Gold Preparing to Launch as U.S. Dollar Drops to Key Support

Commodities / Gold and Silver 2014 Apr 12, 2014 - 10:51 AM GMTBy: Jason_Hamlin

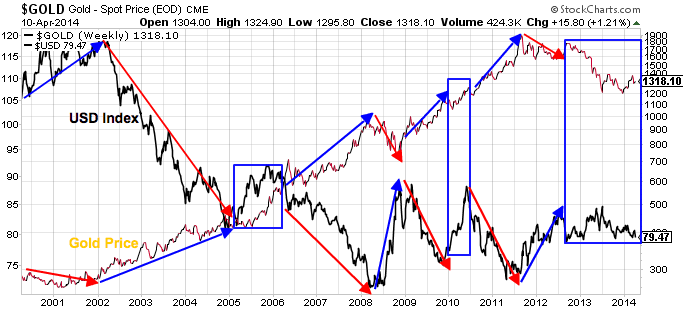

Gold bugs have been forecasting a dollar collapse for years. They have been correct about the gold price, which has advanced nearly 400% in the past 12 years versus a gain of just 64% for the S&P 500. They were also correct about the dollar during the first phase of the gold bull market (2001-2008), when the USD index fell from 120 to around 72.

Gold bugs have been forecasting a dollar collapse for years. They have been correct about the gold price, which has advanced nearly 400% in the past 12 years versus a gain of just 64% for the S&P 500. They were also correct about the dollar during the first phase of the gold bull market (2001-2008), when the USD index fell from 120 to around 72.

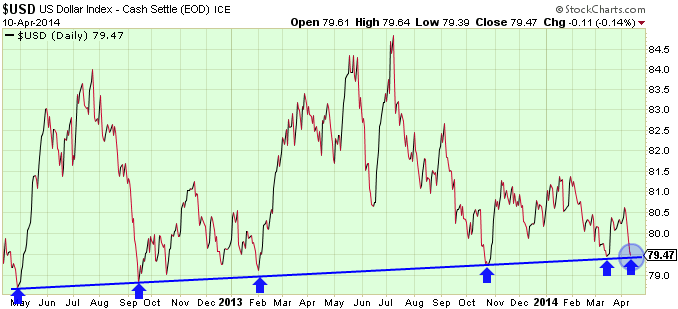

But the dollar did not continue to plummet after 2008 and indeed has held up remarkably well. The USD index has put in a series of higher lows over the past few years, showing strength against other currencies. But this strength is being tested once again as the index has fallen to critical support around the 80 level. While these tests of support are typically spaced out by several months, this will be the second test of support in the past month. Pressure on the U.S. dollar appears to be increasing and failure of support could ignite a massive decline.

Looking back to the start of the gold bull market, we see that gold and the dollar have maintained a fairly consistent inverse relationship. When the dollar moved up, gold moved down. When the dollar fell, gold pushed higher. The only major exceptions were 2005 and early 2010, when gold and the dollar moved higher in lockstep.

It is interesting to note that over the first 12 years on this chart, there was never been a prolonged period where gold and the dollar dropped together. This has changed over the past year.

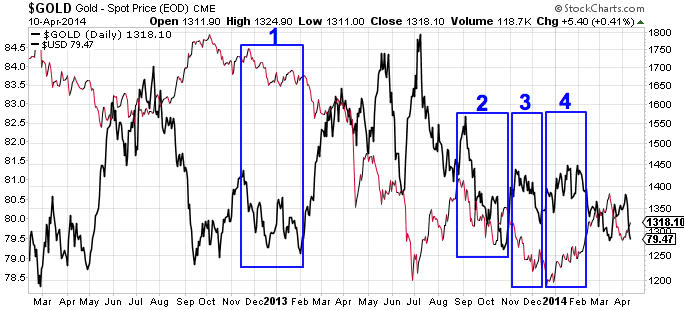

When we zoom in on the chart, we can see a new anomaly in boxes 1, 2 and 3, whereby the gold price has been dropping alongside the dollar, rather than rallying. If we add together gold’s losses in these three boxes, we get a decline of nearly $300, despite a weakening of the U.S. dollar. Something is clearly out of whack as gold has failed to push higher against the backdrop of a lower dollar for the first time in over a decade.

Lastly, in box 4 we can see gold rising alongside the U.S. dollar for the first time since 2010. When combining these time periods, gold and the USD have actually had a positive correlation for a good part of the past 18 months.

I believe the anomaly is due to increased manipulation and use of HFT algos in the precious metals market. I don’t suspect that the positive correlation will persist, especially with the increasing spotlight on gold price manipulation. Additionally, fundamental conditions are becoming increasingly favorable for a major drop in the value of the U.S. dollar.

There is a growing movement to dump U.S. dollars in global trade in favor of local currencies or even gold. Russia and China appear to be spearheading these efforts, with new bilateral trade deals that bypass the U.S. dollar and additional agreements with BRICS nations to use Rubbles or local currencies. Russia has also set up agreements to purchase oil from Iran with Rubbles, Yuan or even gold. Central banks are increasingly replacing dollar reserves with Yuan reserves and the increased spotlight on the manipulation in the gold market could hamper the ability of the United States to continue propping up the dollar.

These developments are all very bearish for the U.S dollar, whose days as world reserve currency appear to be numbered. Given the debt levels of the U.S. government, unprecedented money printing to bail out the banks and keep the economy afloat over the past 5 years and growing distrust and distaste for the U.S. following the NSA revelations, one has to wonder if the whole house of cards could come crumbling down sometime soon.

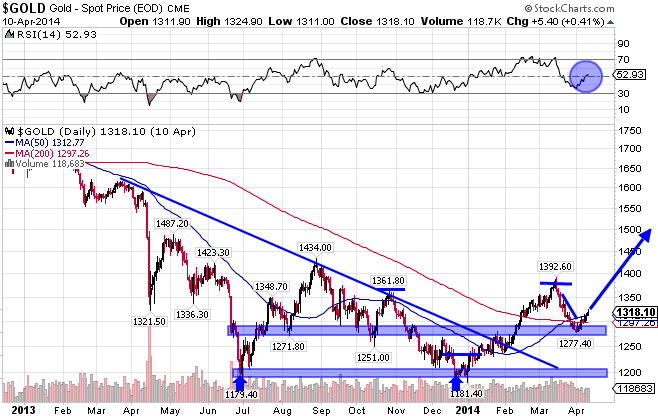

Gold has been the major benefactor, up roughly 10% year to date. The technical chart has turned bullish, with gold breaking through long-term resistance in February. It put in a rough double bottom, followed by outlines of a cup and handle pattern, both bullish indicators. The RSI is pointing higher with room to run and I expect gold will be above $1,500 within the next few months.

Gold bugs may have been too early in their call for the dollar’s demise, but the prediction may prove true yet. With the stock market looking to be in the midst of a major crash, precious metals would seem the obvious buy at the moment. Gold is one of the only asset classes that does not appear overheated and wildly overvalued at current levels. Whether the dollar collapses suddenly or dies a slow death, you will want to have gold and silver in your portfolio to protect your wealth.

To get regular updates like this in your inbox and more thoughts on why I believe the end of the current monetary system and collapse of the petro-dollar is near, consider signing up for the Gold Stock Bull premium membership. You will get our monthly contrarian newsletter, access to the GSB model portfolio, email trade alerts whenever we are buying/selling and a free subscription to our technology newsletter with updates on Bitcoin and other crypto-currencies. You can try it out for just $39 before committing to a full year subscription.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here.

Copyright © 2014 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.