Starbucks Solid Growth Stock Expected to Keep Ticking Higher into 2014

Companies / Company Chart Analysis Nov 06, 2013 - 11:28 AM GMTMitchell Clark writes:

If volatility is the name of the game with stocks right now, consistency of performance is a very attractive asset.

Over the last several years, few companies have been able to deliver consistently rising financial metrics like Starbucks Corporation (SBUX).

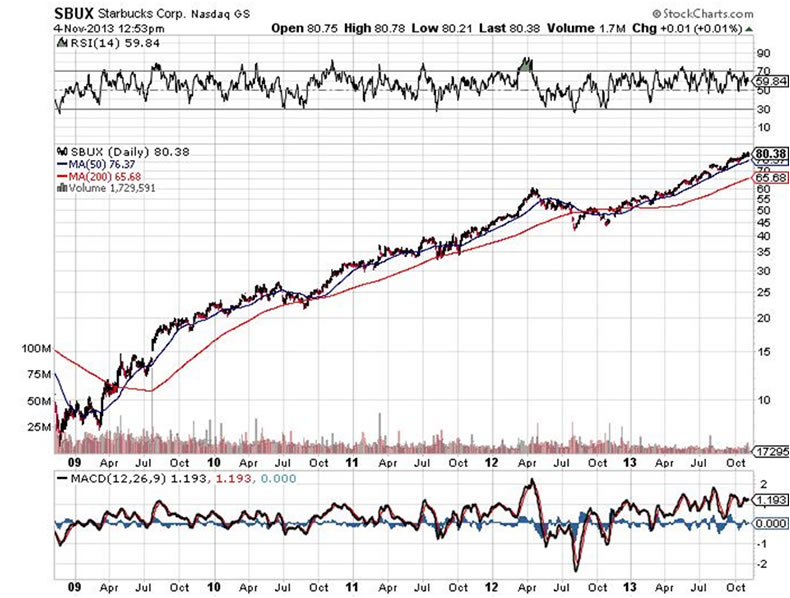

The company’s sales, earnings, and dividends continue to increase, even in a market that’s saturated and mature. And most consistently of all, the company’s share price has been ticking solidly higher ever since the market low in 2009. Just take a look at Starbucks’ five-year stock chart featured below.

The stock is fully priced and has a lot of high expectation, but the company continues to deliver in terms of growth.

Chart courtesy of www.StockCharts.com

In its fourth (and most recent) fiscal quarter (ended September 29, 2013), Starbucks’ global sales rose 13% to $3.8 billion, with comparable store sales increasing seven percent and a five-percent increase in traffic.

The company’s earnings per share leapt 37% to $0.63, or $481 million.

Cash and short-term investments grew by more than 50% (some of which was due to a new debt offering). Shareholders’ equity grew by 20% in the latest quarter. Company management boosted its cash dividend 24% comparatively to $0.26 per share.

Today, double-digit growth is a very tough thing to come by, but Starbucks is still doing it.

Of note is the company’s continued strong growth in the Americas. China is also a fast-growing market and is highly profitable, but U.S. market sales and margins continue to be robust (sales grew eight percent last quarter in the U.S. market alone).

The company’s cash flow is considerably higher in its first fiscal quarter of the year due to the holiday season. It is therefore highly likely that Starbucks’ next quarter will once again show excellent top- and bottom-line growth, also increasing the probability that the company’s share price will continue to tick higher.

Wall Street is typically pretty good with Starbucks’ earnings estimates. If the company beats on earnings per share, it’s usually not too far over consensus.

The most impressive part of this story from an investors’ perspective is the consistency with which the company delivers on growth. According to management, stronger sales are due to new volume growth and new product introductions.

This fiscal year, Starbucks expects global sales to grow 10% or better, with continued margin improvement in all geographic regions except China and Japan.

If investor sentiment remains positive near-term, it’s likely that Starbucks’ share price will continue to tick higher. At the beginning of this year, Starbucks was trading for $55.00 a share. It was $45.00 a share the year before that, and $33.00 a share the year before that.

The one thing this company hasn’t effected in quite some time is a share split. I wouldn’t be surprised at all to see one soon.

Company management recently increased its dividend payout ratio to 45% from 35% on the back of 10.8 million repurchased shares in fiscal 2013.

In terms of business execution and stock market performance, it’s probable that Starbucks will continue to be a winner. The stock is expensively priced, but it’s likely to remain so, with such strong expectations for big earnings growth. (See “Proven Wealth Creator Delivers Again; Earnings, Sales Growth Surge” for another stock that’s delivering consistent growth.)

This article Solid Growth Stock Expected to Keep Ticking Higher into 2014 is originally published at Profitconfidential

Mitchell Clark, B.Comm. for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.