Gold Price 14 Years and Three Patterns

Commodities / Gold and Silver 2014 Mar 12, 2014 - 05:38 AM GMTBy: DeviantInvestor

Gold peaked in August of 2011 and fell erratically into December 2013.

Gold peaked in August of 2011 and fell erratically into December 2013.

Was that the end of the collapse, or is there more downside coming in gold prices?

Bearish Scenario: Listen to the banks who are forecasting weak prices in 2014 and thereafter. "Nothing to see here folks, the dollar has weakened drastically since 1971, gold sells for 30 times its 1971 price, but it's all good. Just move on and pretend... Gold will drop below $1000 before you can say 2016 elections..."

I'm not a fan of:

-

The bearish gold scenario when decades of Federal Reserve "printing" and US government budget deficits have all but guaranteed continued destruction of the purchasing power of the dollar.

-

Belief that even though dollar debasement practices have accelerated since the 2008 crash, gold prices will fall because bankers say so.

-

Propaganda that gold is useless and that unbacked debt based fiat currencies are solid and stable.

-

Large High Frequency Trading companies that short the gold market, loudly proclaim that gold prices will fall, dump a huge number of paper contracts on the Comex, quietly cover their shorts after the gold price crash, book huge profits, and then reverse the process as they push prices up. These traders are in the business of making profits so none of this is surprising

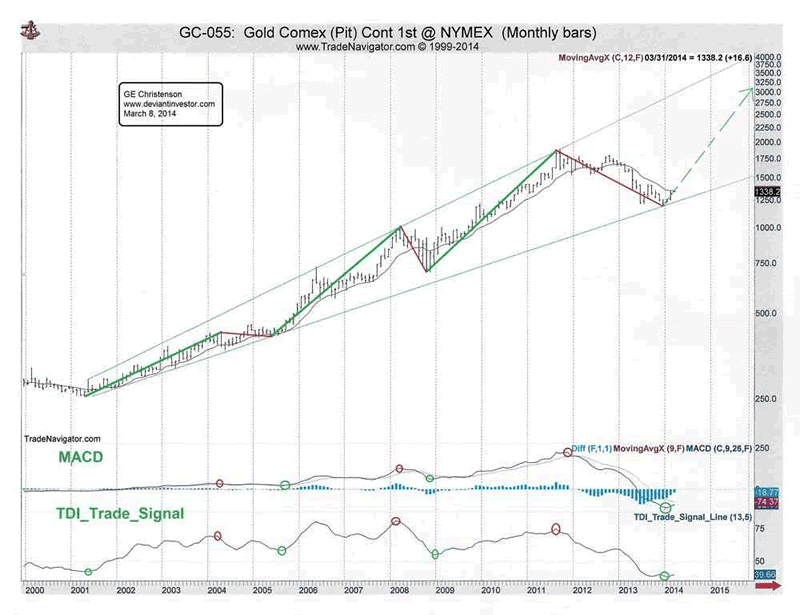

Instead of listening to self-serving banker opinions, let's examine the data. The following chart shows monthly prices for gold since 2000. Note that highs and lows as listed in the monthly data are slightly different from actual hourly highs and lows. For this analysis over 14 years, the differences are immaterial.

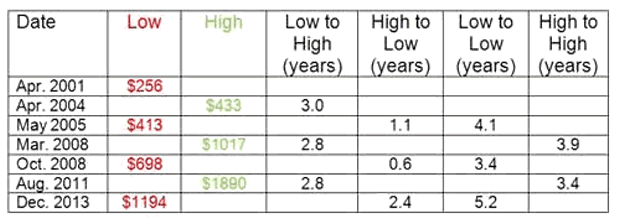

This table shows the price and approximate number of years.

Summary: The price of gold bottomed in 2001, rallied for 3.0 years, fell for 1.1 years, rallied for 2.8 years, fell for 0.6 years, rallied for 2.8 years, and fell for 2.4 years. Lows were about 4 years apart, highs were about 3.5 years apart, and the rallies lasted, on average, about 3 years.

