Senkaku - America Stalks the Perimeter of Another Hotspot

Politics / GeoPolitics Mar 13, 2014 - 07:34 PM GMTBy: Jeff_Berwick

The narrative reads like a political soap opera. But, arguably, it is more likely to create the next global crisis than any other flash point. And American fingerprints are all over the crime scene.

The narrative reads like a political soap opera. But, arguably, it is more likely to create the next global crisis than any other flash point. And American fingerprints are all over the crime scene.

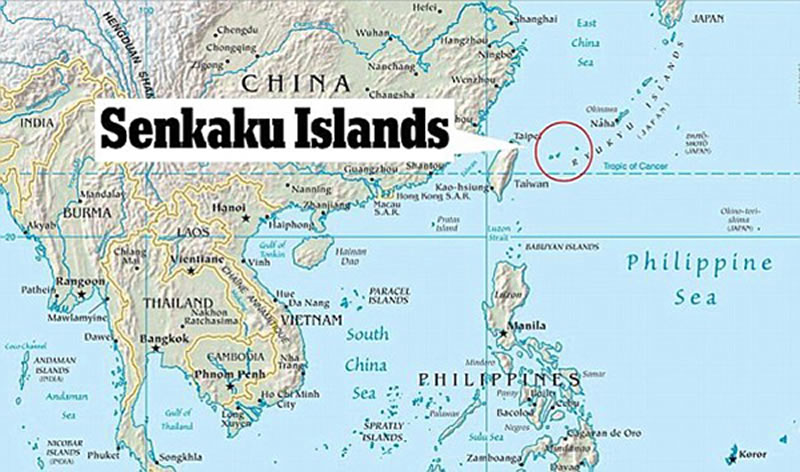

In Japan, the five small and uninhabited islands in the East China Sea are called Senkaku. In China, or the People's Republic of China, they are called the Diaoyu Islands. In Taiwan, or the Republic of China, they are the Tiaoyutai Islands. All three governments lay claim to the bitterly disputed patches of rock. Why? One reason is because they are key to controlling important shipping lanes, lucrative fishing areas and potential oil deposits. But historical and political motives join with economic ones to make the tiny islands explosive.

Indeed, it seems to draw closer to exploding each day, especially the situation between Japan and Mainland China. That's because the islands are currently owned by Japan but deeply coveted by China. On March 8th, a New York Times headline declared, “China’s Hard Line: ‘No Room for Compromise’.” A March 9th headline in the China Times stated, “DF-21D missile could sink US aircraft carrier.” The article continued, “The report, written by various experts in India, concluded that the existence of the DF-21D has shaken the traditional view of the US Navy's unassailable superiority in the Asia Pacific region.” On the same day, a Reuters' headline reported, “Japan, US differ on China in talks on 'grey zone' military threats.”

How the US got chin deep in the East China Sea

Mainland China roots a claim to the Senkaku Islands in its presence there in the 14th century. It maintains that the much-later Japanese claim came as a result of brutal imperialism; specifically, Japan annexed the islands in 1895 after winning the First Sino-Japanese War. Then, in 1945, America assumed their administration as part of Japan's terms of surrender in World War II.

As political control of East Asia became increasingly problematic, however, America decided to accept Japan as a junior partner through a series of treaties and amendments. The first Security Treaty was signed in 1951. Japan basically recovered sovereignty on the condition of surrendering its right to react militarily on an international level. In return, the US offered Japan the shadow of its protection.

To this day, the Security Treaty and other agreements militarily join America and Japan in significant ways. On January 27, the GlobalOpsAnalysis Center observed, “The US maintains considerable forward based presence in Japan; notably Okinawa, Iwakuni, Futemna, Sasebo, Camp Butler, Misawa, Kadena, Kure, Yokota, et al hosting the USAF 18th Air Wing and 35th Fighter Wing, and the US Navy’s 7th Fleet.” Several of the bases are in close proximity to the Senkaku Islands. “Most recently, the Japanese Minister of Defense, the Honorable Mr. Itsoneri Onodera reinforced and linked past and current ties stating that: “Secretary Hagel and I confirmed...the US-Japan security treaty applies to the Senkaku Islands and that we are opposed to any unilateral action that aims to change the status quo by force.”

