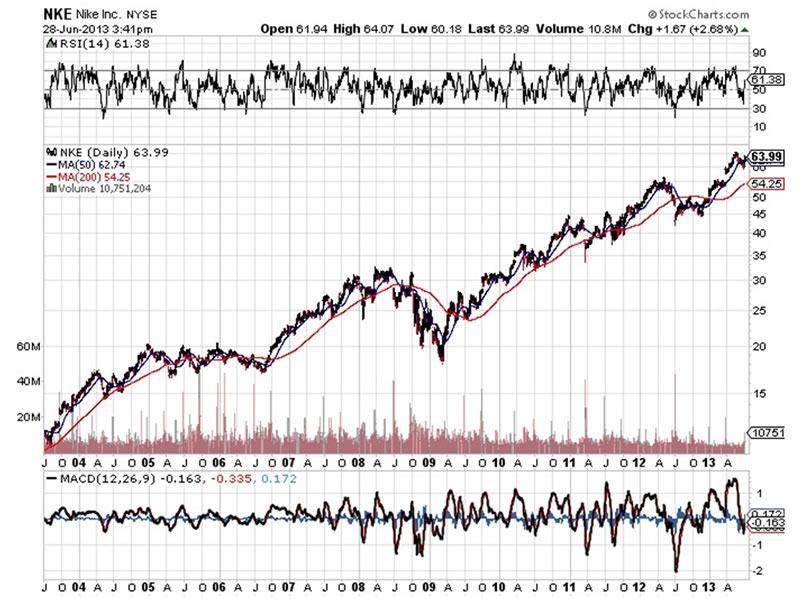

NIKE’s stock chart is featured below:

Chart courtesy of www.StockCharts.com

NIKE has proven to be a solid equity market investment. According to the company’s history, it’s never down for long.

Similar to the company’s first quarter, the standout in NIKE’s latest earnings report was its strength in the North American market. Footwear, representing about half of the company’s total sales in the North American market, grew seven percent, while apparel sales grew 22%, and equipment grew 24%.

Also noteworthy was the company’s huge increase in its cash balance, growing 44% to $3.34 billion over the comparable quarter.

The company has been steadily increasing its annual dividends over the last five years. The huge increase in NIKE’s cash balance suggests another quarterly increase is likely this year.

NIKE has now doubled in value on the stock market since 2010, not including its dividends. The company’s long-term stock market performance is exemplary and history suggests that an investment in NIKE may be a worthwhile long-term endeavor.

While no business can provide absolute consistency in both revenue and earnings growth, NIKE has been able to execute its business plan with remarkable effect. (See “How Five Hundred Bucks and a Handshake Created a Colossal Stock Market Winner.”)

The company experienced a slow period between 1997 and 2004, but all stocks go through cyclical enthusiasm from Wall Street, even while business conditions continue to grow.

I always follow NIKE as a benchmark on consumer confidence. The company is fully priced on the stock market, but it always is.

Source -http://www.profitconfidential.com/stock-market/the-one-stock-that-always-seems-to-keep-on-rising/

Mitchell Clark, B.Comm. for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.