Gold in December of 2013 had dropped to the lower logarithmic trend line after falling for 2.4 years. The patterns suggest that the next move should be a rally that lasts approximately 3 years to new highs near the top of the trend channel well above $3,500.

But there is more: (If you distrust Technical Analysis, skip this section.)

- Gold prices made a double-bottom in June and December 2013 thereby indicating a successful test of the lows formed in June.

- The MACD - a technical indicator (first chart) which tracks the difference between two moving averages - registered a very low reading in December 2013. Further, the moving averages in the indicator have turned up. This is strongly supportive of the analysis that December marked a major low in gold prices.

- The TDI-Trade-Signal line - another technical indicator (first chart) - registered its lowest reading in 15 years at the June 2013 low and has also turned up. This is another strong indication that gold bottomed in December.

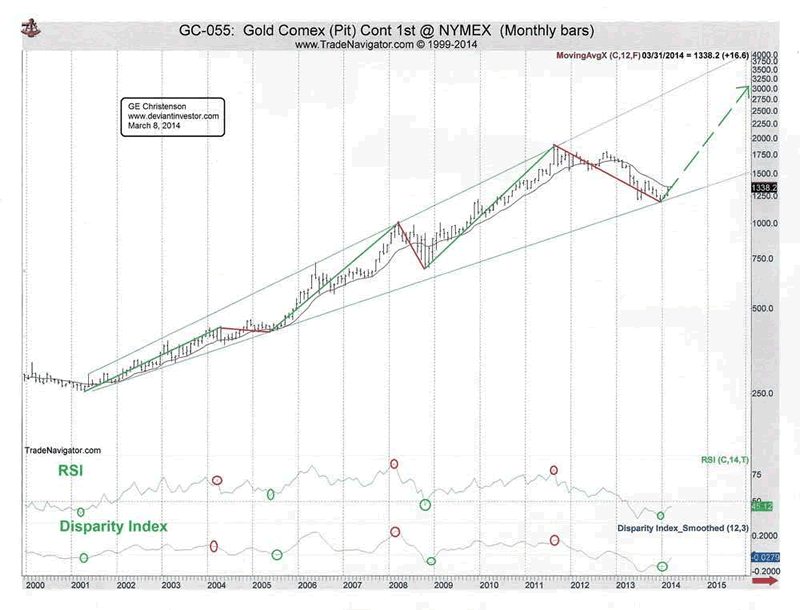

- The RSI - Relative Strength Index - as shown on the second chart was at a 15 year low at the June 2013 gold price lows. It has turned upward.

- The disparity index, which is simply the deviation between the monthly prices and the 12 month simple moving average (second chart), was at a 30 year low and flashing a buy signal after the June 2013 gold price lows.

For those who have no faith in technical analysis:

Consider this GEM - Gold Equilibrium Model (thanks to Nick Migliaccio for the name). I summarized the model in this short article. The model is based on three variables and calculates the equilibrium gold price with no reference to oscillators or technical indicators. The GEM model projects a "fair" or equilibrium price for gold in March 2014 of approximately $1,580. Gold prices, based on this long-term model, are currently low and are likely to move much higher over the next several years. This long-term model produced an excellent statistical correlation with the smoothed price of gold over the 42 years from 1971 - 2013.

Conclusions

-

The GEM indicates that, over the next several years, gold prices are headed much higher.

-

The chart of gold prices since the year 2000 (log scale) shows a "megaphone pattern" of higher lows and higher highs. Currently the gold price is near the bottom of the exponentially up-trending pattern.

-

Technical oscillators indicate important bottoms in June and December - at levels not seen in more than a decade.

-

The disparity index shows that gold prices in June were well below the 12 month moving average. Similarly daily and weekly prices were well below their moving averages. Prices tend to regress to the mean - another indication that prices are likely to rise from the deep lows in June and December.

-

Short term prices could rise or fall a little from here - I'm offering no opinion - but gold prices should be much higher in 2015 and 2016.

-

Gold is for savings and investing, not trading. Dollars buy groceries while gold buys safety, insurance, and peace of mind.

-

As Darryl Robert Schoon always says, "Buy gold, buy silver, have faith." It is good advice.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2014 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.