The status quo is ownership by Japan; the unilateral action would be from China. The significance of the security treaty is that the two nations have agreed to act together in the face of a common danger. Note: Article 9 of Japan's constitution prohibits a military response to an attack on foreign soil; therefore, it would not respond militarily to an invasion of America. Nevertheless, America is committed – at least, in theory – to such a response if Japanese territory is invaded.

And America made sure the Senkaku Islands were Japanese territory. The Okinawa Reversion Treaty of 1971 tacked on those islands as part of returning Okinawa. Thus the Senkakus became Japanese territory under existing agreements. If an armed clash occurred over their ownership, Japan could invoke the Security Treaty. America would either provide the agreed-upon support or reveal a 'weakness' to the world – namely, its unwillingness to live up to treaties or to fight in the East Asian theater.

Unholy Trinity: Political, Historical & Economic Interests Unite

Both Chinas quickly cried “foul!” at the Reversion Treaty. For Mainland China, it was the first aggressive effort to assert a claim. One reason? A 1969 report from the U.N. Economic Commission for Asia and the Far East indicated there might be large reserves of gas and oil in the seas surrounding the islands. The Chinas' cries have only grown louder as the ability to drill off-shore in deep water has become less expensive and more common. As Mainland China's onshore resources are drained away, it especially is looking to unexploited areas like the East China Sea.

Japan adamantly objects. And international law seems to be on its side. For example, the U.N. Convention on the Law of the Sea prescribes exclusive economic zones (EEZs) for nation states. The EEZ gives a nation special rights over the marine life and other resources for 200 nautical miles from its coast. The EEZs of China and Japan overlap in the East China Sea, which is approximately 360 nautical miles wide between them. In such cases, the U.N. Convention specifies that the overlapping nations should negotiate and do nothing to endanger an ultimate settlement. Japan has suggested dividing jurisdiction at the median line; China has refused because this would give Japan some of the richest areas, including one of which China has become particularly possessive.

Other economic factors can be piled high but the most worrisome tensions in the region may come from less obvious factors.

The Hidden Wild Cards

Less obvious factors include:

- America has been doing a full-court press, albeit a secretive one, on negotiating a multi-national Trans-Pacific Partnership (TPP). Talks have stalled, partly due to Chinese obstruction. Japan is America's greatest friend in negotiations but even Japan is balking. The promise of military assistance to an old ally could go a long to forging a final TPP.

- The Senkaku islands are only one of several territories in contention in the same region. The Asian Pacific Defense Forum noted other “island/sea border disputes Japan has with other countries. The Senkakus, Takeshima...another group of rocky islets, and the Northern Territories...” And China has disputes and ambitions of its own in the region.

- A simmering anger between China and Japan has not cooled since World War II. While visiting China several years ago, I was amazed at the passionate and abundant tales of murder and rape committed by Japanese troops against Chinese civilians. Often they were told by people too young to have been alive at the time. China is an angry nation and a rising military power; it is also out to correct historical wrongs. It sounds like Germany in the 1930s.

- And, then, there is the oncoming train wreck of global economic collapse. No one knows what that will bring. But it usually is not peace and goodwill.

Conclusion

The American people may be war-weary after thirteen years of concerted conflict in hell-holes of the world. But other nations are not. China is not. Russia is not. Japan seems willing to war, especially with American support. The question becomes whether the American government can resist the lure of war drums if these oh-so tiny islands promote a global explosion.

Wendy McElroy is a regular contributor to the Dollar Vigilante, and a renowned individualist anarchist and individualist feminist. She was a co-founder along with Carl Watner and George H. Smith of The Voluntaryist in 1982, and is the author/editor of twelve books, the latest of which is "The Art of Being Free". Follow her work atwww.wendymcelroy.com.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2014 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.