Golden Opportunity Coming in Silver

Commodities / Gold and Silver 2014 Mar 28, 2014 - 03:02 PM GMTBy: Jordan_Roy_Byrne

Silver has been in a bear market for almost three years and the recent lack of strength suggests the metal could be headed for new lows. New lows are always bearish until the last one. Our technical work suggests that we should watch for a final low and end to the bear market in the coming months.

Silver has been in a bear market for almost three years and the recent lack of strength suggests the metal could be headed for new lows. New lows are always bearish until the last one. Our technical work suggests that we should watch for a final low and end to the bear market in the coming months.

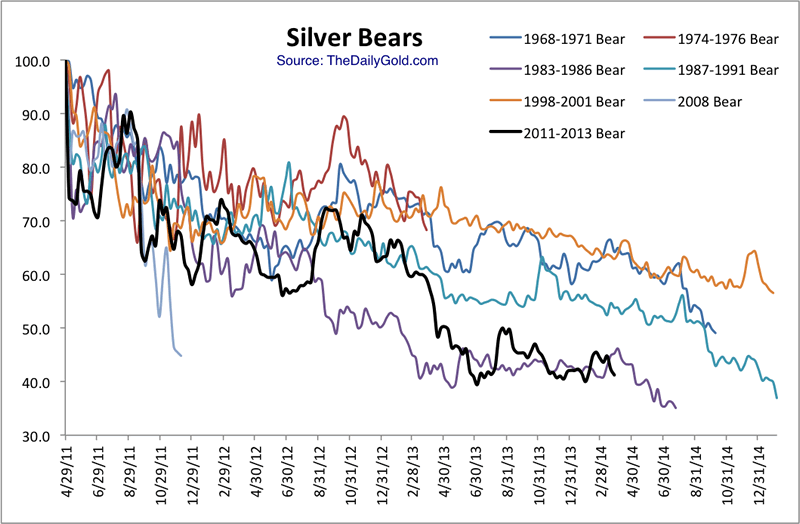

This chart plots every major bear market in Silver dating back 45 years (excluding the 1980-1982 bubble bust). It plots them on the same time scale as the current bear market. Excluding the 1980-1982 bear market, we find that the current bear market is inline for being the worst bear market. It is already the fourth longest in time and close to the second worst in price. The current bear is very close to the 1983-1986 bear. This chart and the 1983-1986 bear suggest that if the current bear breaks to a new low then its final bottom could occur about one month later.

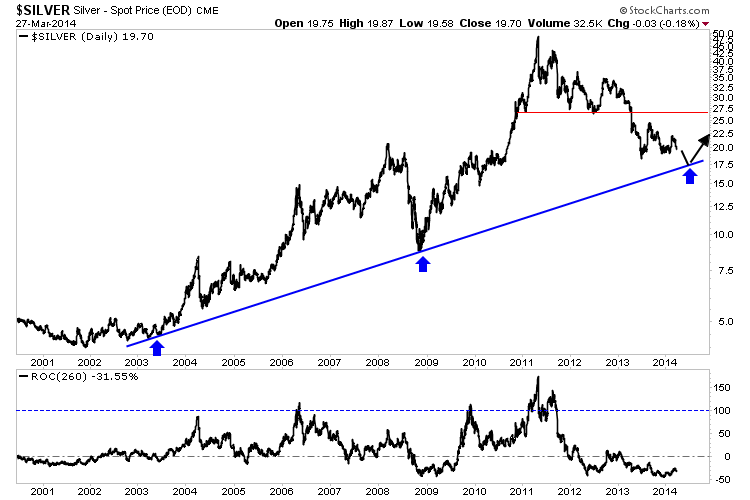

Silver has very strong trendline support on the daily chart around $17. If Silver breaks to a new low then it will run into this trendline support which dates back 11 years.

In the lower column we plot a 12-month rate of change for Silver. Note how it often reaches or comes close to 100%. After lows in 2003, 2005, 2008 and 2010 Silver gained 100% in a 12 month period. Moreover, following the 1983-1986 bear market which closely resembles the current bear, Silver rebounded 89% in 10 months. Following the 2008 low, Silver rebounded 84% in 11 months. Let’s say Silver bottoms at $17.50 and rebounds 70% in 12 months. That would take it to $30. That would create huge upside in most silver stocks.

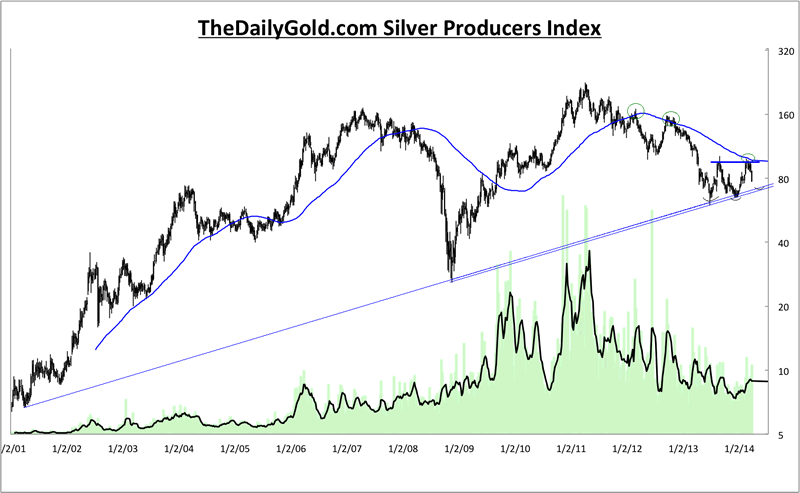

Below is a chart of our proprietary silver producers index which contains 14 stocks and is partially weighted by market cap. It contains all of the large, important silver companies as well as junior producers. We didn’t just pick the 14 best. This index recently peaked at neckline resistance and just below the 80-week moving average. Note how the 80-week moving average marked resistance in early 2012 and late 2012. A new bull market will only be confirmed when this index is able to surpass that confluence of resistance.

From a bird’s eye view, the bear market in Silver is just about over while the bear market in silver stocks probably is over as we don’t expect them to make a new low. However, the silver stocks won’t break resistance and confirm a new bull market until Silver has bottomed. Our analysis shows that Silver’s bear has a bit more to go in terms of price and time. We’ve laid out what we are looking for in Silver which is a new low and a bounce from 11-year trendline support. If that occurs at a time of extreme bearish sentiment then it is a buy signal. This prognosis, if correct means we have some time to research and patiently accumulate the best silver stocks which are positioned to benefit from a resumption of the secular bull market.

If you'd be interested in professional guidance in this endeavor, then we invite you to learn more about our service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2013 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.