The Case for Gold Right Now

Commodities / Gold and Silver 2014 Mar 12, 2014 - 05:39 PM GMT With special thanks to the St. Louis Federal Reserve and its FRED charting software.

With special thanks to the St. Louis Federal Reserve and its FRED charting software.

Published with permission. These charts update automatically.

'A picture is worth a thousand words'

This collection of charts is for those who do not like a lot of verbiage to justify an investment decision -- just the facts. Two primary themes drive the specific chart selections presented here:

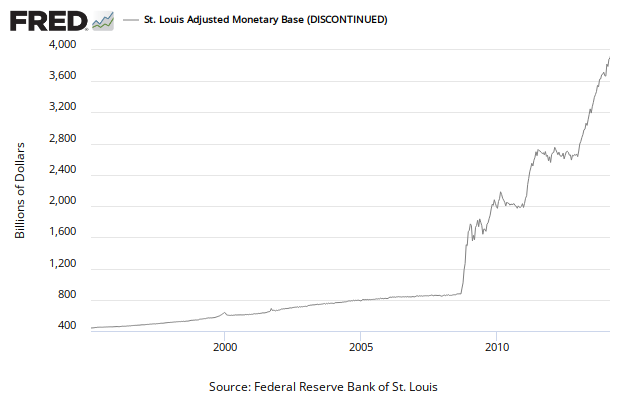

First, it is clear that none of the factors which caused the financial crisis of 2008 have been addressed in any sustainable fashion by those charged with setting economic policy. Explosions in both the monetary base and reserve bank credit show they have simply been 'papered-over' - a far-cry from a lasting solution. In fact, one could argue (and many have) that such policies may one day fuel a second tier to the crisis even more damaging than the first.

|

||||

|

||||

|

||||

|

||||

|

||||

|

||||

|

If you are looking for a gold-based analysis of the financial markets and economy, we invite you to subscribe to our FREE newsletter – USAGOLD’s Review & Outlook, edited by Michael J. Kosares, the author of the preceding post, the founder of USAGOLD and the author of “The ABCs of Gold Investing: How To Protect And Build Your Wealth With Gold.” You can opt out any time and we won’t deluge you with junk e-mails.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.